In this article, I will discuss the workings of LarkFunding, a quick and dependable financial platform that allows companies to obtain the capital they require.

LarkFunding provides short-term loans and lines of credit and is designed to provide quick and easy access.

I will discuss the flexible, fast solutions with little documentation. I will analyze its characteristics, advantages, and the efficient and safe manner in which it fosters the growth of companies.

What is LarkFunding?

LarkFunding is tailored to one‘s requirements. It focuses on providing quick, flexible, reliable, and modern funding solutions. It is not similar to conventional banks as it focuses on simplifying the funding process.

It helps companies receive capital without having to deal with time wasting procedural paperwork and approvals. LarkFunding focuses on providing short-term loans, business lines of credit, and invoice financing.

LarkFunding also focuses on helping borrowers understand the funding and making the right decisions.

Considering how quickly one can deal with checks and balances, LarkFunding helps entrepreneurs with investments, cash flow, and financial challenges using the reliability of their platform.

Key Points Overview

| Key Point | Details |

|---|---|

| Fast Approval | Quick application review and funding disbursement, reducing waiting time. |

| Flexible Funding Options | Offers short-term loans, business lines of credit, and invoice financing. |

| Transparent Terms | Clear fees, interest rates, and repayment schedules with no hidden costs. |

| Secure Platform | Uses advanced security measures to protect borrower information. |

| Supports Business Growth | Enables businesses to manage cash flow, invest, and expand efficiently. |

| Minimal Paperwork | Streamlined online process for easy and convenient applications. |

| Customer Support | Dedicated team available to guide borrowers through the process. |

| Challenges | Eligibility limits, possible higher rates, repayment pressure, industry restrictions. |

How to Sign Up with LarkFunding

Visit the Official Website

- Access the official LarkFunding website with a secure browser for security purposes.

Click on “Sign Up” or “Get Started”

- Find the sign-up button on the homepage, which is prominently displayed, to start the registration.

Provide Basic Information

- Fill in the blanks with your full name, email, phone number, and create a secure password for your account.

Verify Your Email or Phone Number

- LarkFunding will email you a verification link or send a code to your phone, which you will need to enter to confirm your identity.

Complete Business Information

- Provide information regarding your busines,s such as the name, type, registration number, and the industry in which it operates.

Upload Required Documents

- Upload documents that will need to include the business registration, financial statements, and proof of identification.

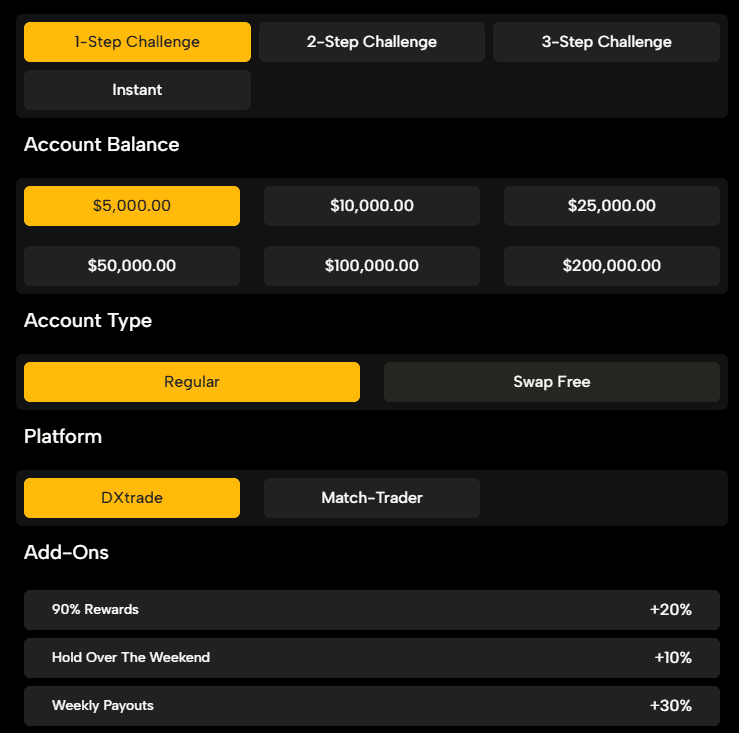

Choose a Funding Option

- Indicate the type of funding that you will require which may include a short-term loan, line of credit, or invoice financing.

Review Terms and Conditions

- Before proceeding, review the loan terms, interest rates attached to the loan, and the repayment schedule.

Submit Your Application

- When you finish entering your details and are sure everything is correct, you may proceed to submit your application.

Await Approval

- The LarkFunding team analyzes what you’ve sent, and provided everything is in order, you should expect a rapid transfer of capital to your business account.

Lark Funding Challenges

Eligibility Restrictions: Often, small businesses or startups do not meet the lower thresholds for approval for funding.

Interest Rates and Fees: LarkFunding fees, whilst competitive, may be comparatively higher than traditional loans for some funding options.

Limited Funding Options for Certain Needs: LarkFunding may not cover all industries or specific business needs.

Reliance on a Digital Platform: Because LarkFunding is primarily a digital platform, businesses with unreliable internet may be disadvantaged.

Pressure to Repay: Funding that is easily accessible usually has a short repayment period, which can be a problem for businesses low on cash.

How LarkFunding Works

Step 1: Application Submission

A funding application is submitted online with required details such as business description and amount needed.

Step 2: Document Verification

A reviewer assesses the business registered and submitted identification and financial statements for eligibility.

Step 3: Funding Option Selection

After approval, the applicant will select which of the available funding options best suits their business needs whether it is a short term loan, line of credit or invoice financing.

Step 4: Approval Process

An application will undergo a creditworthiness evaluation, and a decision is given in a competitive timeframe.

Step 5: Transparent Terms

Conditional approvals show a breakdown of all costs involved such as interest, service charges and repayment milestones.

Step 6: Fund Disbursement

Onboarded clients receive an instant disbursement of the agreed amount directly to their business account.

Step 7: Repayment and Support

Client repayment is aligned with the contractual terms, and support is provided via business customer service.

Benefits of Using LarkFunding

Fast Access to Capital: Receiving funding in a timely manner enables the business to effectively manage cash flow and take advantage of new opportunities for growth.

Flexible Funding Options: LarkFunding’s versatile short-term loans, business lines of credit, and invoice financing are tailored to diverse business requirements.

Minimal Paperwork: The new online application saves time by eliminating much of the documentation needed for traditional banks.

Transparent Terms: Businesses know exactly what to expect out of a financing agreement with LarkFunding, as all interest rates, fees, and repayment timelines are laid out and clear.

Supports Business Growth: LarkFunding’s financing essential to the growth, expansion, and overcoming short-term cash flow issues.

Secure and Reliable Platform: LarkFunding assures the safety of business and personal information with state-of-the-art security measures.

Dedicated Customer Support: Support professionals are accessible to assist through the application, approval, and repayment phases.

Improves Financial Planning: Flexible repayment policies are designed to lessen the financial burden to the business.

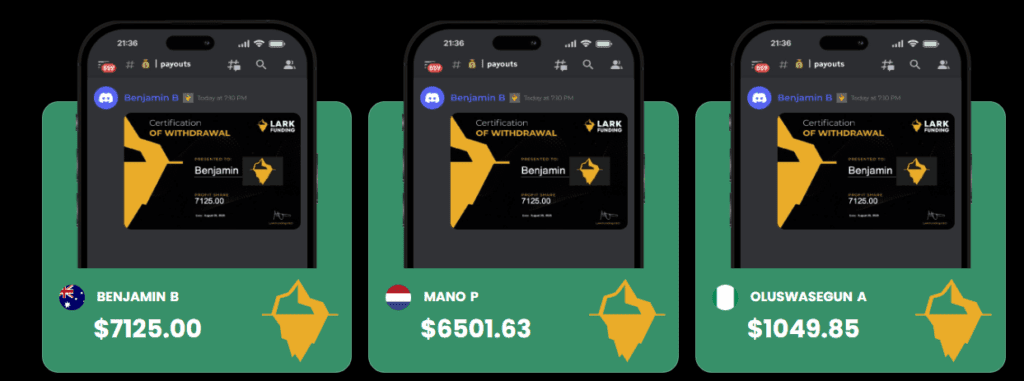

Our Recent Payouts

Features of LarkFunding

Fast Approval Process

Funding decisions are made quickly.

Various Funding Options

Accommodate different business needs with short-term loans, lines of credit, and invoice financing.

Repayment Plans That Work for You

Designed with your business cash flow and operational cycles in mind.

Direct and Open Terms and Conditions

No hidden fees, clear rates, and straightforward repayment plans.

Safe Online System

Multi-layered defenses on the website.

Less Documentation Needed

Less administrative preparation is needed on your end.

Customer Care You Can Count On

Guidance given from application to funding.

Business Growth is a Priority

Lending to reach where you need to go for your operational and cash flow needs.

Quick Fund Transfer

Approved funds will be in your designated business account and available for use immediately.

Risks and Considerations

Eligibility Limitations

Depending on size, revenue, or industry, not all businesses or startups may not qualify for funding.

Interest Rates and Fees

Some funding options have interest rates and/or processing fees that are higher than traditional loans.

Shorter Repayment Timelines

Funding that gives you quick access to cash often requires you to repay it in a shorter time, which can strain your cash flow.

Dependence on Online Platform

LarkFunding primarily operates digitally, which may pose a problem for businesses that have poor or limited access to the internet.

Incomplete Information Risks

Inaccurate and/or incomplete information that you provide can delay the approval or cause rejection of the application.

Limited Industry-Specific Options

Some specialized industries have limited funding options.

Conclusion

LarkFunding has gained a reputation for being fast, reliable, and flexible. It has a range of multiple funding options and offers quick approval, which assists small and medium-sized businesses in meeting growth, cash flow, and other financial needs efficiently.

Unlike other funding options, LarkFunding has less oversight and paperwork, which facilitates fast access to funding.

It has no hidden clauses and has customer service available to address any concerns, which provides a sense of security. In summary, LarkFunding has become a great partner for small and medium-sized businesses needing funding in order to obtain growth and cash flow sustainability.

FAQ

LarkFunding offers a fast approval process, with many applications reviewed and approved within a few business days.

Small and medium-sized businesses, startups, and entrepreneurs that meet the platform’s eligibility criteria can apply.

Once approved and terms are accepted, funds are transferred directly to the business bank account, usually within 24–48 hours.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.