In this article, I will discuss AlphaTrader Firm, a proprietary trading platform that enables traders to grow their investments with or without personal capital.

AlphaTrader Firm offers flexible funding models, numerous market options, high profit splits, and many more, allowing both new and professional traders to take advantage. Having said that, let us look at the features, benefits, and challenges of this firm and also the reasons to be highlighted.

What is AlphaTrader Firm?

AlphaTrader Firm is a prop trading platform with a good reputation that enables traders to trade with the firm’s capital, instead of with their own funds.

To assist both beginner and professional traders, it offers a variety of easily funded accounts and access to various markets like Forex, stocks, and crypto.

The firm focuses on risk management, profit maximization, and loss minimization with specialists trading tools which enables the traders to maximize their profit and minimize their losses.

AlphaTrader Firm is now a popular option among traders for traction and prop trading due to the transparent profit-sharing system, professional assistance, and trading systems simplicity like MT4 and MT5.

Key Points Overview

| Category | Details |

|---|---|

| Firm Name | AlphaTrader Firm |

| Type | Proprietary Trading Firm (Prop Firm) |

| Markets Supported | Forex, Stocks, Crypto, Indices, Commodities |

| Account Types | Evaluation Account, Funded Account, Demo Account |

| Funding Options | Firm-funded accounts after evaluation, flexible capital allocation |

| Leverage | Up to [Insert Typical Leverage, e.g., 1:100] depending on account type |

| Profit Split | Typically 70%-80% for traders, depending on program |

| Minimum Deposit | Varies by program, often $0–$150 (for evaluation) |

| Trading Platforms | MT4, MT5, Web Trading, Mobile App |

| Risk Management Tools | Stop-loss limits, max drawdown, performance tracking |

| Customer Support | Email, live chat, FAQs, educational resources |

| Target Traders | Beginners, Experienced traders, US clients accepted |

| Unique Features | Low entry barriers, fast payouts, flexible evaluation programs |

Pricing Plans and Challenges

One-Step Challenge

- Track funding ultra-fast through this effort.

- Profit Target: 8%

- Duration: Unlimited

- Min Trading Days: 7

- Max Loss: 6%

- Daily Loss: 3%

- Profit Share: 90/10 after funding

- Fee: $149 (refunded upon passing)

Traders that want to deal with minimal challenges will find this form of trading most favorable.

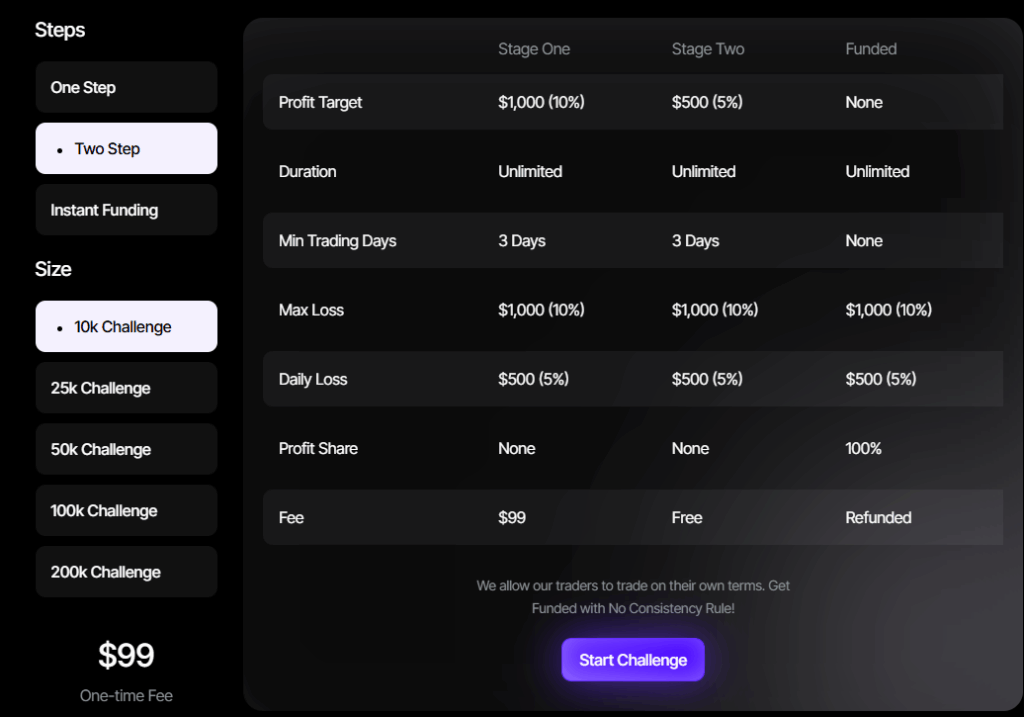

Two-Step Challenge

This is tailored to traders who want an additional layer to their evaluations.

- Stage One Target: 10%

- Stage Two Target: 5%

- Duration: Unlimited

- Min Trading Days: 3 per stage

- Max Loss: 10%

- Daily Loss: 5%

- Profit Share: 90/10 after funding

- Fee: $99 (refunded upon passing)

This approach grants the firm additional safety while remaining easily approachable.

Instant Funding Model

This allows traders to bypass the challenges and become instantly funded.

- Min Trading Days: 10

- Max Loss: 5%

- Daily Loss: 3%

- Profit Share: 90/10

- Fee: $149

Those without the time to spare will find this option most ideal. It is most suited for seasoned traders who are sure of their prescient edge.

The Funded King Challenge

This advanced plan is for dedicated traders.

- Account Size: $1,000,000

- Profit Target: 15%

- Duration: Unlimited

- Min Trading Days: 5

- Max Loss: $50,000 (5%)

- Daily Loss: $30,000 (3%)

- Fee: $2,499

Key Features of Alpha Trader Firm

Funded Trading Accounts

After taking and passing the evaluation programs, traders are given access to capital from the firm.

Flexible Account Types

Tailored for both novice and professional traders by providing evaluation, demo, and funded accounts.

Multiple Markets

Allows the trading of Forex, stocks, crypto, commodities, and indices.

Trading Platforms

Allows trades on MT4, MT5, the web, and mobile without hindering trading capabilities.

Profit Sharing

Traders are given between 70%-80% of the profits, which is a highly competitive profit share.

Risk Management Tools

Incorporates stop-loss limits, drawdown protection, and performance monitoring.

Rapid Withdrawals

The profit earned is paid out quickly and reliably.

Support for US Clients

Access has been broadened to include traders from the United States.

Educational Resources

Offers skill enhancement webinars, tutorials, and instructional guides.

Clear Policies

Straightforward trading fees, withdrawal, and trading rule policies.

Who Should Join Alpha Trader Firm?

Beginners: New account users seeking to gain experience with firm capital rather than risking their own.

Expert: Advanced level traders wanting to tap into more capital for bigger profits.

Domestic Traders: US citizens seeking prop firms working with US traders.

Conservative Risk: Traders who appreciate having some risk control tools, such as max exposed drawdown and daily losses.

Flexible Program Traders: Traders who like diverse funding systems like one-step, two-step, or instant funding.

Scale Traders: Those who are wanting to advance their trading skills and grow capital with little to no high pre-investment.

Traders Tired of Being Dealt: Professionals who wish to work with more clearly stated weaknesses, rules and transparent profit-sharing systems.

Limitations & Risks

Traders Restriction: Some instruments or strategies may depend on the program.

Set Daily Loss Limit: Max daily and overall loss rules are set and may lead to account termination.

Removal of Initial Challenge Fee: Fee refund is only applicable if the candidate manages to pass the evaluation.

Timeframe Pressure Evaluation: Under a specific number of days, profits must be made which is set a target for some, and may be stressful.

Region Restriction: Other regions may face some restrictions, however, US clients must be registered.

Business Risk: In a volatile market, profits are not guaranteed, as trading with the firm’s capital still involves market risk.

Suspension Risk: Loss of account due to violation of firm rules, use of improper strategies or exceeding the firm’s risk limits.

Practical Tips for Participants

Understand the Rules

Read carefully all the program requirements, including profit targets, max loss, and daily limits.

Start Small

First, use demo accounts to practice your strategies and familiarize yourself with the platform.

Concentrate on More Risk Management

Stop loss levels and overusing leverage are key factors that can lead to termination and should be avoided.

Pre-Plan your Trades

Identify the necessary steps needed to complete the trades and rigidly stick to the plans you make instead of trading for the sake of trading.

Consistently Track your Performance

After every trade, identify the effective and ineffective strategies to devise better ones.

Right Program Selection

The challenge you select be one-step, two-step, or instant funding but should always be one that is aligned with your experience.

Maintain Mental Stability

Emotional trading should be avoided at any time, especially around the profit target or loss limits.

Educational Resource Utilization

Webinars, guides, and other materials on AlphaTrader should be used.

Pros & Cons

| Pros | Cons |

|---|---|

| Provides firm-funded accounts with flexible funding models | Strict max loss and daily loss rules can cause account termination |

| Multiple trading programs (one-step, two-step, instant funding, premium challenge) | Requires upfront fees, refundable only upon passing evaluations |

| High profit split (up to 90/10 in favor of traders) | Certain instruments and strategies may be restricted |

| Supports a wide range of markets (Forex, stocks, crypto, commodities, indices) | Evaluation challenges may add pressure for new traders |

| Accepts US clients, making it accessible to more traders | Geographic restrictions may apply in some regions |

| Offers trading on MT4, MT5, web, and mobile platforms | Market risks remain, profits are not guaranteed |

| Provides educational resources and community support | Violating rules can lead to account suspension or funding loss |

Conclusion

AlphaTrader Firm is one of the few prop trading platforms that is flexible while being reliable. It is useful for both new and seasoned traders.

Having multiple funding models, high profit splits, and access to various markets like Forex, stocks, and crypto, it offers an opportunity for growth without putting up a lot of personal capital. Its acceptance of US clients, transparent policies, and sound risk management frameworks make it appealing to traders globally.

There are challenges like loss limits and the buckling pressure of evaluations, yet the risk is balanced by the firm’s structured programs, education, and speedy payouts. In short, AlphaTrader Firm is an excellent choice for traders in need of capital and growth striving for success in forex trading.

FAQ

Yes, AlphaTrader Firm accepts traders from the United States, making it accessible to a wide global audience.

AlphaTrader Firm is a proprietary trading platform that provides traders with access to firm-funded accounts, enabling them to trade Forex, stocks, crypto, commodities, and indices without risking large amounts of personal capital.

Traders can receive up to a 90/10 profit split, keeping the majority of their earnings once funded.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.