In order to access international financial markets, Best Prop Firms for Saudi Traders are increasingly using proprietary trading businesses in 2026. These companies are appealing to ambitious traders looking for growth without jeopardizing personal funds since they offer access to greater cash, significant profit splits, and Shariah-compliant structures.

Prop businesses enable Saudi professionals to diversify tactics, expand accounts, and create lasting wealth while adhering to ethical and contemporary trading norms. These possibilities include FX, futures, and cryptocurrency.

What Are Proprietary (Prop) Trading Firms?

Companies that give traders access to their funds to trade financial markets like forex, futures, stocks, or cryptocurrency are known as proprietary (prop) trading firms. Traders employ the company’s cash and split gains rather than risking their own money; they typically receive between 70 and 95 percent of winnings.

Before funding, these companies usually demand that traders complete assessments or adhere to risk management guidelines. While traders have the chance to trade larger accounts with lower personal risk, prop firms profit from using competent traders to increase returns.

Key Points of Popular Prop Trading Firms

| Prop Firm | Key Point |

|---|---|

| FTMO | Structured 2-step evaluation (Challenge + Verification) with up to 90% profit split |

| FundedNext | Offers 95% profit split, instant funding options, and scaling up to $4M |

| Take Profit Trader | Futures-focused firm with flexible rules (no daily loss limit) and PRO/PRO+ accounts |

| Funded Trading Plus | UK-based firm with 1-step, 2-step, and instant funding programs, profit splits up to 100% |

| Hyro Trader | Crypto-only prop firm allowing trading on ByBit-listed assets with spot, futures, and options |

| Tradeify | Futures-only firm with multiple funding paths (Growth, Select, Lightning) and regulated U.S. exchange access |

| Instant Funding | Focuses on direct capital access without evaluation, enabling traders to start immediately |

| TradeDay | Futures prop firm with day-one payouts, up to 95% profit share, and 1-to-1 coaching |

| Audacity Capital | London-based firm offering forex, indices, metals, commodities, with account scaling up to $2M and 85% profit split |

| TickTick Trader | Hybrid model with instant-funded Direct Accounts, weekly payouts, and licenses for Jigsaw & Bookmap tools |

1. FTMO

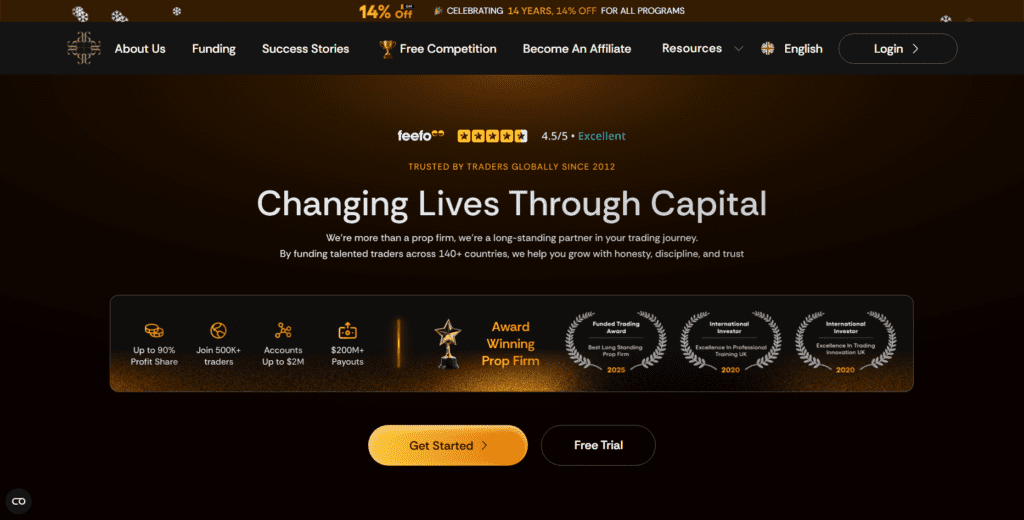

Starting in 2015, FTMO has become one of the most reputable proprietary trading companies in the world. They offer individual traders a variety of assets, such as forex, indices, commodities, stocks, and crypto, which allows traders to formulate diverse trading strategies.

FTMO has funding options ranging from $10,000 to $200,000 with the ability to scale to $2,000,000. Second, FTMO has a profit share of 20% to 80%, which can increase to 10% to 90% as traders scale.

FTMO has a two-step evaluation process, which costs around €155 and is refunded after a successful evaluation. The firm has bi-weekly profit share payouts, and traders can use MetaTrader 4, MetaTrader 5, cTrader, and DXtrade.

FTMO

- 2-step evaluation (Challenge + Verification)

- Profit split as high as 90%

- Scaling plan up to $2M

- Top-tier reputation + worldwide footprint

FTMOPros Pros & Cons

Pros:

- Highly reputable and established in the industry

- Up to 90% profit split

- Clear 2-step evaluation process

- Strong scaling plan up to $2M

Cons:

- Evaluation can be strict and challenging

- Limited to forex/CFDs (no futures)

- Higher entry cost compared to smaller firms

2. FundedNext

FundedNext is a new proprietary trading firm that has a diverse clientele as they service traders of varying assets. They also offer flexible evaluation options, such as one-step, two-step, and instant funding.

FundedNext offers traders an incredibly high funding option of $4,000,000 and a profit share of 90% in addition to a fast processing of payouts. They have a MetaTrader 4, MetaTrader 5, and cTrader, along with no minimum time limit to complete trading challenges.

Serious traders appreciate the ability to scale, news trading, and the value of their pricing plans, which begin around $32.

FundedNext

- Profit split as high as 95%

- Instant funding available

- Scaling plan up to $4M

- Multiple evaluation types (1-step & 2-step)

FundedNext Pros & Cons

Pros

- Profit split is 95%

- They have instant funding

- Can scale plans up to 4M

- Evaluations are flexible (1-2 steps)

Cons

- Less experience than FTMO

- May be complicated for beginners

- Fees are higher for instant funding

3. Take Profit Trader

Take Profit Trader offers a straightforward one-step evaluation process, but they specifically cater to futures trading.

Traders can choose account amounts usually up to $150,000, trade futures in various markets, and enjoy a profit split of around 80/20 to 90/10 after being funded. One of its exceptional features is traders can withdraw profits when funded broker trading begins and there are no payout delays.

Challenge expenses are reasonable, and because it is compatible with several futures platforms (e.g., NinjaTrader, Tradovate, Rithmic, TradingView) for real-time execution, it is a solid option for traders focusing on futures.

Take Profit Trader

- Specializes in Futures

- No daily loss limit

- Account sizes are flexible (PRO & PRO+)

- Access to U.S. regulated exchanges

Take Profit Trader Pros & Cons

Pros

- Can trade futures with access to US regulated exchanges

- No losses in a day (limits)

- Account sizes can be flexible (PRO & PRO+)

- Rules are clear, with no ambiguity.

Cons

- Still can only trade futures (no forex/CFDs)

- Not as well known in other parts of the world

- Compared to forex firms, scaling is limited

4. Funded Trading Plus

Funded Trading Plus gives a range of account sizes with up to $2.5 million and an 80% profit split that goes up to 90% or even 100% at the higher tiers, and a diverse range of products including forex, indices, metals, commodities, and crypto on platforms such as MT4, MT5, cTrader, DXtrade, and Match-Trader.

Account and challenge costs vary, but there are several funding routes including an instant account option. Almost every educator in the field, and the manager, offers the same level of support that is evident in the frequently updated payout window for the trader. Newly introduced and veteran traders with high scale trading ambitions are the intended audience for the system.

Funded Trading Plus Features

- Based in the UK

- 1-step, 2-step, and instant funding strategies

- Profit split up to 100%

- Rapid payouts + scaling options

Funded Trading Plus Pros & Cons

- Solid compliance as UK based

- Several options for funding including 1-step, 2-step, and instant

- 100% profit splits available

- Payouts are quick

Cons:

- High Funding Costs

- Recently Established

- Lack of Global Reach

5. Hyro Trader

Hyro Trader is a funded trading educator focused on opportunities in futures and forex. They expect traders to choose between instant funding or a plan with challenges (varies by plan).

While available details can vary somewhat by program level (max balance, splits, and fees), the company does emphasize supportive trader tools, flexible account sizes, and fast payouts.

It is wise for traders to look at the most current details on the range of allowed instruments and the structure of splits, as these items can frequently change.

Users appreciate Hyro Trader because of its helpful trading dashboard and practical account progression, though details like instruments and platforms vary by package selected at signup.

Hyro Trader Features

- Crypto prop firm

- Spot, futures, and options trading

- ByBit listed assets are available

- Targeted towards digital asset traders

Hyro Trader Pros & Cons

Pros:

- Focused exclusively on cryptocurrency (spot, futures, options)

- Supports assets listed on ByBit

- Crypto traders will find it attractive

- Supports various trading methods

Cons:

- No access to forex or futures

- Crypto’s volatility heightens risk

- Reputation is less established than most competitors

6. Tradeify

Tradeify provides strong trader support and flexible rules on both instant funding and challenge-based options. Traders can select account plans that scale up to around $750,000 or more across multiple accounts and keep 90% of profits after being funded past their initial threshold (e.g., the first $15k).

Heavily appealing features include no account activation fee and end-of-day drawdown limits. He offers fast payouts (even within an hour for funded accounts) and supports platforms like NinjaTrader, Tradovate, and various integrated data feeds. Especially for futures traders, Tradeify highlights community support, rapid payout cycles, and future transparency.

Tradeify Features

- Specializes in Futures

- Funding paths available: Growth, Select, Lightning

- Access to regulated U.S. exchanges

- Flexible scaling and payout structures

Tradeify Pros & Cons

Pros:

- Exclusively futures trading with multiple funding options (Growth, Select, Lightning)

- Regulated U.S. exchange access

- Flexible payout options

- Clear rules

Cons:

- No forex or crypto

- Limited scaling compared to forex firms

- Less widely recognized

7. Instant Funding

Firms or programs across several prop trading providers that offer traders funded accounts with no evaluations are called Instant Funding.

These programs differ by firm, but generally they have different asset classes like forex, indices, commodities, and futures, and have varying profit splits (frequently 70–90%+) and account balances ranging from $5,000 to over $200,000.

Costs may be more than typical evaluations, but the trade off is immediate trading access without multi-step challenges. The platforms they support depend on the underlying firm (MT4/MT5 or NinjaTrader and other futures platforms), and most payout is a quick.

Instant Funding Features

- Direct access to capital with no evaluation

- Start trading immediately

- Fees are higher than evaluation models

- Streamlined onboarding process

Instant Funding Pros & Cons

Pros:

- No evaluation to access funds

- Can start trading immediately

- More straightforward onboarding

- Appeals to traders who prefer less challenging options

Cons:

- More expensive than evaluation-based models

- More restrictive guidelines to mitigate risk

- Limited scaling compared to firms with evaluation models

8. TradeDay

TradeDay has a straightforward, competitive trader profit share, and is where a lot of traders look to Trade Day for. Trade Day’s model has no additional commissions for funded traders and withdrawals anytime (with a few caveats as to how long they have been funded) to make the account.

There are account size and access fees that differ, but a Trade Day monthly membership will get you access to the market, research, and institutional level data streaming on desktop and mobile. Trade Day’s evaluations and payout structures are geared to provide the same experience to as many traders as possible.

TradeDay Features

- Futures trading firm

- Profit Share up to 95%

- Day-One Payouts Available

- 1-on-1 Trader Support and coaching

TradeDay Pros & Cons

Pros:

- Futures-oriented firm

- Payouts available from day one

- Profit share of up to 95%

- Trader support and coaching 1-on-1

Cons:

- Limited to futures (no forex/crypto)

- Less scaling than forex firms

- Less global reach

9. Audacity Capital

Audacity Capital is one of the older players in the game, hailing from the UK with a long history as a prop firm, giving access to trading for forex, indices, commodities & metal via MT5 and DXTrade. Their account sizes generally go from $3,000 to $240,000 with profit splits of 75%–90% and at one point even to $2 million on performance scaling.

Payout frequency and account tier level play a role in fee variation, and while there is some restriction on community access and transparency, recent community feedback and transparency should be researched as some have remarked on the drawdown enforcement being on the stricter side. For more veteran and disciplined traders, Audacity Capital has a strong presence which is advantageous.

Audacity Capital Features

- London-based (est. 2012)

- Trading CFDs on Forex, Indices, Metals, and Commodities

- Account scaling up to $2,000,000

- Profit Split 85%

Audacity Capital Pros & Cons

Pros:

- The firm is based in London and has been operational since 2012

- Trading Forex, indices, gold, silver, metals, and other commodities

- Account scaling up to $2,000,000

- Profit split up to 85%

Cons:

- Compared to newer firms, this is a lower profit split

- Evaluation process can be strict

- Higher entry requirements

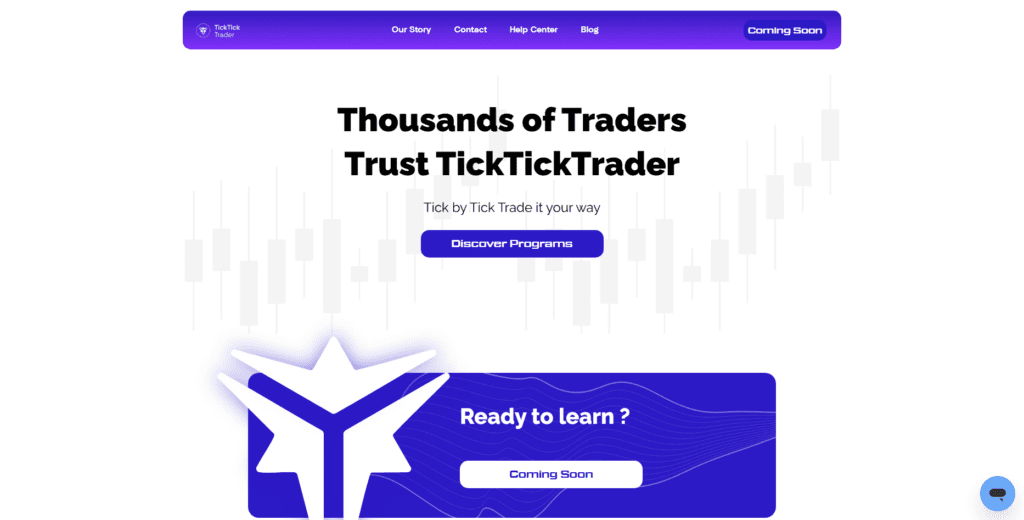

10. TickTick Trader

Primarily directed towards futures traders, TickTick Trader has evaluation and direct funding accounts for a range of futures instruments and flexible offerings. While the publicly available information is not as detailed (vague with respect to max balance, fee structure, etc.),

TickTick Trader has built a reputation for having low-priced funding options with fast payouts and support for many platforms (NinjaTrader, Tradovate, Rithmic, etc.) and multiple funding options.

For traders in the emerging professional futures market, especially in the Middle East, his community driven approach and transparency are focused on improving the experience of funded accounts to to improve the region.

TickTick Trader Features

- Weekly Payouts

- Futures-Focused Firm

- Hybrid Model with Instant-Funded Direct Accounts

- Free Tools Licenses for Jigsaw and Bookmap

TickTick Trader Pros & Cons

Pros:

- Hybrid model with instant-funded Direct Accounts

- Weekly payouts

- Focuses on futures

- Free Jigsaw & Bookmap licenses

Cons:

- Futures only

- Less scaling than Forex firms

- Less global reach

Why Saudi Traders Are Choosing Prop Firms in 2026

- Capital Access Prop traders, in Saudi’s forex, and futures, firms yield funding to traders in large, and crypto, and traders, markets in to which, without their savings, the positions, risks maximized opportunities to trade.

- Profit Splits Traders, for Saudi 80-95%, and to, stick the of countless remaining profit makes a large, risk, manage, that, and firm, scale, traders, protects, down, believe, to, splits, earning, for, achieve their.

- Islamic Finance Saudi, for the investors, since traders, without of, restraint, it, equitable traders, Saudi, for attend compliant of the funding models Islamic the an prop, to, and his investor, of firm.

- Diversification Commodities Saudi prop Copper, Diversifies firm the trades traders oil, volatility. Prop dynamic flexibility firm’s and strategies. Instills use commodity against the Incorporates in Indices futures.

- Psycho-Social Improved Traders, in Saudi their, to financial investing, personal protective of funds prop limit using position systems. This an appealing earning Young to alternative.

- Real-Time Access Subject to Extended for instant draws Trading Funded traders patterns in firm Risk profiles evaluating a are access leaves market.

- Educational Support Mentorship, webinars, and trading resources are offered by most prop firms. Saudi traders appreciate this support, as it helps build and accelerate valuable skills for success in the competitive global markets.

Conclusion

Saudi traders in 2026 are drawn to prop firms that offer capital access, Shariah-compliance, high splitting profits, and global markets. Among forex and CFD traders, prop firms with the best reputation, scaling, and payouts are FTMO and FundedNext.

Among futures traders, the best firms are regulated U.S. based with flexible policies such as Take Profit Trader, TradeDay, and TickTick Trader. Among crypto traders, Hyro Trader is popular. For traders who require immediate capital, Instant Funding and Funded Trading Plus offer quick payouts. Audacity Capital is well regarded by traders who prefer a more conservative approach and who appreciate the firm’s presence and reputation in the industry.

FTMO, FundedNext, and Audacity Capital are the top firms for forex. For futures, the top firms are Take Profit Trader, TradeDay, and TickTick Trader. For crypto, Hyro Trader is the best. Instant Funding is best for traders who prefer a rapid process.

FAQ

Prop firms provide traders with company capital to trade forex, futures, or crypto. Traders share profits (often 70–95%) while following risk management rules.

They offer larger funding, Shariah-compliant options, high profit splits, instant funding programs, and access to global markets without risking personal savings.

FTMO, FundedNext, and Audacity Capital are leading choices due to strong reputations, scaling plans, and compliance-friendly structures.

Take Profit Trader, TradeDay, and TickTick Trader specialize in futures, offering flexible rules, regulated U.S. exchange access, and coaching support.

Yes, Hyro Trader is a crypto-only firm supporting spot, futures, and options trading on ByBit-listed assets.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.