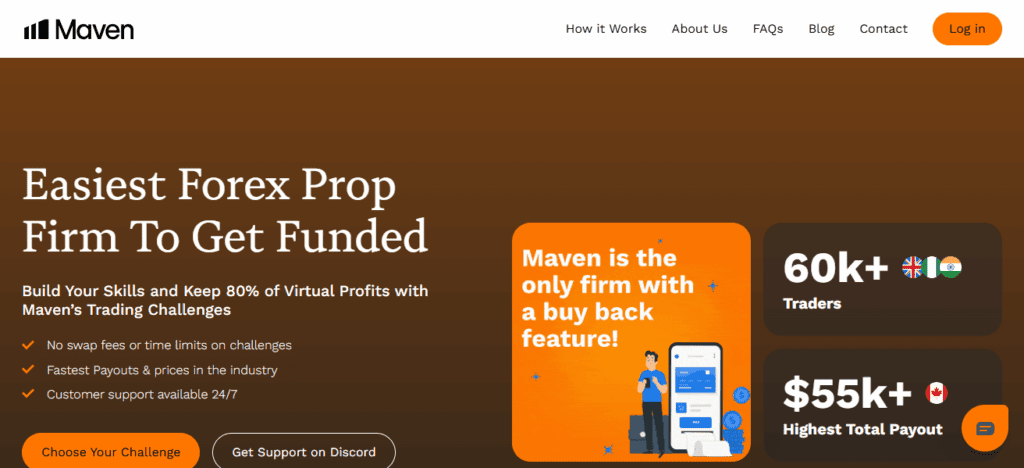

In this article, I will discuss the MavenTrading Prop Firm, a platform designed for traders who want to access company funds and grow their trading career.

MavenTrading offers funded accounts, flexible trading options, and a profit-sharing model that rewards consistent performance. We will explore how it works, its benefits, and what makes it stand out in the prop trading industry.

Overview

As global markets continue to evolve, proprietary trading firms have positioned themselves as essential platforms for skilled individuals wanting to amplify their trading ambitions while safeguarding their own capital.

Among this expanding landscape, MavenTrading Prop Firm distinguishes itself through a disciplined methodology, an empowering trading culture, and compensation structures anchored to measurable performance.

This article outlines MavenTrading’s core products, the architectural foundations of its trading model, and the attributes that are steadily cementing its status as a go-to venue for aspirational traders worldwide.

What is MavenTrading Prop Firm?

MavenTrading is a proprietary trading enterprise that allocates significant capital to proficient merchants in return for a share of the profits generated within the financial markets. In contrast to retail trading

In which an individual exposes personal capital to risk, a proprietary firm places its own balance sheet at risk while compensating successful traders for their intellectual and empirical expertise.

The firm is singularly committed to the discovery and cultivation of exceptional trading talent, furnishing market participants not only with discretionary, high-velocity liquidity

But also with a suite of analytic tools, risk-management infrastructure, and strategic mentorship required to prosper in a tight-margin, high-velocity trading environment.

How MavenTrading Works

MavenTrading employs a strictly performance-driven compensation structure. Prospective traders who express interest in partnering with the firm customarily complete a thorough evaluation. This review examines trading acumen, strategy caliber, risk discipline, and track record consistency.

Upon demonstration of the requisite benchmarks, candidates receive a capital allocation calibrated to their tenure, expertise, and demonstrated proficiency. Several tiered account sizes are accessible, empowering traders to expand their capacity gradually as they deliver sustained, repeatable gains.

A differentiating aspect of MavenTrading’s structure is the profit-sharing Cornposition. The firm permits traders to retain a substantial share of the earnings they produce, engender a durable incentive to excel.

By design, the arrangement reconciles the individual trader’s outcome with the enterprise’s interest: disciplined strategy execution is rewarded, and the firm’s capitalized income is in direct proportion to the trader’s success.

Key Features of MavenTrading Prop Firm

Fully Financed Trading Accounts

MavenTrading offers generously capitalized, firm-backed accounts to traders who meet its performance criteria. This capital removes the personal risk of trading equity, permitting individuals to devote their energies to analysis and execution rather than the worry of initial capital requirements.

Adaptive Trading Methodologies

Every chosen trading modality is welcome, be it intra-day, position-oriented, or ultrashort, the firm imposes no stylistic constraints. This accommodation enables traders to execute their personally refined tactics in an uncompromised environment.

Institutional Risk Framework

Preserving capital occupies the firm’s forefront. Traders inherit robust directives governing position magnitude, optimal leverage, and tolerable maximum drawdown, thus cultivating an ingrained discipline requisite for systematic success.

Progressive Allocation

Traders who repeatedly deliver superior returns may petition for upward adjustments in the firm’s capital assignment. This mechanism allows accounts to multiply their trading size and correspondingly increase future earning potential.

Collaborative Learning Ecosystem

Equally valued are traders who embrace continuous development. The firm orchestrates an interactive culture in which seasoned operators mentor peers, formal instruction delivers advanced techniques, and trading forums disseminate shift-of-breath market intelligence.

Pros of MavenTrading Prop Firm

| Pros | Details |

|---|---|

| Low Entry Fees | Challenges start from just $15, making it accessible for traders at various levels. |

| Flexible Evaluation Models | Offers both 1-Step and 2-Step evaluation processes, catering to different trading styles. |

| High Profit Split | Traders can earn up to 80% of the profits, which is competitive in the industry. |

| Fast Payouts | Known for quick payout processing, with some traders reporting payouts within hours. |

| No Swap Fees on Weekends | Allows traders to hold positions over weekends without incurring swap fees. |

| Wide Range of Trading Instruments | Supports various markets including Forex, crypto, indices, and commodities. |

| Support for Automated Trading | Compatible with Expert Advisors (EAs) and automated trading strategies. |

| Community Engagement | Active community with resources like Discord support and educational materials. |

Cons of MavenTrading Prop Firm

| Cons | Details |

|---|---|

| Limited Platform Options | Excludes popular platforms like MetaTrader 4/5, offering only Match-Trader and cTrader. |

| Wider Spreads | Reportedly higher spreads compared to some competitors, which may affect trading costs. |

| Lack of Transparency | Limited information on liquidity providers and pricing structures, leading to concerns about operational clarity. |

| Restrictive Payout Policies | Some traders have noted restrictive payout policies, such as caps on withdrawal amounts per cycle. |

| Limited Customer Support | Customer support options are limited, with no live chat or phone assistance available. |

| Lack of Educational Resources | Offers only basic FAQ and blog content, lacking comprehensive educational materials for traders. |

Conclsuion

In summary, MavenTrading Prop Firm stands out as an attractive alternative for traders pursuing minimal initial outlay combined with customizable evaluation parameters.

The enterprise provides favorable profit-sharing ratios, expedited withdrawal processing, and access to an extensive catalogue of tradable instruments.

Nonetheless, prospective clientele must weigh the restricted selection of trading platforms, potentially wider bid-ask spreads, and the current opacity surrounding fee structures and client support responsiveness.

A balanced appraisal of these variables will clarify whether MavenTrading is congruent with individual trading objectives and stylistic inclinations.

FAQ

Traders join by completing an evaluation, which tests their strategy, consistency, and risk management.

MavenTrading supports cTrader and Match-Trader platforms. MetaTrader 4/5 is not available.

Traders can trade Forex, crypto, indices, and commodities.

Leave a Reply