In this article, I will review the Gimmer Prop Firm, which allows traders to gain access to professional funding without putting their own money at stake.

Gimmer provides an evaluation process, a variety of account selections, as well as a risk management framework which accommodates both novice and veteran traders.

We will examine its features and advantages, as well as the ways it aids traders to attain consistent profits.

Overview

Proprietary trading firms, or prop firms, have emerged as a go-to option for traders in search of capital, valuable mentorship, and a professional trading setting.

Within this category, Gimmer Prop Firm is noteworthy for its unique method of funding traders and providing risk management programs.

This article will detail the benefits and drawbacks, as well as the alternatives of Gimmer Prop Firm so that traders can be well informed.

What is Gimmer Prop Firm?

Gimmer Prop Firm is a prop firm which provides traders with access to institutional-level capital. In addition to forex, stocks, and cryptocurrencies, Gimmer Prop Firm provides traders with an array of financial instruments to trade without any capital at risk.

In most cases, traders undergo a funding challenge or an evaluation program which assesses their risk management, trading skills, and consistency.

Basic Information – Gimmer Prop Firm

| Feature | Details |

|---|---|

| Company Name | Gimmer Prop Firm |

| Type | Proprietary Trading Firm |

| Founded | Not publicly specified |

| Instruments Traded | Forex, Stocks, Cryptocurrency |

| Account Sizes | Small to large, based on trader experience |

| Profit Sharing | 70%–90% |

| Evaluation Program | Trading challenge or demo evaluation |

| Risk Management | Drawdown limits and position sizing rules |

| Payout Speed | Fast, usually within a few days |

| Support & Mentorship | Educational resources and guidance for traders |

| Target Traders | Beginners to experienced traders |

| Entry Requirement | Completion of evaluation challenge (may require fee) |

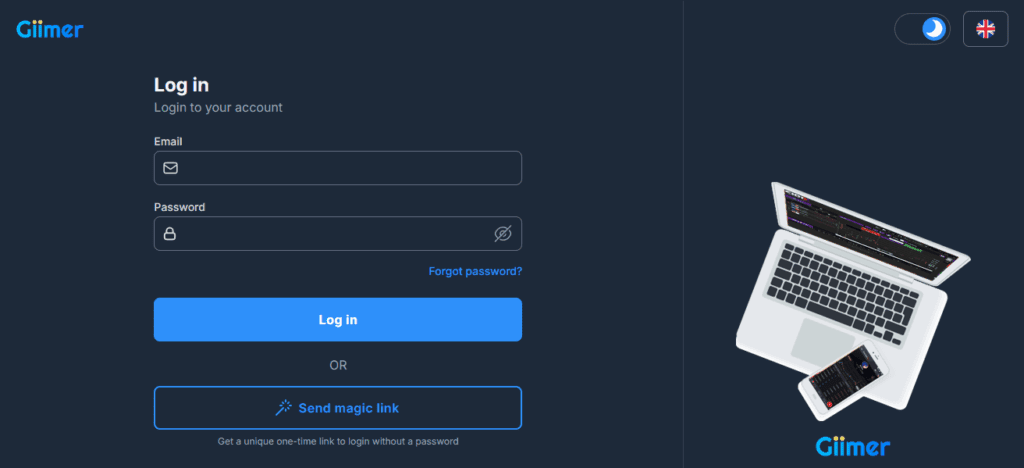

How To Login On Gimmer Prop Firm

Visit the Official Website For your safety, make sure to visit the official Gimmer Prop Firm website so that you are interacting with the authentic site.

Create an Account Click on the “Sign Up” or “Register” button. Set up your profile by entering your full name, active email address, and chosen password.

Verify Your Email Look within your email for a message from Gimmer and confirm your email address. Click the link provided in the email to finalize your account confirmation.

Choose an Evaluation Program Based on your trading history and ambitions, select an account type or evaluation program. These programs often differ by account balance, risk parameters, and the profit-sharing structure.

Pay Evaluation Fee (if required) A few of Gimmer’s evaluation programs come with a non-refundable fee. Please follow the provided payment methods to process the fee.

Accept Terms and ConditionsAfter reading Gimmer’s rules, risk management strategies, and trading policies you can accept them to move forward.

Start the Evaluation Challenge A demo account or funded evaluation account will be granted to you. Follow the guidelines and achieve the profit target within the timeframe.

Complete the Evaluation Your account will be approved for funding if you meet the set goals and comply with the outlined guidelines. At this point, you may begin trading with Gimmer’s resources.

Profits Withdrawal Profit withdrawal is available after funding is received, in accordance with Gimmer’s payout schedule and profit-sharing policies.

Is There a Fee To Start?

Certain evaluation programs at Gimmer Prop Firm have a non-refundable fee which traders must pay in order to take part in the challenge.

This payment is meant to cover the administrative work, platform access, and risk management associated with the evaluation.

Upon payment, traders receive a demo or evaluation account from which they can access their trading skills, consistency, and risk management.

Regardless of whether the trader is able to pass the challenge or not, the fee remains unchanged. This emphasizes the importance of participants understanding the rules and preparing adequately before joining.

Key Features of Gimmer Prop Firm

Varying Account Sizes

Different account sizes are available based on the trader’s experience and risk of choice. This ensures that both beginners and seasoned traders can participate on the skill tier level.

Profit Split

Gimmer offers profitable splits ranging from seventy to ninety percent, which is one of the most attractive splits available. Traders can, therefore, keep most of their earnings.

Risk Control Policies

Strict policy enforcement on drawdowns and position sizing promotes disciplined trading. This benefits the firm as well as the traders.

Training and Support

As a Gimmer trader, one can take advantage of the provided mentorship and other educational assets to refine their strategies and enhance their individual performance.

Quick Withdrawals – Profits can be requested to be withdrawn within days, allowing for quick access to funds which is beneficial for active traders.

Pros of Gimmer Prop Firm

- Low Entry Barrier: Traders don’t need huge capital to start.

- Structured Evaluation: The funding challenge ensures only disciplined traders progress.

- Profit Maximization: High profit share allows traders to earn more than typical brokers.

- Diverse Trading Options: Access to multiple markets under one platform.

- Educational Support: Continuous learning opportunities to grow trading skills.

Cons of Gimmer Prop Firm

- Strict Rules: Failing to follow risk management rules can lead to account termination.

- Evaluation Fees: Some programs require a non-refundable fee for the challenge.

- High Pressure: Time-bound challenges can stress traders, impacting performance.

- Limited Strategy Flexibility: Certain prop firms restrict high-risk strategies or automated trading.

Alternatives Gimmer Prop Firm

Topstep

Topstep stands as one of the more recognized prop firms specializing in futures trading. Traders must first complete a trading combine—an assessment of their self-discipline, risk management skills, and effectiveness toward profitability.

Upon passing the combine, traders receive funded accounts, allowing them to trade with capital provided by Topstep.

The firm stresses trading methodology, systematically offering rules and educational materials, and under their profit-sharing system, traders can retain a substantial portion of the profits while benefiting from a professional trading infrastructure.

The Fiveers

The Fiveers is a forex prop trading firm with instant funding options. Unlike evaluation challenges, The Fiveers allows traders to meet specific criteria and start trading with real capital right away.

The firm promotes cautious trading, ensuring long-term sustainability, profit, and firm health. Traders enjoy various benefits such as flexible account sizes, low-stress evaluation programs, mentorship, and scaling options. This means successful traders can increase their funded capital and thus, their potential earnings.

OneUp Trader

OneUp Trader allows traders to complete an evaluation to earn funding, offering flexible timeframes and various account sizes to suit different strategies.

They support a range of instruments, offering futures and forex, and provide funded accounts with a competitive profit-sharing scheme after the evaluation.

OneUp Trader places a strong focus on trader support and education, aiding both novice and seasoned traders in strategy formulation and performance consistency in a bid to maintain an optimal trading environment.

My Forex Funds

My Forex Funds serves forex and CFD traders with a reputation of providing low-cost evaluation programs. They offer rapid and standard evaluations, making it easier for traders to select one based on their experience and trading preferences.

Traders also enjoy fast payouts, with a generous profit-sharing system. They also offer scaling opportunities, where traders can increase the capital after exceeding performance benchmarks. With low fees and high flexibility, the company is equally appealing to novice and pro traders.

Conclsuion

In conclusion, Gimmer Prop Firm provides traders with a well-organized prop trading firm framework to access capital, hone their skills, and benefit from high profit shares.

It accommodates both novice and seasoned traders, offering varying account sizes, risk management policies, effective ranging, and even coaching.

Despite Gimmer’s strict guidelines and evaluation fees, their offering is favorable for disciplined traders seeking professional funding options.

FAQ

Profit-sharing typically ranges from 70% to 90%, depending on the program and trader performance.

You need to create an account on the official website, choose an evaluation program, pay any required fees, and complete the trading challenge. Successful traders receive a funded account.

Profits can usually be withdrawn within a few days after request, depending on the account type.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.