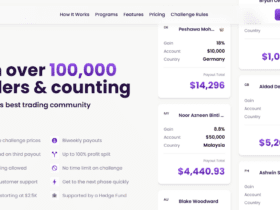

This article will showcase the Best Prop Firms for Prop Traders in Emerging Markets. Prop firms allow emerging-market traders the chance to trade forex.

Crypto and multi-asset trading using company capital enjoy lucrative profit splits and partake in global trading. We will examine the foremost firms and their funding plans, policies, and perks for driven traders.

Key Points & Best Prop Firms for Prop Traders In Emerging Markets

| Prop Firm | Key Point |

|---|---|

| FundedNext | Best for global access and flexible evaluation models |

| FXIFY | Instant funding and fast scaling options |

| DNA Funded | Broker-backed with strong infrastructure |

| BrightFunded | Reward program for consistent traders |

| Blueberry Funded | Supports stock and crypto trading |

| Funded Prime | Specializes in meme coin and altcoin trading |

| ThinkCapital | Low fees and transparent rules |

| MyForexFunds | Popular in Asia and Africa for forex traders |

| FTMO | Well-established with strong global reputation |

| The5ers | Flexible risk models and remote access |

10 Best Prop Firms for Prop Traders In Emerging Markets

1. FundedNext

FundedNext is a prop trading company acclaimed worldwide, offering traders up to 90% profit share and flexible evaluation models, or profit share agreements.

Instant funding and various account types, such as challenge-based and express funding accounts, are available to traders from emerging markets.

The firm allows trading of forex, commodities, and indices. The dashboard is designed in a simple, beginner-friendly manner.

The firm sponsors community trading and educational resources that are great for traders with a steady-growth focus. Low-growth and high-growth traders from South Asia and Africa prefer this firm.

Features FundedNext

- Globally accessible – Accepts traders from 190+ countries.

- Profitable profit split – Offers up to 90% profit split.

- Different funding models – Evaluation accounts, express accounts and giveaway accounts.

- Developing trader tools – Tools that are analytical and track performance.

- Communery support – Mentorship program and community help offered.

2. FXIFY

FXIFY’s unique selling point is its instant funding. It allows traders to commence trading instantly without the lengthy assessment procedures.

It offers numerous trading assets, including forex, crypto, and indices, and features highly appealing profit splits.

FXIFY is recognized for its rapid trading scale plans, as successful traders can promptly grow their capital.

Its site is mobile- and desktop-compatible and supports MetaTrader 4 and 5. Due to its low entry capital and ease of use, it is also a viable option for many traders within developing economies.

Features FXIFY

- Instant funding option – Start trading without evaluations.

- Assets are widely covered – Covers Forex, crypto, commodities, and indices.

- Quickly scaling plans – On-going performance leads to further account access.

- Compatible with MT4/MT5 – Integrated with MT4 and MT5 platforms.

- Convenient for mobile – Mobile trading is offered.

3. DNA Funded

Self-sufficient with infrastructure and organizational reliability of paramount importance, DNA Funded is a broker-backed prop firm.

It provides traders with competitive market conditions and comprehensive organizational support.

In many developing economies where capital is difficult to obtain, traders find it appealing for its flexible assessment structures and competitive profit distribution.

Its latency-sensitive tech infrastructure enables fast trade execution, which is particularly useful for scalpers and day traders.

In economies where proprietary trading is new, DNA Funded also actively helps traders build careers by offering coaching and mentorship, including webinars.

Features DNA Funded

- Broker-based infrastructure – Offers institutional trading conditions.

- Flexible evaluations – Select from distinct challenge models.

- Classing de latency – Low latency for scalping and day trading.

- Educate the trader – Resources such as mentorship and webinars.

- Focus on emerging market – Offers help for regions that are under served.

4. BrightFunded

BrightFunded employs a unique rewards system that ensures performance consistency across all traders.

Accounts are structured so that traders can unlock bonuses as they maintain profitability and effective risk management over given periods.

BrightFunded provides access to a range of instruments, including trade, all the way to crypto commodities and foreign exchange.

The interfaces are intuitive, and the robust in-built analytics aid traders in self-assessment and enhancement toward goal attainment.

The firm’s community-oriented framework has earned appreciation in Latin America and Southeast Asia.

The firm Boosted engages its users through gamification, using competitions and community leaderboards.

Features BrightFunded

- Performance rewards: Bonuses for consistent profitability.

- Multiple account types: Challenge, express, and hybrid models.

- Advanced analytics: Tools it track and improve trading behavior.

- Regional popularity: Strong presence in Latin America and Asia.

- Gamified experience: Leaderboards and competitions for engagement.

5. Blueberry Funded

Blueberry Funded also provides access to a range of diversified assets. Emerging-economy traders prefer the firm because it offers flexible funding structures and high-profit splits at very affordable costs.

The firm blends high-level analytics with other firm’s top-tier instruments of trade. The focus on analytic tools and trader educational resources creates a supportive

framework and has fostered the firm’s reputation in South Asia and Africa. The firm sponsors educational initiatives through mentorship, structured self-paced courses, and webinars.

Blueberry is passionate about supporting traders who do not speak English. This has motivated the firm to develop global support and multilingual customer service.

Features BrightFunded

- Bonuses for profit – Bonuses for profitability consistently.

- Various account types: Challenge, express, and hybrid models.

- Behavioral analytics Track and improve your trading behavior.

- International reputation: Particularly in Latin America and Asia.

- Gaming elements: Engaging through leaderboards and competitions.

6. Funded Prime

Funded Prime offers trading in various alternative assets, including meme coins, altcoins, forex, and indices.

This includes traders interested in high-volatility markets and seeking institutional backing. With quick onboarding and a streamlined evaluation process, Funded Prime is gaining popularity in emerging markets due to low support and entry costs.

Funded Prime has also developed educational material and tools deployed for forex and altcoin volatility to help traders manage complex, high-volatility markets.

Features Blueberry Funded

- Multi-asset trading: Forex, stocks, and crypto.

- Inclusive services: Non-English traders can access our services.

- Trader education: Formalized training and mentorship.

- Competitive profit splits: Funded traders enjoy high profit splits.

- Performance metrics: Real-time tracking of performance and risk.

7. ThinkCapital

ThinkCapital is a low-cost, transparent prop firm that supports traders with various account sizes and has unlocked trading for forex, indices, and commodities.

Due to the simplicity of the evaluation model, emerging markets traders find it easy to obtain funding. The firm focuses on discipline and consistency and therefore encourages traders to manage risk.

ThinkCapital has established a significant market presence in Eastern Europe and Southern Asia. This is due to the affordability and transparency, which are especially valued in these regions.

Features Think Capital

- Low costs: Budget-conscious traders can enter the market.

- Clear rules: Guidelines are easy to follow, expectations coherent.

- Easy evaluation: Simplified challenge assessment process.

- Risk reward model: Encouraging disciplined trading.

- Population: Popular in South Asia and Eastern Europe.

8. MyForexFunds

MyForexFunds is one of the best-known prop firms in the world, especially in Asia and Africa. This prop firm features several funding models, including rapid and evaluation accounts, and numerous trading instruments.

MyForexFunds offers low entry costs, which enable access to traders with smaller accounts and features an up to 85% profit share.

MyForexFunds has built a knowledge base to aid novice traders and offers excellent service, especially regarding responsiveness.

MyForexFunds allows traders to operate on MT4/MT5 platforms and provides comprehensive performance reports. MyForexFunds is certainly a prop firm of choice for traders in emerging markets.

Features My Forex Funds

- Wide reach: Dominant user base in Asia and Africa.

- Profit Share up to 85%: Great earning potential.

- Various funding options: Rapid, evaluation, and accelerated accounts.

- Access to metrics: Trade and performance metrics.

- Support is quick: Efficient customer service.

9. FTMO

FTMO is a reputable prop firm worldwide and has built a strong reputation in the industry. After a thorough evaluation, traders can achieve a 90% profit share.

FTMO offers a wide selection of trading instruments, including forex, crypto, and commodities.

Possibly the most prominent reason for FTMO’s success is the risk management tools and performance analytics that FTMO provides.

Along with advanced trading features, FTMO also offers performance and psychological coaching which helps to create a more balanced trader.

Their strong reputation with frequent payments makes them one of the best options for traders.

Features FTMO

- Most reputable: Traders from all over the globe trust them.

- Challenging eval: Two-phase challenge set up with ambitious goals.

- Spilt up to 90%: Outstanding compensation.

- Psychological training: Mental coaching for traders.

- Comprehensive feedback: Analytics and performance insights.

10. The5ers

The5ers is the first remote-friendly prop firm to offer flexible risk models and long-term growth. It is for traders with low drawdown tolerance.

It is also for traders who value consistency over high returns. The5ers funds both swing and day traders and provide access to forex and indices.

It is great for traders in emerging markets seeking mentorship, as the platform offers extensive trade reviews and coaching.

The5ers’ low entry barrier and global reach explain popularity in the Middle East and Southeast Asia. For qualified traders, The5ers’ lifetime funding ensures no hassle throughout their careers.

Features The5ers

- Work remotely: Trade from any location globally.

- Drawdown constraints: Create a risk management strategy.

- Adaptable risk frameworks: Your choice on how to trade.

- Coaching with feedback: Mentor supervision.

- Lifetime funding: Supporting traders for a sustainable period.

Conclusion

To summarize, prop firms are growing in number and variety for prop traders from emerging markets, and each firm has its own perks.

While firms such as FTMO and FundedNext have established reputations and solid support, more recent firms such as DNA Funded and FXIFY offer a variety of instruments and flexible funding.

By paying attention to regional accessibility, withdrawal policies, profit splits, and global market risk, traders can scale efficiently.

FAQ

A prop firm provides traders with company capital to trade, sharing profits while limiting personal financial risk.

Yes, many firms like FundedNext, FXIFY, and FTMO accept traders globally, including emerging markets.

A challenge tests a trader’s skill under firm-specific rules before granting access to funded accounts.

Profit splits range from 70% to 95%, depending on the firm and account type.

Most use MT4/MT5, while some offer proprietary platforms for multi-asset trading.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.