In the financial markets, being a great trader requires more than just hopeful thinking. With strategy, discipline, and education, a trader can thrive.

The Best Tips and Strategies for Traders demonstrates a combination of risk, proven techniques, and insightful market data to help any trader maneuver around volatility and extract profitable trades.

No matter the experience level, management of emotions, entry or exit timing, and a systematic approach can turn a trader’s downfalls into successes.

What are Trading Strategies?

Trade strategies are unique approaches that each trader employs to make sound, reasonable decisions in any financial trading. It gives a trader the ability to structure ways of taking advantage of opportunities created by a volatile market while controlling risk.

Best Tips and Strategies for Traders in 2025

- News Trading Strategy

- Trend Trading Strategy

- Range Trading Strategy

- Day Trading Strategy

- End-of-Day Trading Strategy

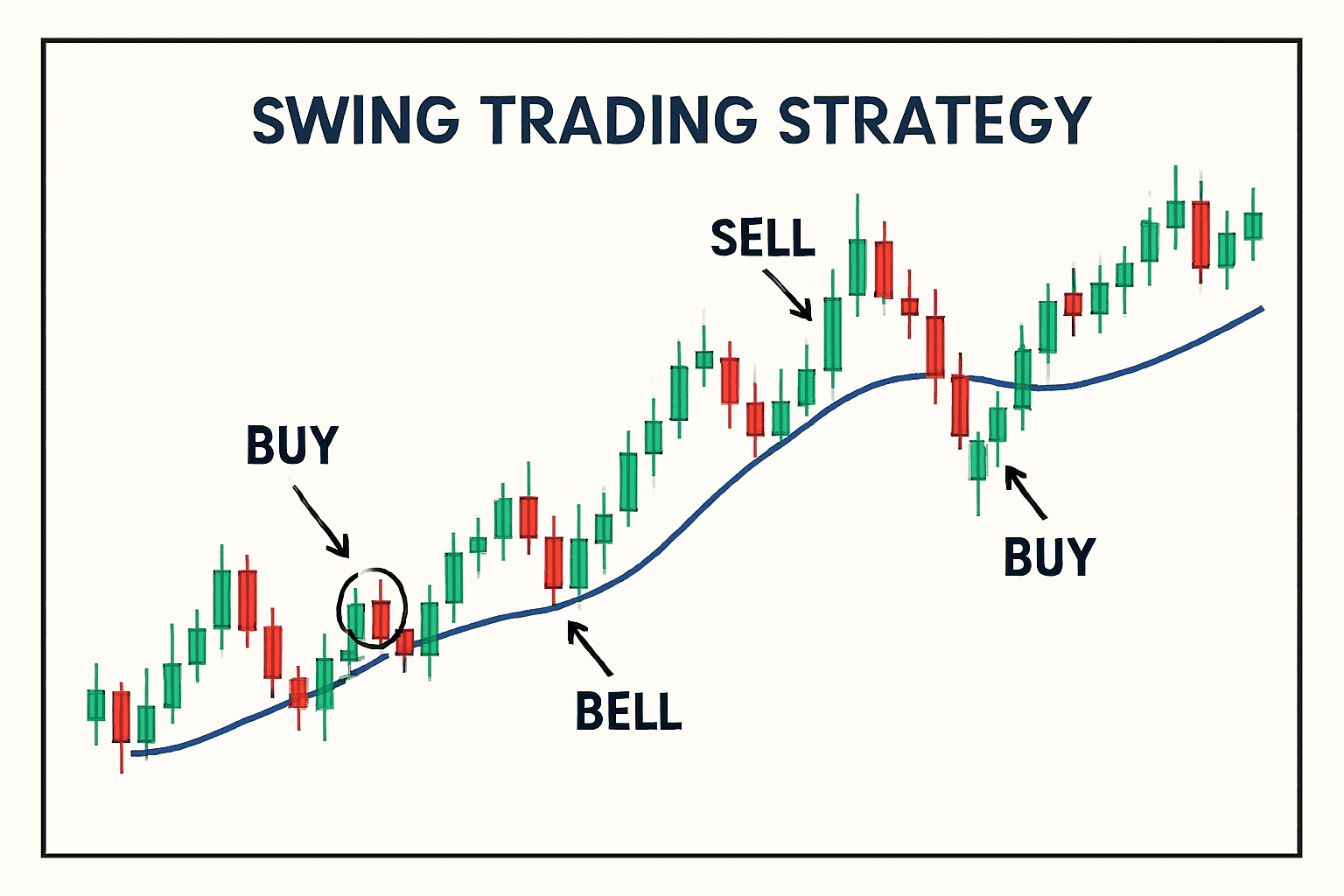

- Swing Trading Strategy

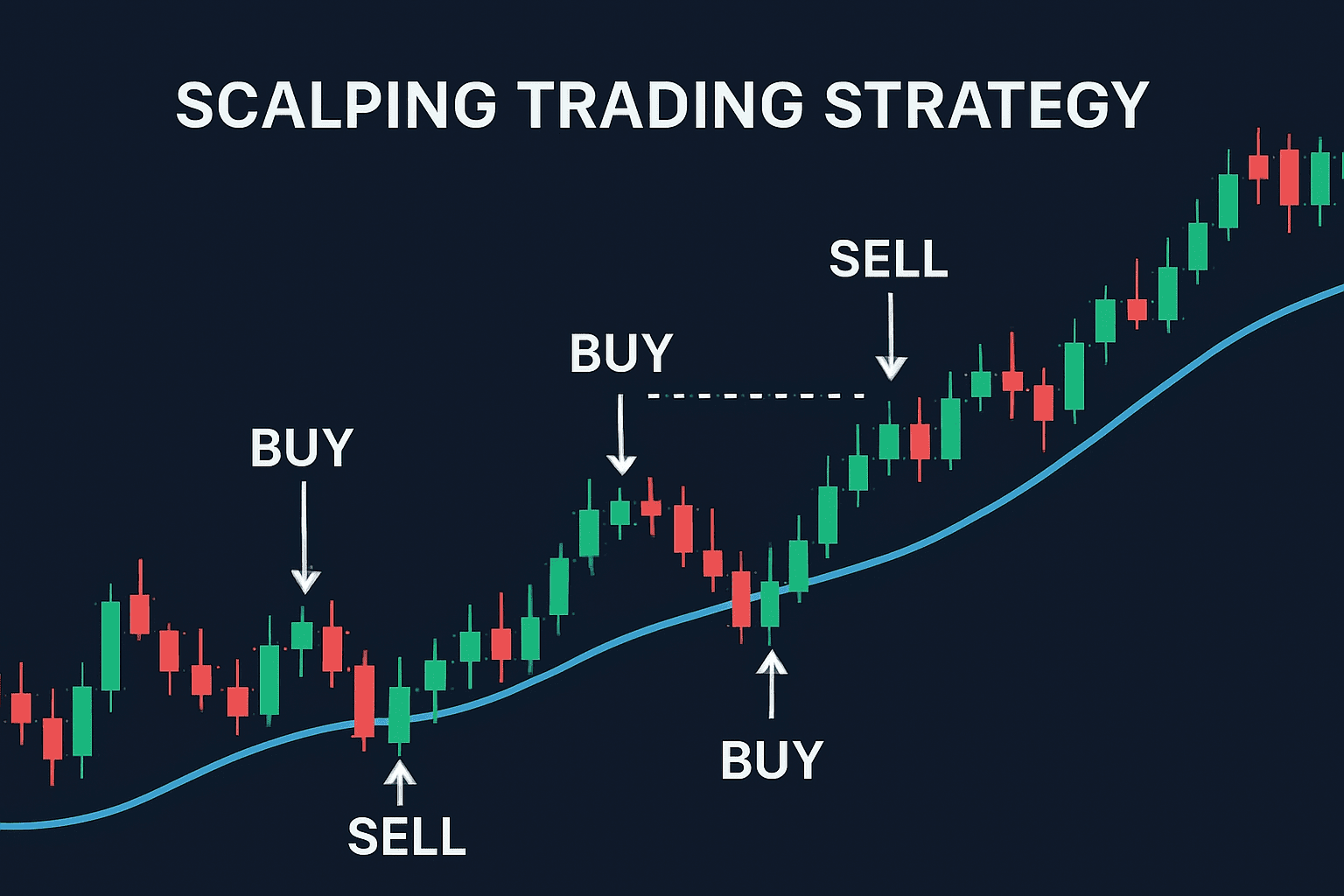

- Scalping Trading Strategy

- Position Trading Strategy

- Gap Trading Strategy

- Price Action Trading Strategy

1. News Trading Strategy.

News Trading is used to take advantage of the market’s volatility due to economic announcements, company earnings, or geopolitical issues. For traders, the challenge lies in simultaneously evaluating the market sentiment while trying to catch the wave while the price is still moving.

News-influenced market shifts happen all the time, so it is essential always to have your data about different news sources. For example, news sources that boast the Best Tips and Strategies for Traders in 2025 suggest a specific plan of action: monitor news that can have a large impact, set alarms for alerts to take immediate action, and use risk control.

In a situation where multiple news sources cross-check, that and only that, is known to bring practice in adequate time. This, of course, is the correct news. This involves interpreting the news and making hasty conclusions that smart traders would avoid.

Pros of News Trading Strategy:

- Revenue can be acquired almost instantaneously during high-impact changes.

- Traders are updated on critical and important managerial changes.

- The period of the market can be high during the economic period.

Cons of News Trading Strategy:

- The market is very volatile.

- Requires high levels of focus and instant decision making.

- Unmanaged emotional strain can cost someone much.

2. Trend Trading Strategy

Trend Trading is focused on the objective of recognizing, “does the trend have a chance of… going upwards, going downwards, or staying the same.’” In this case, the market has both a positive and a negative aspect.

Traders use technical tools on the market such as moving averages, trend lines etc to make it easier Best Tips and Strategies for Traders, look for the positive and stronger side of the trend because that way you would have more profit and greater chances to gain more, do not take the trade if the trend has indecision, and exit the trend if the trend is going down. You have detected the fall before others.

This is because it’s easier to avoid a trend that is going downwards, as your chances of losing while buying a large number of option contracts are very high, to make a little money.” The large number of option contracts is definitely known to bring practice in adequate time. This is the correct way.”

Pros Of Trend Trading Strategy:

- The strong, never-ending growth of the market is beneficial.

- Less frequent trading is beneficial to a trader.

- Tech indicators are easy to operate.

Cons Of Trend Trading Strategy:

- One would eventually face losses in a sideways, choppy market.

- In a bid to chase a trend, one can lose a lot of money.

- You need to work hard.

3. Range Trading Strategy

For the Range Trading Strategy, you buy at support and sell at resistance prices. For confirmation, you use oscillators.

Flexible Strategies for Traders in 2025 highlights the importance of traders understanding ranges, precise timing, and range stop-losses at trading volume, as well as range trading whips.

But less volatile ranges indeed offer more opportunities for static confirmation of changes in the market.

Pros of Range Trading Strategy:

- Used to fix station crises.

- You can gain a lot.

- The gain can be frequent.

Cons of Range Trading Strategy:

- In absence of the right market changes, one would lose money.

- Things moving sideways can be very dangerous.

- You can lose a lot of money very quickly.

4. Day Trading Strategy

With a Day Trading Strategy, the value of the shares is calculated during the trading session, and multiple trades for profit are carried out. Exposure at night is avoided, and positions are kept open until market close.

Flexible Strategies for Traders in 2025 suggest more instruments than other trades, quicker latency systems, and more discipline than ever before.

Fundamental shifts in strategy, risk, and positions are critical to trade off plans. Balance, trade strategy, and trading shifts are key in the systematic approach to performing the program.

Pros of Day Trading Strategy:

- You won’t lose a lot of money overnight.

- You can be a day trader and earn a lot of money multiple times in one day.

- You can gain a lot from someone people.

Cons of Day Trading Strategy:

- The work is hard and requires a lot of focus.

- Transaction fees and costs could cut into net income.

- Worries caused and emotional pressure concerning it are tough on novices.

5. End-of-Day Trading Strategy

The End-of-Day Trading Strategy works on market data and closing relevant trades on daily charts. For day trades, only confirmed patterns or signals are traded. Best Tips and Strategies for Traders advises on moving averages and candlesticks for end-of-day decisions.

Traders in this category can plan trades for the next day, which reduces their stress. They can focus on high-probability trades, and the combination of patience and strategic risk management results in steady results in the long run.

Pros of End-of-Day Trading Strategy:

- Intra-day observation is no longer a necessity.

- Trades can be done based on confirmed daily market movements.

- Less stressful than day trading.

Cons of End-of-Day Trading Strategy:

- Fewer trading than intraday strategies.

- Daily observation requires a considerable amount of time.

- Missing market opportunities at the beginning is a risk.

6. Swing Trading Strategy

The Swing Trading Strategy profits on price swings over the subsequent days/weeks. Traders use technical and market tools to determine trend continuation or reversals.

Best Tips and Strategies for Traders recommends the disciplined use of stop-loss management, tracking critical levels, and trading with the main market.

Swing trading holds a position long enough to capitalize on the market’s momentum. This form of trading protects the capital from overnight volatility or extended market fluctuations.

Pros of Swing Trading Strategy:

- Profits can be earned through short and medium term trends.

- Less time consuming than day trading.

- Technical and fundamental analysis can be used.

Cons of Swing Trading Strategy:

- Weekend and night risk exposure.

- Must have trend analysis to not hit a reversal.

- Declined emotional stability and peak concentration is a must.

7. Scalping Trading Strategy

Scalping is a trading strategy that aims at making a profit from small price movements within short time intervals. Traders complete a lot of transactions at the same time using high-frequency trading platforms and liquidity detection.

Precision, discipline, and fast decision making are the most essential things that Active Trading Traders Tips and Strategies for the Year 2025 emphasizes.

Emotionally, a trader needs to be prepared to accept losses while monitoring the order flow, spread, and other transaction costs to be a successful trader.

Highly liquid markets become the goldmine of the trader, and everything else is for the attention span of the trader and the risks he/she is ready to take.

Pros of the Scalping Trading Strategy:

- Small profits can be obtained many times over a short period of time.

- Less overnight risk exposure.

- Works in liquid markets.

Cons of Scalping Trading Strategy:

- Very time heavy and fast.

- High transaction costs can reduce profits.

- Must be quick with movements.

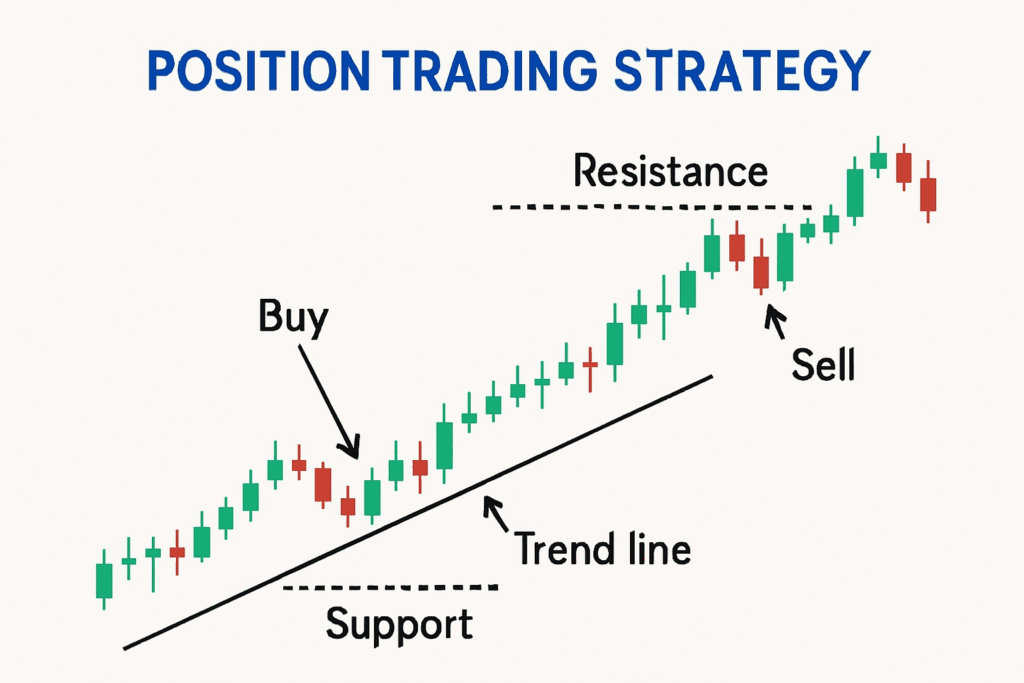

8. Position Trading Strategy

Investors who want to earn profit as well as dividends should also be well versed with the economy, as well as a few well-thought-out Position trading strategies that spend a tremendous amount of time understanding the economy and studying set patterns.

As mentioned, the best traders in the business believe in a strategy that helps traders maintain losing positions while accumulating greater interest. This means low transaction expenses and increased compound interest.

Such calm and collected investors who like to earn profit over a short period of time through trading will find this strategy perfect for them.

Pros of Position Trading Strategy:

- Less stressful because it is based on long term market trends.

- Less frequent trading which means costs are low.

- High potential profits from major market movements.

Cons of Position Trading Strategy:

- Low returns which takes a considerable amount of time to earn for short term strategies.

- Patience and willingness to endure drawdowns is necessary.

- Over the long-term, the market is subject to reversals.

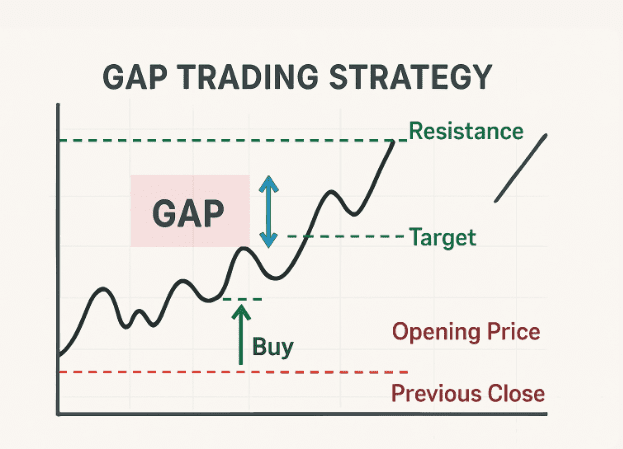

9. Gap trading strategies

Gap trading strategies focus on the price gaps that occur between trading sessions, attributed to overnight news or market activity. Traders assess gaps in direction and volume to formulate their entry points.

Gap Tips and Strategies for Traders in 2025 advise tracking gaps in types and employing stop-loss gap protection. Market context, confirmation of market momentum, and calculated risk need to be addressed.

Gap trading strategies can be highly profitable, but require precision, speed, and complete attention to market reactions. At the same time, volatility can reduce the gap in hyper profits.

Pros of Gap trading strategies:

- Fast Profit Target that closes a Position to capture a Gap.

- A trader can close a position to capture a profit target at multiple price levels.

- There is a higher chance for profits in a volatile market.

- Uses simple and clearly defined tools for technical analysis.

Cons of Gap trading strategies:

- Shifting in gaps is unexpected and can be unfavorably impacted.

- The strategy is profit-targeted and therefore closely monitored.

- In periods of low volatility, the strategy will be ineffective.

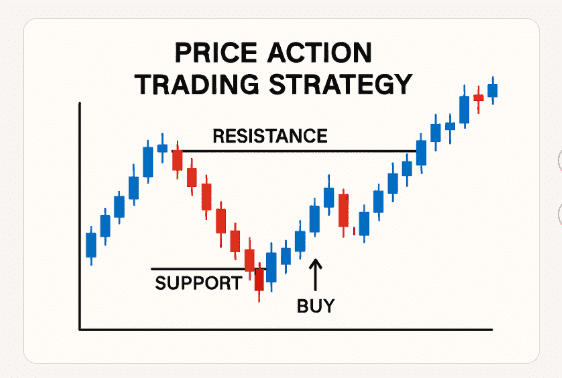

10. Price action trading strategies

Price action trading strategies in their purest form rely solely on historical price movement for trend and candlestick pattern analysis. Overly complicated price and volume indicators do not burden them.

Traders, in this case, attend to support and resistance as well as trend indications for their decision-making. Price Tips and Strategies for Traders in 2025 focus on price action and emphasize risk control, market context, entry control, and exit discipline.

This way, they reduce the analysis to the pure price movement, enhancing the trading decision agility for action on the trend, allowing the price movement to dominate the decision instead of the market lagging indicators.

Pros of Price action trading strategies:

- The analysis is purely price action, and there are no indicators to lag.

- The trader can identify strategies in any market.

- Enhances the trader’s overall market understanding and skill.

Cons of Price action trading strategies:

- Requires extensive knowledge of their patterns and what the market context is.

- Without rules, the analysis can be open to interpretation.

- A lot of self-control and practice is needed.

How To Start Day Trading?

Starting day trading involves bringing together your money, finding a reputable broker, and self-educating to create a strategy. Here’s a five step process approach with research to back it up.

Step 1: Learn The Trading Strategies And The Basics

Retail day traders don’t need a degree in finance, but they must, however, learn and understand the basics in depth. Some of these basics include trading psychology, risk management, and even technical analysis.

The knowledge of books, online editors, and tools to analyze the markets is a must have. A survey from 2023 and onwards states that 78% of successful retail traders with strong technical and risk management knowledge understand how they got to where they are.

Step 2: Design A Trading Plan

Every trading plan must include the goals of the investment, the risk appetite, and the rules surrounding entry into and exit from the investment. Every trading plan must include the percentage of the capital that is at risk for a single trade and the risk on the trade management plan.

Trading simulators and other tools that teach you day trading strategies are highly recommended; it has been proven that traders who first practice in a virtual environment are 60% less likely to lose money in the initial stages.

Step 3: Choosing a Platform and Add Money to Your Account.

To begin day trading, focus on builders with low fees, fast execution, and sufficient reliable tools. Open a modest account using money you are willing to lose. Data from 2024 suggests that postponing day trading losses can be cut by 50% when starting with smaller capital.

Step 4: Start with a Small Amount.

In day trading, starting with lower capital reduces significant losses as you become a more proficient trader. Post-trade reviews and adaptability are paramount. Research suggests very small initial trades help reinforce trader-level principles and risk management, thereby boosting confidence.

Step 5: Focus and Control Your Feelings.

To report on day trading success, line by line, you rigidly follow your plan and avoid any changes due to emotional impulses. Industry insight suggests 65% of unsuccessful retail traders abandon their plans due to stubborn trading. Having a plan and sticking to it, especially with stop losses, is paramount, considering the data, not fear or profits.

Key Elements of Trading Strategies

Entry and Exit Points No matter what time, a target price should always be established. A trading strategy should be created to encourage the purchase and selling of an asset base. Research confirms that a trader who had entry and exit ranges reported a 40% emotional mistake reduction.

Estimation of Equivalent Volume This strategy helps to identify the size of the asset volume that will be bought/sold in a single transaction. It allows a trader to mitigate losses and efficiently employ capital rationally. Traders who practice precise position sizing are 30% less likely to experience a capital loss.

Time Frame of Transaction The technique/s may be implemented a day, month, or year depending on what the individual decides. A trader who styles them self choosing milliseconds can very much rely and trust on their tactic while a trader who chooses to engage them self in fundamental has both self-control and patience.

Control of Potential Loss It limits the ability of setting thresholds a trader can use for their position, risk diversification, and capital that can be traded for the loss of a position. Research has calculated that a risk that is fully, ignored and ignored results to been gained a transactional loss in the future is 60%.

Conclusion

Analysis shows that, in 2025, successful trading is underpinned by a mix of continuous education, discipline, and the correct strategy. It does not matter if you do news trading, trend trading, swing trading, or use price action techniques.

You must learn market dynamics and implement risk control. Tips and strategies for traders advance the proposition of developing a trading plan, risk control, and discipline.

In this case, it is following the plan without giving way to emotions. A trader who is educated, practices, and is a specialist in the modern business environment increases the chances of long term profit.

FAQ

The top strategies include news trading, trend trading, range trading, day trading, swing trading, scalping, position trading, gap trading, and price action trading. Each strategy suits different market conditions and risk profiles.

Consider your time availability, risk tolerance, capital, and market knowledge. Beginners often start with trend or swing trading before attempting high-speed strategies like scalping or news trading.

Risk management is crucial. Setting stop-losses, defining position sizes, and diversifying trades help protect your capital and reduce emotional decisions.

Yes, but beginners should start small, use simulators, and follow a strict trading plan. Discipline and continuous learning are key to long-term success.

Study trading principles, practice with demo accounts, analyze your trades, and stay updated with market news. Combining education with strategy testing improves decision-making and confidence.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.