In this article, I’ll talk about BoerFunded, a trading funding platform that enables traders to obtain capital and advance their trading careers.

A single Standard Boer account with different account sizes, unambiguous rules, and a simple scaling strategy is provided by BoerFunded.

In addition to obtaining individualized guidance, traders can demonstrate their abilities, receive profit splits, and progressively manage up to $2 million in cash.

What is BoerFunded?

BoerFunded is a cutting-edge funding platform that gives companies, startups, and entrepreneurs access to customized financial solutions.

BoerFunded, in contrast to traditional banks, concentrates on streamlining the funding process by providing adaptable choices, including grants, loans, and equity-based help. Its goal is to expedite corporate expansion by eliminating common financial obstacles, offering quick approvals, and guaranteeing clear conditions.

Additionally, the platform provides individualized advice to help applicants select the best funding option for their requirements. BoerFunded helps companies grow effectively and sustainably by bridging the gap between aspirational entrepreneurs and accessible funding.

Overview

| Category | Details |

|---|---|

| Type / Category | Financial Services / Funding Platform – Specializes in providing business loans, grants, and equity-based funding. |

| Target Audience | Startups, SMEs, entrepreneurs seeking capital for business growth. |

| Funding Options | Loans, grants, equity funding, and other tailored financial solutions. |

| Mission | To empower businesses by providing fast, flexible, and transparent funding options while guiding them toward sustainable growth. |

| Key Features | Fast application process, flexible funding, personalized support, transparent terms. |

| Website | [Insert Official Website] – Main portal for applications and support. |

| Supported Regions | [Insert Regions/Countries] – Geographic areas where BoerFunded operates. |

Trading platform

How to Get Started BoerFunded

Step 1: Visit BoerFunded’s Website

The first thing you should do is to access BoerFunded’s website to investigate the services it offers and the type of funding that is available.

Step 2: Signing Up

To create a secure account, please enter your details as requested, including your name, business name, and business email address.

Step 3: Defining Your Funding Needs

Depending on the needs of your business, you can determine the funding needs, be it a loan, a grant, or equity funding.

Step 4: Filling in the Detailed Application Form

The application form needs to be filled including the name of your business, the financial details, and what you need the funding for.

Step 5: Submitting the Necessary Documents

Your business registration, financial statements, and forms of ID should be uploaded, as they are essential for the funding process.

Step 6: Information Accuracy and Submission

Before you send in your application, please double-check that all of the details are correct.

Step 7: Application Evaluation

BoerFunded checks your application, and depending on the funding type and your account profile, they will most likely get back to you within a short period of time.

Step 8: Fund Accessibility

As soon as your account is funded, you are free to access the money given to you on loan, and you may use it to grow your business.

Step 9: Funding Journey Support

Essential BoerFunded support and guidance is given during the funding utilization period and repayment to make sure that your business can operate effectively.

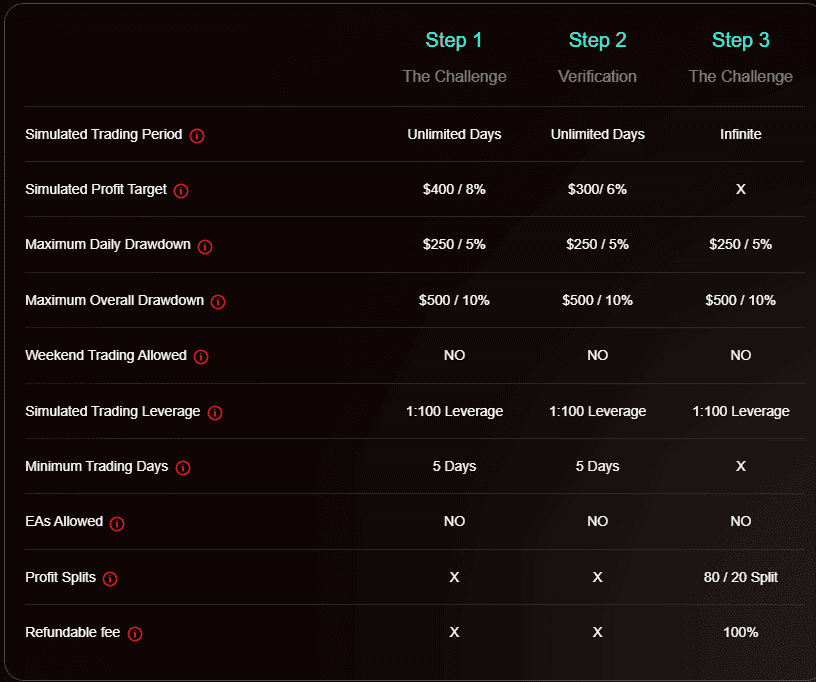

Challenge Details

BoerFunded recently began offering a single trading challenge: The Standard Boer Account. This account allows traders to showcase their skills on different account sizes while meeting straightforward criteria.

Price:

- $5,000 Account: $79

- $10,000 Account: $149

- $25,000 Account: $249

- $50,000 Account: $349

- $100,000 Account: $579

- $200,000 Account: $999

Trading Guidelines:

- Phase 1 Profit Target: 8%

- Phase 2 Profit Target: 5%

- Maximum Total Loss: 10%

- Daily Loss Limit: 5%

- Profit Share: 80%

- Drawdown Type: Static

- Time Limit: Unlimited

- Leverage: 1:100

- Maximum Lot Size: 10

- Payout Frequency: 14 days

- Copy Trading: Allowed

- Minimum Trading Days: 5

Scaling Plan

Traders can manage up to $2 million in funding. They need to have a 6% profit in three consecutive months to qualify.

Rewards:

- Account balance grows by 25% every three months (up to $2 million).

- Enhanced profit split up to 95/5 with an add-on, rewarding consistent performance.

Countries Banned from Purchasing

Owing to regulatory restrictions, BoerFunded is unable to accept traders from certain countries at this time. These countries include:

- India

- Russia

- Belarus

- Indonesia

- Cuba

- Venezuela

- Sudan

- South Sudan

Trusted & Rewarded

Benefits of Using BoerFunded

Quick and Hassle-Free Access to Funds – The easy application process takes less time to get approved for than a standard bank.

Diverse Funding Solutions – Your business can get funding in the form of a loan, a grant, or equity.

Tailored Assistance – Help is provided to ensure that businesses get the most appropriate funding.

No Surprises – Repayment and conditions are clear and documented, minimizing the risk of hidden fees.

Facilitates Growth of the Enterprise – Helps all financed SMEs to grow by funding the purchase of additional operational capacity and the expansion of the business.

Lowered Financial Access Constraints – Funds businesses that were likely not to get financing by formal loan providers.

Potential for Lifelong Collaboration – Clients are financed with the expectation that the funding services will be utilized by the businesses in the future.

How BoerFunded Works

Explore Funding Options

The entrepreneurs and businesses check what types of funding options are available (loan, grant, equity financing).

Create an Account

Create an Account on BoerFunded’s website with personal and business info.

Submit an Application

Complete the application by including info about the business, finances, and how much funding is needed.

Upload Required Documents

Upload all needed documentation, like business registration, financial statements, and identification.

Application Review

BoerFunded reviews the application to check if they are eligible, what the financial status of the business is, and what the potential of the company is.

Approval Notification

Applicants are notified of the funding they received and the terms of the funding.

Receive Funds

After funding is approved, the amount of money is sent to the applicant’s available bank account to use for the business.

Ongoing Support

BoerFunded helps the business to make sure the money is used as it should be, and to make sure it is paid back.

Risks and Considerations

Obligations of Repayment – You are bound to return the money that you borrow against the lending terms, otherwise it will affect your credit score and/or you will not be able to access funding in the future.

Cost of Capital – Some of the funding options come at a price which may be in the form of interest and/or service fees.

Eligibility Restrictions – not all businesses will qualify; the relevant criteria will need to be reviewed closely before one applies.

Financial Mismanagement – the funds may not be managed properly resulting in the failure to achieve the desired goals of growth or the development of real strain.

Funding Dependency – Becoming too reliant on external funding will lead to a loss of self-sufficiency and long term viability.

Uncontrolled Market and Business Risks – There are some external factors, including fluctuations in the market, that may to affect success of the projects that are being financed.

Compliance and Legal Risks – these risks are associated with failure to observe the funding provisions and the relevant legislation.

BoerFunded vs. Other Funding Platforms

| Feature / Category | BoerFunded | Other Funding Platforms |

|---|---|---|

| Funding Options | Loans, grants, equity-based funding | May offer only one or two types (e.g., loans or crowdfunding) |

| Application Process | Fast, simple, and online | Often longer with more complex procedures |

| Approval Speed | Quick approval for eligible applicants | Can take longer depending on platform and requirements |

| Support & Guidance | Personalized assistance throughout the process | Limited support; mainly self-service |

| Transparency | Clear terms, fees, and repayment schedules | Terms can be less transparent, hidden fees possible |

| Target Audience | Startups, SMEs, entrepreneurs | Varies; some focus on large businesses or investors |

| Flexibility | Tailored funding options based on business needs | Often standardized funding options |

| Growth-Oriented | Focus on helping businesses scale efficiently | May focus only on funding provision without growth support |

| Technology & Platform | User-friendly online platform | Varies; some platforms less intuitive |

Boer Funded: Trade the Future

24/7 Customer Support

Our dedicated support team is available around the clock to assist with any questions, technical issues, or guidance needed. Whether it’s day or night, we’re here to ensure a seamless experience, so traders can stay focused on what they do best.

Up to 95% Profit Split

We offer one of the highest profit splits in the industry, allowing traders to retain up to 95% of their profits. This unmatched rate reflects our commitment to truly rewarding our traders’ success and maximizing their earnings.

AI-Powered Trading Journal

Our innovative AI trading journal helps traders discover their best strategies, pinpoint optimal trading days, and build a comprehensive trading log from scratch. It keeps traders on track by monitoring their trades and ensuring adherence to personal risk rules, empowering smarter, data-driven trading decisions.

Biweekly Payout Options

Traders enjoy biweekly payouts, offering regular access to their hard-earned profits. This dependable schedule ensures consistent cash flow, helping traders manage their finances seamlessly in line with their goals.

Diverse Platform Access

Trade seamlessly across multiple platforms, including Tradelocker and soon DX Trades, with compatibility for all major trading tools. This multi-platform access ensures traders can use their preferred platforms without limitations, making it easier to transition and trade confidently.

Trader Community and Mentorship

Join a vibrant community of top traders with access to exclusive monthly Zoom calls with industry leaders. Our community offers support, networking, and mentorship to help traders continuously learn, improve, and stay motivated throughout their trading journey.

Boer Funded prop technology

Key Features of BoerFunded

Diverse Funding Profiles

To address issues of varied business models, we have loans, grants, and equity, complemented by strategies for funding.

Quick Approval Process

Response and submission are one click apart, encouraging efficiency on both sides.

Assisted Self-service

We work on creating optimum algorithms and solutions for every client to be able to navigate our system to their funding outcome, and we are there to help them.

No hidden stips

Our paperwork details are consistent across the board, to what is to be included, to ensure there are no hidden costs to what we are charging.

Cooperative/dependable products

Services are tailored around customers needs based on our wiq system to ensure we give the correct competition and better products in the corporate world.

Assists enterprises to grow

As their strategies are to help every enterprise build in the simplest manner and with the lowest efforts.

Niche Financing

Most of the loans are tailored to provide support to even clients who are usually missed in the net to get financially supported.

Documented support

Application, document submission, and all transactions are done on a digitally auditable system.

Pros & Cons

| Pros | Cons |

|---|---|

| Fast and Simple Application – Quick and easy online process. | Eligibility Limitations – Not all businesses may qualify for funding. |

| Multiple Funding Options – Loans, grants, and equity-based solutions. | Repayment Obligations – Borrowed funds must be repaid on schedule. |

| Personalized Support – Expert guidance throughout the funding process. | Potential Fees/Interest – Some funding options may include costs. |

| Transparent Terms – Clear repayment schedules and conditions. | Dependency Risk – Over-reliance on external funding can affect sustainability. |

| Growth-Oriented – Designed to help businesses scale efficiently. | Market Risk – External business or market fluctuations can impact success. |

| Accessible to Startups & SMEs – Funding available even for smaller businesses. | Compliance Requirements – Businesses must adhere to legal and regulatory obligations. |

| Secure Platform – Safe document uploads and fund management. | Limited Regional Availability – May not operate in all locations. |

Conclusion

BoerFunded is a vibrant and easily accessible fundraising platform created to support entrepreneurs, SMEs, and startups. It eliminates many of the conventional obstacles that companies encounter when looking for funding by providing flexible funding options, quick approvals, and individualized advice.

BoerFunded helps companies expand effectively and sustainably with clear terms, growth-oriented solutions, and a safe online platform.

The advantages of quick access to finance and professional assistance make BoerFunded an invaluable partner for business expansion, even though candidates should take eligibility conditions and repayment obligations into account. It works well for transforming big ideas into profitable endeavors.

FAQ

BoerFunded is an innovative funding platform that provides loans, grants, and equity-based financial solutions to startups, SMEs, and entrepreneurs to support business growth.

Startups, small and medium-sized enterprises (SMEs), and individual entrepreneurs looking for capital to grow their business can apply, provided they meet the eligibility criteria.

BoerFunded offers multiple funding options including business loans, grants, and equity financing tailored to different business needs.

Applicants need to create an account on the BoerFunded platform, choose a funding type, complete the application form, upload required documents, and submit for review.

Approval time varies depending on the funding type and completeness of your application, but BoerFunded is designed to provide fast and efficient evaluation.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.