With its speed, accuracy, and emotionless execution, Best Prop Firms That Allow Automated Trading Bots has completely changed how traders approach the financial markets. Selecting prop organizations that permit trading bots is crucial for individuals looking to optimize these benefits.

These companies enable traders to use algorithms, take advantage of opportunities across a variety of assets, and uphold consistent tactics while adhering to stringent risk controls. In 2026, disciplined, tech-driven traders seeking efficiency and sustainable growth will find that bot-friendly prop businesses are the best option.

What Are Trading Bots?

Trading bots are automated programs that take execute trades based on certain strategies set up by the user. They study market information and look for chances to make an order to buy or sell an asset.

They do this quicker than a human could, and are advantageously free from the emotional bias that a trader might have. Since they are automated, they can work as much as 24/7 which allows them to trade on platforms such as Forex, equity, or cryptocurrency.

They can be designed to follow certain rules relating to technical indicators, arbitrage, or market making. Using trading bots has it’s advantages, however, requires a certain balance of risk and management on the part of the human trader so the bot does not lose too much money, especially in a volatile market.

Key Point

- FTMO – Supports automated trading using MT4/MT5 Expert Advisors (EAs) and algorithmic strategies for funded accounts.

- The5ers – Allows traders to run EAs and algorithmic trading on their funded programs.

- MyForexFunds – Permits automated trading on MT4/MT5, suitable for bot and algorithmic traders.

- FundedNext – Supports algorithmic trading and copy-trading via MT4/MT5 platforms.

- City Traders Imperium (CTI) – Allows the use of trading bots and automated strategies under their risk guidelines.

- Maverick FX – Permits algorithmic trading on funded accounts, with adherence to proper risk rules.

- Leeloo Trading – Supports automated trading using EAs and other bot software for funded accounts.

- Topstep – Allows automated trading strategies during evaluation and funded accounts within their platform rules.

- FTMO Challenge Sub-Program – Offers bot-friendly conditions for traders during the challenge and verification stages.

- OneUp Trader – Supports automated trading via MT4/MT5, allowing traders to use their bots legally on funded accounts.

1. Best Prop Firms That Allow Automated Trading Bots – FTMO

When it comes to proprietary trading, FTMO is one of the oldest and most prominent firms in the industry, having been established in 2015. Traders pay an evaluation fee, which is dependent on the size of the account, as well as completing a two-step challenge.

Once these requirements are satisfied, they have access to accounts worth anywhere from $10,000 to $200,000+. The profit shares begin at 80% and can go up to 90%. The trading options include MetaTrader 4, MetaTrader 5, cTrader, and DXtrade.

All these options provide the capability of trading with an Expert Advisor. FTMO also has the best reputation among firms for its top-notch regulations and community.

FTMO Key Point

- A very reputable and well-known company, including company formation, in 2015.

- 2-step challenge solutions.

- Profits 80-90%

- EAs, trading bots, and good risk controls.

- Uses MT4, MT5, cTrader, DXtrade.

FTMO

| Pros | Cons |

|---|---|

| Well-established and reputable (founded 2015) | Evaluation fee required |

| Supports automated trading (MT4, MT5, cTrader, DXtrade) | Strict daily/total drawdown limits |

| Profit split 80–90% with scaling options | Challenge may be stressful for beginners |

| Fast payouts and multi-asset support | Must follow strict risk rules |

| Large trader community and educational resources | Limited flexibility on some account sizes |

2. Best Prop Firms That Allow Automated Trading Bots – The5ers

The5ers started in 2016 as one of the earliest market players with a flexible evaluation model, including instant funding, and one-step and two-step evaluation options.

Traders have the ability to commence trading with lower amounts of capital (i.e., $5,000–$100,000), and can subsequently increase to larger amounts as they achieve profit targets. The profit share also varies, with splits of 50% to 100% at the top tiers.

The company allows automated trading bots and EAs on funded accounts using MetaTrader 5, as long as risk guidelines are observed.

The5ers starts offers solid scaling potential as its primary strength, and there are no strict time limits which is why it is appropriate for both algorithmic and discretionary trading.

The5ers Key Point

- Established in 2016 and has multiple financing options.

- 1-step, 2-step, and instant funding evaluation flexibility.

- Profits up to 50-100%

- Automated trading via MT5.

- Accounts that promote scalability.

The5ers

| Pros | Cons |

|---|---|

| Flexible evaluation programs (1-step, 2-step, instant) | Lower profit split at initial levels (50%) |

| Allows automated trading on MT5 | Some accounts require longer-term commitment |

| Scalable accounts and funding up to $1M+ | Limited platform options (only MT5) |

| No strict time limits for evaluation | Less known compared to FTMO |

| Transparent payout process | Limited CFD coverage |

3. Best Prop Firms That Allow Automated Trading Bots – MyForexFunds

MyForexFunds is a major player in the forex and CFD prop trading industry, having been established in 2020. The firm offers funding upwards of $2 million. These traders will encounter a variety of sets of programs.

After they meet the established evaluation goals, they will collect profit splits of as much as 90%. The company allows MetaTrader 4 and 5, which are compatible with automated Expert Advisors and trading bots.

The firm is appealing for bot traders as it offers greater funded amounts, especially for those looking to get their capital funded quickly, as long as it is not outside the parameters of the risk management guidelines within the programs.

MyForexFunds Key Point

- Established in 2020 and is one of the fastest growing proprietary trading companies.

- Multiple evaluation options.

- 90% of profits are split.

- Bots can trade on and funded accounts with MT4 and MT5.

- Rapidly growing a large potential fund with flexible rules and fast payouts.

MyForexFunds

| Pros | Cons |

|---|---|

| Fast payouts and multiple funded programs | Evaluation fees apply |

| Supports bots/EAs on MT4 & MT5 | Profit split lower than some competitors initially |

| Large funding potential (up to $2M) | Limited educational resources |

| Flexible rules and beginner-friendly | Risk rules must be strictly followed |

| Multi-asset trading available | Customer support can vary in responsiveness |

4. Best Prop Firms That Allow Automated Trading Bots – FundedNext

FundedNext is one of the leading prop trading providers with an impressive ability to attract new clients. One of the most appealing features are the profit splits which reach as high as 95% for CFDs and in certain futures programs, you get 100%.

Traders who evaluate fees have the chance to get scalable accounts, with no time restrictions to pass challenges, and accounts that are bot-scalable on friendly support for MT4/MT5 and other common applications.

FundedNext’s outstanding factor is the rapid payout speed (in most cases within 24 to 72 hours) and allowed news trading along with EAs and trading bots, supporting automated strategy developers.

FundedNext Key Point

- Started in 2021 and created a proprietary trading company with a large focus on the trader.

- Unlimited time evaluation flexibility.

- A profit split of 95% is allowed.

- EAs trading bots can be used on MT4 & MT5.

- Algorithm trading and news trading are allowed.

FundedNext

| Pros | Cons |

|---|---|

| High profit split (up to 95–100%) | Newer firm, less historical track record |

| EA/bot-friendly with MT4/MT5 support | Some programs may have higher evaluation fees |

| No time limits to pass evaluation | Limited community support |

| Allows news trading and algorithmic strategies | Some account rules can be complex |

| Scalable accounts and fast payouts | Multi-asset options may vary by program |

5. Best Prop Firms that Permit the Use of Automated Trading Bots – City Traders Imperium (CTI)

Established in 2018, City Traders Imperium (CTI) props up traders with 1‑step, 2‑step, and instant funding programs, with paving profit splits up to 100% as the performance rises. Automated trading strategies and EAs are allowed on MetaTrader 5 and Match-Trader, the two of which support platforms.

Balance-based drawdown rules, free trial options, and transparent payout processes with fast funding are CTI’s standout strengths.

The most flexible challenge structures and support for trading bots are interest to systematic traders who require flexible funding that scales up to millions while being able to retain a high profit share under a straightforward rules-based structure that is trader friendly.

City Traders Imperium (CTI) Key Point

- Established in 2018 and has multiple evaluation options.

- Profits are splittable up to 100%

- Available on MT5 and Match-Trader.

- Accounts that possess scalable bots and fast funding.

- Flexible rules on risk and smooth payouts.

City Traders Imperium (CTI)

| Pros | Cons |

|---|---|

| Profit split up to 100% | Smaller community compared to FTMO |

| Bot/EAs allowed, MT5 & Match-Trader | Less historical data for performance |

| Fast funding and scalable accounts | Limited multi-asset options initially |

| Transparent payouts and flexible risk rules | Evaluation fees apply |

| Multiple evaluation programs | May not support some advanced platforms |

6. Best Prop Firms that Permit the Use of Automated Trading Bots – Maverick FX

Maverick FX (established around 2020) is a relatively young and noteworthy prop trading firm that allows automated traders to get access to funded forex/CFD accounts after they pass its evaluation.

Profit splits can be competitive and 85% + at higher levels. The firm focuses on solid risk management and training. While exact founding details may differ per program, Maverick allows automated trading on standard systems like MT4/MT5.

Its core competency lies in balanced structured risk supervision and growth potential, hence valuable for algorithmic traders. The firm provides clarity in profit sharing and support for bot-based strategies

Maverick FX Key Point

- Established in 2020, this firm is growing

- 85% and higher profit splits

- Automated trading on MT4 & MT5

- Risk management

- Trading on multiple assets, along with structured evaluation

Maverick FX

| Pros | Cons |

|---|---|

| EA/bot-friendly with MT4 & MT5 | Relatively new firm |

| Profit split 85%+ with growth options | Limited evaluation program options |

| Structured risk management | Multi-asset support may be limited |

| Clear evaluation targets | Smaller trader community |

| Supports algorithmic strategies | Less brand recognition |

7. Best Prop Firm with Automated Trading Bots – Leeloo Trading

Leeloo Trading provides funded trading programs for forex and CFD traders using MT4 and MT5 which support automated bots and EAs. Traders fund an evaluation fee for qualification, then get a profit split of up to 90% after being funded depending on account type and performance.

Leeloo’s competitive advantage is its flexible challenge formats and trader autonomy, including bot automation and cross asset trading.

Its reputation is most prominent among algorithmic traders due to transparent regulations and customizable scaling capital options.

Leeloo Trading Key Point

- Established in 2021, accessible for beginners

- 90% profit splits

- Bots and EAs for MT4 & MT5

- Various formats for challenges

- Risk management rules for scalable accounts

Leeloo Trading

| Pros | Cons |

|---|---|

| Bot/EAs friendly (MT4 & MT5) | Newer firm with smaller track record |

| Flexible challenge formats | Smaller community support |

| Profit split up to 90% | Limited multi-asset coverage |

| Scalable accounts | Less educational resources |

| Clear risk rules | Evaluation fees required |

8. Best Prop Firm with Automated Trading Bots – Topstep

At Topstep, established in 2012, most focuses on futures trading and has simple evaluation funded accounts.

Automated strategies in futures markets are compatible with NinjaTrader, Quantower, and TopstepX, which are automated trading technologies.

A common profit split on first profits ranges from 90-100%, and Topstep’s risk management tools are promising for manual and algorithmic systems.

Additionally, its strong community and business longevity provide useful risk management strategies for systems and bots at trading futures and similar markets

Topstep Key Point

- Established in 2012 and specializes in futures

- 90-100% profit splits

- Supports Quantower, TopstepX, and NinjaTrader

- Automated trading is allowed

- Strong risk management and community support

Topstep

| Pros | Cons |

|---|---|

| Futures market specialist | Primarily for futures, not forex/CFDs |

| Profit split 90–100% | Limited multi-asset trading |

| Supports automated strategies | Evaluation rules can be strict |

| Strong risk management | Platform limited to NinjaTrader, Quantower, TopstepX |

| Long-standing reputation and community | Less suitable for beginner forex traders |

9. Best Prop Firms That Allow Automated Trading Bots – FundYourFX

While the majority of proprietary trading companies offer funded accounts for cryptocurrency, commodities, indices, and forex, FundYourFX even offers funding up to several million dollars with profit percentages of up to about 95%.

While fully automated trading is permitted by other leading prop firms, FundYourFX prohibits high-frequency trading (HFT), arbitrage bots, and third-party automated systems. Every trader on FundYourFX must trade manually within their rulebook.

This must be taken into account before considering automated techniques, and traders must study the firm’s policies and customer reviews as part of their due diligence.

FundYourFX Key Point

- FundYourFX is a proprietary trading firm offering instant and evaluation-based funded accounts.

- Traders can access funding up to several million dollars based on performance.

- Profit splits are advertised up to 90–95% on funded accounts.

- Supports MT5 and Match-Trader platforms for trading.

- Offers access to forex, indices, commodities, and crypto markets.

- No strict time limits for completing some evaluation programs.

FundYourFX

| Pros | Cons |

|---|---|

| Access to evaluation and instant funding plans with potential large capital (up to millions) | Numerous complaints about payout delays, denied withdrawals, or account breaches even after meeting targets |

| Profit share reportedly up to ~90–95% | Mixed trader feedback on legitimacy and transparency, with some calling the firm untrustworthy |

| No strict time limits or minimum trading days required for some programs | Several traders report poor or slow customer support and communication problems |

| Offers multiple account types and trading instruments (forex, indices, crypto, commodities) | Some independent reviews highlight opaque rules and insufficient disclosure of key details |

| Weekly payout options and flexible drawdown rules in marketing materials | Rule enforcement and breach disputes reported by traders on review platforms |

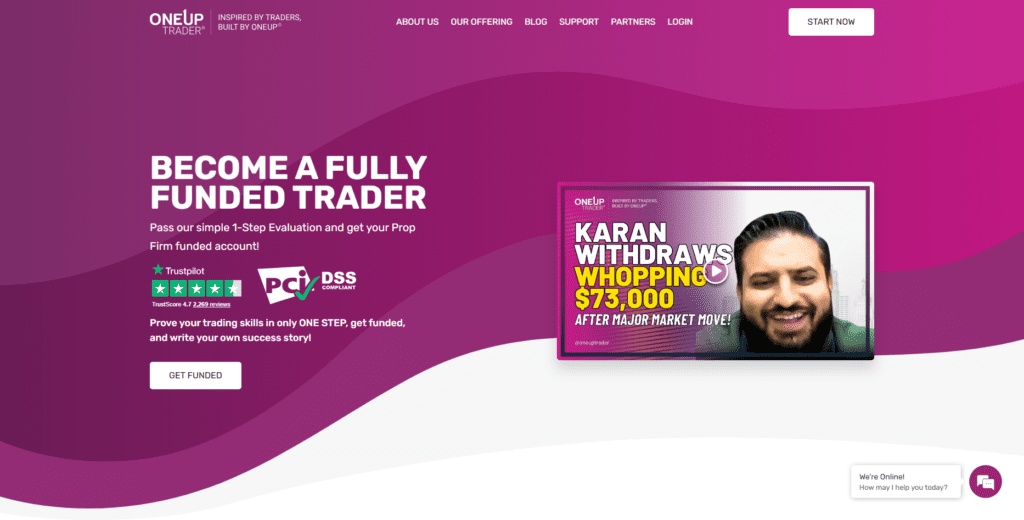

10. Best Prop Firms That Allow Automated Trading Bots – OneUp Trader

OneUp Trader provides a streamlined one-step evaluation that allows for funded accounts of $250,000 and approximately 90% profit sharing post-funding.

NinjaTrader and similar platforms offer manual and automated trading options. OneUp Trader has no hidden fees, free trials, and unlimited balance resets, allowing bot developers to work on automated strategies while trading real money.

The community is responsive, and the rules are easy to understand. This makes OneUpTrader an excellent option for systematic traders who want funded accounts and do not want complicated challenge structures.

OneUp Trader Key Point

- Established in 2017 with straightforward one-step evaluations

- 90% profit splits

- Supports MT4/MT5 & NinjaTrader

- Bots are allowed with unlimited resets

- Scalable accounts, fast payouts

OneUp Trader

| Pros | Cons |

|---|---|

| Bot/EAs allowed on NinjaTrader & MT4/MT5 | Smaller funding limits compared to top firms |

| Profit split up to 90% | Limited multi-asset coverage |

| 1-step evaluation, beginner-friendly | Smaller community support |

| Unlimited balance resets | Less well-known than FTMO/The5ers |

| Fast payouts and scalable accounts | Fewer advanced account features |

Why Choose Prop Firms That Allow Trading Bots?

Coverage 24/7

Trading bots cover the whole global market. Prop bots provide trading opportunities and profit potential. Best of all, there’s no need to trade in real time, manually.

Emotionless Decision-Making

The prop firm automating trading removes the human side of trading, including emotions and stress. Greed and fear are pushed aside resulting in consistent long-term profitable trading.

Execution Speed

Traders who can use prop trading bots can make trades in milliseconds. Being able to trade faster than manual posers less delays and instantly more trades to get more profits.

Scalability Across Multiple Instruments

Prop firms automated trading lets users trade numerous strategies at once. Besides forex, you can now trade equities and digital currencies, resulting in more adaptive and greater portfolio value.

Zone Consistency Bot Misapplication

Using trading strategies programmed into the prop firm’s automated trading system. Staying zoned in on a trading plan reduces mistakes and consistency on reaching desired trading goals increases.

Controlled Risk Bot Mismanagement

To manage trading loss, a person’s manual systems can be overrode and programmed into the systems used with the stop loss and the position size limits.

Automated trading systems are validation of firm’s commitment to trader protection; they ensure patron safety by enforcing risk parameters and protecting accounts from ruin.

Backtesting & Optimization

Automated trading strategies can be evaluated and refined using historical data. Prop firms with trading bots allow trader to create and deploy proven systems with confidence, and reduce execution risk with guesswork.

Automated Execution of Arbitrage Opportunities

Trading bots are able to identify and exploit differences in prices across different markets in an instant. Prop firm support automation, allowing traders to gain arbitrage profits, which is virtually impossible with manual trading.

High-Frequency Trading Access

Trading bots enable high-frequency strategies. Prop firms that support automation allow traders to adopt advanced trading strategies (such as high-frequency trading) that require speed and sophistication algorithimically.

Less Manual Tasks

Automated bots can take care of the repetive, boring tasks. Prop firms that support trading automation allow traders to shift their attention from active trading to post-automation tasks such strategy development, trade analysis, and trading scale.

Conclusion

In today’s volatile markets, traders might get a significant advantage by selecting prop firms that permit trading bots. Automated tactics guarantee that opportunities are seized all the time by offering speed, consistency, and emotionless execution.

Businesses that embrace bots enable traders to apply stringent risk management, diversify across a variety of assets, and optimize tactics through backtesting. These businesses foster a climate where technology improves discipline and profitability through features like scalability, arbitrage access, and decreased workload.

In the end, choosing a bot-friendly prop company guarantees that traders can use automation sensibly, fusing creativity with risk management to achieve long-term trading success and sustained growth.

FAQ

Trading bots are automated software programs that execute trades using pre-defined strategies. They analyze market data, manage risk, and place buy/sell orders faster than human traders.

Bot-friendly prop firms let traders leverage automation for speed, consistency, and 24/7 market coverage. They also enable diversification across assets and reduce emotional bias in trading decisions.

No. Some firms restrict bots, especially high-frequency trading (HFT) or latency arbitrage strategies. Always check each firm’s terms and conditions before deploying automated systems.

Bots can fail during volatile markets, overfit to past data, or malfunction due to technical errors. Risk management and monitoring are essential to avoid losses.

Top firms include Nova Funding, Infinity Forex Funds, Quantec Trading, FundedFirm, SmartT Prop, The5ers, MyFundedFX, True Forex Funds, Finotive Funding, and E8 Funding.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.