Fintokei Prop is the first-of-its-kind proprietary trading company that provides access to substantial trading capital without the financial risks typically associated with trading.

With programs like SwiftT, ProT, and StartT, Fintokei offers a strong combination of low, stable spreads, a trustworthy brokerage, and well-developed educational content to assist novice and advanced traders.

They prioritize trading and provide a highly professional, structured environment that helps successful traders advance their careers.

What is Fintokei?

Fintokei is an education and evaluation company for ambitious traders. They provide traders with a safe environment to improve their trading skills, learn healthy trading habits, and strengthen their discipline in order to beat the market and build a valid track record verified by us.

Once evaluated, they reward the consistent traders on their way further, prepare them for trading with larger accounts and for attracting investors’ capital, and connect the best ones with partner regulated portfolio management companies. Fintokei accelerates successful traders by Purple.

Fintokei Company Details Table

| Feature | Details |

|---|---|

| Company Name | Fintokei |

| Company Legal Name | Fintokei a.s. |

| Company Registration Number | 09110127 |

| Headquarters | Brno, Czech Republic |

| Years in Operation | Since 2022 |

| Broker | Purple Trading Seychelles |

| CEO | David Varga |

| Challenge Types | SwiftTrader, ProTrader, StartTrader |

| Challenge Fees | $79 to $799 (corrected from duplicated $79–$79) |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Account Sizes | $1K to $400K (scaling up to $4M) |

| Payouts | After funding; includes contract fee reimbursement |

Who Can Join Fintokei?

We are happy to accept any adult over 18 years old. You don’t need any background or degree to participate. We can’t accept persons with criminal financial records and persons on sanction lists.

Please note that currently we do not provide our services to residents with citizenships of the following: USA, India, Russia, Belarus, North Korea, Iran, Myanmar, Syria, Yemen, Cuba, Venezuela, Sudan, South Sudan, Afghanistan, Somalia, Iraq. Temporarily restricted are: Vietnam, Pakistan, Bangladesh, China.

How Does Fintokei Work?

Traders at Fintokei get mocked-up capital accounts and get to earn money based on their results.

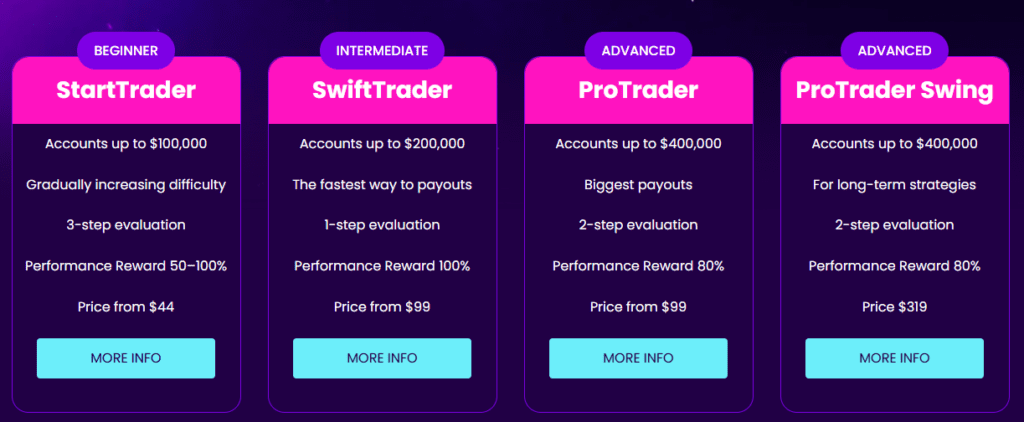

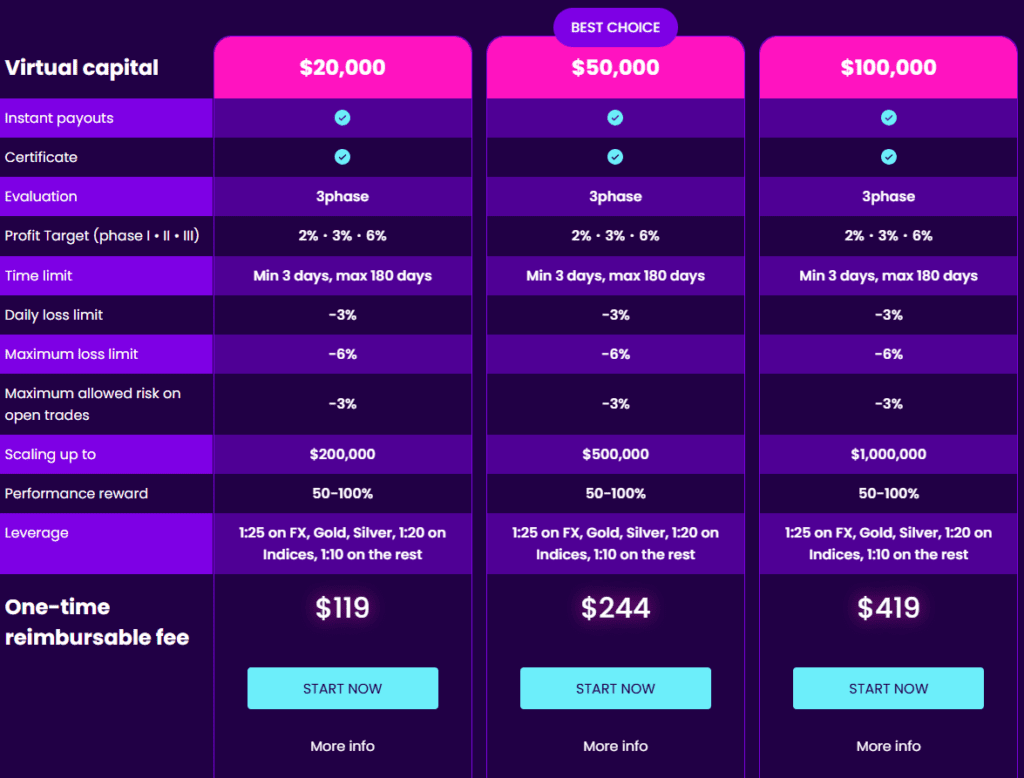

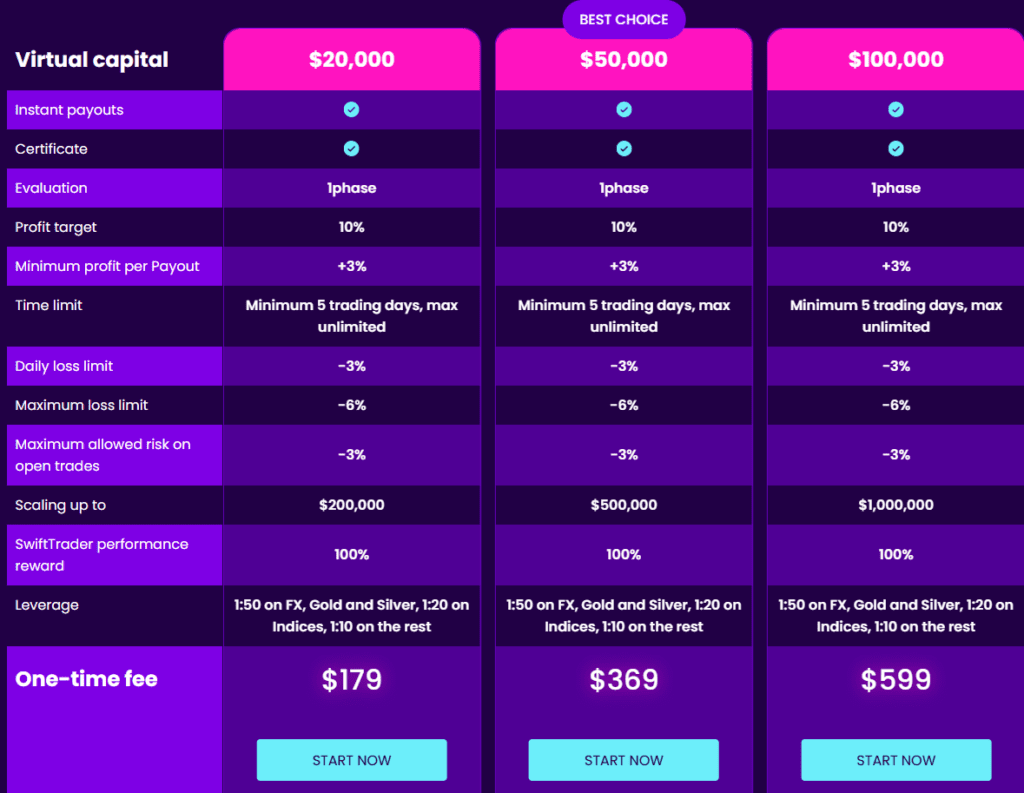

Traders take their pick on which challenges to do: StartTrader, SwiftTrader, and ProTrader. These challenges assess overall consistency in profits, risk management, and drawdown controls.

Once all challenge requirements are met, the trader begins earning real money, with some programs paid out biweekly.

Unlike the other prop firm challenges, the SwiftTrader challenge has no time limits, and all the other challenges have very light requirements, so you can take your time with your trades.

Fintokei Challenge Comparison Table

| Feature | SwiftTrader | ProTrader | StartTrader |

|---|---|---|---|

| Virtual Capital | $1K – $10K | $10K – $400K | $5K – $100K |

| Time Limit | None | Unlimited (Min 3 profitable days/phase) | 180 days total |

| Phases | 1 | 2 (8% → 6%) | 3 (2% → 3% → 6%) |

| Daily Loss Limit | –10% | –5% | –3% |

| Max Loss Limit | –10% | –10% | –6% |

| Scaling Potential | 10x | Up to $4M | Up to $1M |

| Fee | $79 – $519 (one-time) | $99 – $2,399 (one-time) | $44 – $419 (refundable) |

| Certificate | ✅ | ✅ + Online Course | ✅ |

| Consistency Rule | ⚠️ Applied if needed | ⚠️ Applied if needed | ⚠️ Applied if needed |

| Best For | Fast scalpers & confident traders | Serious traders aiming long-term growth | New traders learning prop trading |

Choose Your Demo Trading Challenge

Choose the account size you always wanted to trade with and get access to your Phase 1 account in less than 5 minutes. With the ProTrader Swing program, show off your swing strategy, ride the trends, trade the news.

StartTrader

Entry-level demo trading Fintokei program. A 3-phase beginner-friendly challenge that will prepare you for a future career in prop trading.

SwiftTrader

ProTrader

How does Fintokei have to pay?

The Fintokei pay structure varies by account type. Below is the information specific to each account type, quoted directly from Fintokei to streamline the process.

Swift Trader Accounts

If you want to withdraw profits from your swift trader account as profit is also at 10 or more percent, and at least fourteen or more days have passed since the last withdrawal, or account creation.

This is a one-time rule, after the first withdrawal is made, you only need to have a small amount withdrawable from your account. Before making a withdrawal, please make sure to close all your open trades, this is a solid rule to follow.

Pro Trader Accounts

From the Pro Trader accounts as long as fourteen or more days have passed since the last withdrawal, or account created, you can withdraw any profits as well. It is also important to remember to close any open trades before making a withdrawal request, this can also result in the automatic closing of your open trades, and this is usually the cause of issues when withdrawals are made.

What Strategies Are Not Allowed at Fintokei?

To ensure both Fintokei and the traders have a positive and equitable relationship, some strategies are limited. These regulations help guarantee that the trading activities comply with the firm’s requirements and can be replicated in the actual market. Below are the restricted strategies that are directly quoted from Fintokei’s website:

Issuing copies of other people’s trades or having a third-party manage your account/s.

Utilizing any other third-party service or Expert Advisor (EA) that seeks to ‘pass your prop trading evaluations’ or otherwise exploit certain technical gaps in the platform and its infrastructure.

- Martingale strategies.

- Tick scalping.

- Latency arbitrage.

- Opposite trading or hedging across multiple accounts or traders.

These are the same strategies that a good number of prop firms have removed from their system, as these are the same strategies that are easily archived, to say the least, from live market conditions.

Fintokei’s Trading Terms, Broker, and Platforms

Fintokei has good trading industry experience, and therefore, it’s no wonder that the trading conditions are good and traders get a superior environment backed by good technology and terms. The trader’s trading conditions of the Fintokei company are of top tier. The company has three of the most notable trading software. The trader can choose from any of them.

- Meta Trader 4

- Meta Trader 5

- cTrader

Also, other companies have recently started to charge extra for the cTrader. Fintokei is not charging extra for the cTrader which is why it draws even more traders to the company cTrader.

Is Fintokei regulated

Fintokei is currently not regulated because we do not provide any regulated investment services, do not collect any clients’ deposits, nor do we facilitate any real trading transactions to the customers.

What Brokers Do Fintokei Offer?

Fintokei has a made a partnership with Purple Trading, a broker of the same Purple Holdings group, making them integrated and reliable. Based on the account, Axiory can also be accessed. This account gives a trader the choice to customize a trader with a setup that most closely aligns with their strategy.

Spreads and Commissions

Fintokei provides traders and commission to Forex most of the time, especially during active trading sessions like NY open, also providing traders with competitive trading commission. Fintokei’s Gold average on each of round a 25 with a commission and keeps round a 6 a passive cost goes a 6.

Education and Tools

Fintokei is also a strong supporter of Forex providing traders with a calculator, 100 lessons, and a consolidation of daily financial news. These tools assist traders in adapting their strategy. To gain access to the resources, one is required to purchase an account, after with will the be, to one, Edu Tools.

Fintokei on Social Media

Within the trader community, Fintokei’s social medai presence is valuable to assess social proof and authentic user experiences. Fintokei’s social media platforms provide userproofs, updates, educational content, and team interaction.

Because of the level of social media transparency, potential traders can assess the social proof, activity level, and trustworthiness before attempting a trading challenge with the company.

Fintokei by Purple

Trading with Fintokei? You’re in expert hands! We’re part of a massive fintech group. And there’s more to it than meets the eye! Top-tier brokerage companies? We got it. Own payment solutions? Venture capital fund? That’s all part of Purple too! Established in 2011 – growing steadily ever since!

Pros and Cons of Fintokei

| Category | Details |

|---|---|

| ✅ Pros | – Biweekly real payouts – No time limit on SwiftTrader challenges – Three flexible trading programs – Backed by a reputable fintech group – Affordable one-time fees – Scaling available up to €500,000 – Video course included in ProTrader |

| ❌ Cons | – Limited information about withdrawal methods – No clear profit targets for SwiftTrader – No mobile app available (currently) |

Conclusion

Fintokei is a starting-up firm for beginners that is friendly for pros because if offers multiple challenge programs at competitve rates with clear and transparent spreads with trustworthy and reliable brokers like Purple Trading and Axiory. Their educational materials are strong, ranging from scaling potentials to regular cash payouts.

This firm is good for disciplined people looking to fuse with funding. Their withdrawal information is limited, and they do not have a mobile app, which will require some users to exercise caution. All in all, Fintokei is a great firm with professional partners and is well-suited for people looking to grow.

FAQ

Fintokei is a proprietary trading firm offering funded trading accounts through challenges like SwiftTrader, ProTrader, and StartTrader. Traders can access capital without using their own funds while benefiting from structured programs and scaling opportunities.

Fintokei primarily works with Purple Trading, under Purple Holding, and also provides access to Axiory, depending on account type and trading platform.

Fintokei supports MT4, MT5, cTrader, and TradingView, allowing flexibility across different trading styles and strategies.

Accounts range from $1K to $400K, with potential scaling up to $4M, depending on performance and program type.

Challenge fees start from $79, with higher-tier programs costing up to $2,399, depending on account size and type.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.