In this article, I will discuss MFFU Prop Firm, a platform designed to support traders by offering access to funded accounts.

Instead of risking personal capital, traders can showcase their skills, follow structured evaluations, and earn profits through fair splits. MFFU provides opportunities for growth, making it attractive for both beginners and experienced traders.

What is MFFU Prop Firm?

MFFU is an abbreviation of My Forex Funds Unlimited, which is a proprietary trading company set up to sponsor talented traders who can show track record of consistent profits.

Instead of trading with personal capital, participants compete in evaluation challenges set by the firm and are given its capital which they can use to trade after successfully navigating the challenges. MFFU profits by the funded traders executing its successful trading strategy and in return, traders share the profits with the firm.

Under this model, traders can sustain higher value accounts while limiting personal financial risk. Both the traders and the firm benefit from this model. Both parties emerge victorious as the firm profits through functioning traders.

MFFU Prop Firm – At a Glance

| Category | Details |

|---|---|

| Full Name | My Forex Funds Unlimited (MFFU) |

| Type | Proprietary Trading Firm (Prop Firm) |

| Founded | [Year not publicly specified] |

| Headquarters | Operates online, serves traders globally |

| Main Service | Funded trading accounts for qualified traders |

| Account Sizes | Scalable funded accounts (based on trader performance) |

| Profit Split | 70% – 90% (depending on plan and performance) |

| Markets Available | Forex, commodities, indices, and cryptocurrencies |

| Evaluation Requirement | Yes – traders must pass risk-managed challenges |

| Risk Controls | Daily drawdown limits, overall drawdown rules, position size restrictions |

| Entry Cost | Affordable one-time evaluation fee |

| Extra Support | Trader education, webinars, and community access |

| Target Audience | Beginner to professional traders seeking firm capital |

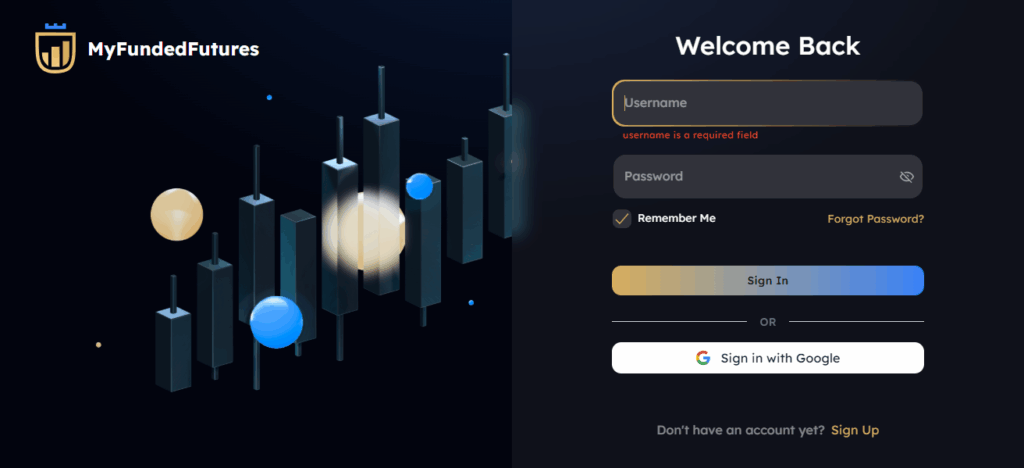

How To Login Mffu Prop firm?

Visit The MFFU Prop Firm Site

Open a browser and go to MFFU Prop Firm’s website.

Select “Login” or “Trader Portal” Button

The buttons are often located on the upper right side of the main page.

Provide Your Email

Enter the email associated with your account, whether you registered or purchased an evaluation plan.

Type Your Password

Enter the password associated with your account, ensuring each letter is in the correct case.

Pass The Security Check

Complete any CAPTCHA or two-step verification (2FA) if requested.

Press The “Login” Button

Click on “Login” to reach your account dashboard.

Trader Dashboard

From here, you are able to see your evaluation and funded account details, performance metrics, and download the required platform credentials.

MT4/MT5 Login

Start trading through MetaTrader 4 or 5 using the credentials on your dashboard.

MFFU Prop Firm Main Characteristics

Funding Programs that are Flexible

Traders must go through evaluation processes as per the instruction of MFFU, displaying risk control, profitability, and discipline. After successfully passing the evaluation, traders are given access to accounts that can range from modest balances to substantial amounts. In some cases, accounts will scale as the traders are able to demonstrate consistent profitability.

Split of Profit

Also very appealing is the generous profit-sharing model. Depending on the plan and account type, traders are able to keep a large share of profit, oftentimes accounting for 70 to 90 percent share. This system ensures that dedicated and competent traders are compensated in accordance to their value and contribution.

Conditions of Trading

Traders are provided access to some of the most known financial instruments such as forex pairs, indices, commodities, and sometimes even cryptocurrencies. MFFU traders are provided with a very competitive spread and commission. This ensures that they are able to trade in the same conditions as professional brokers.

Risk Management Rules

Much like other reputable prop trading firms, MFFU employs risk management guidelines. These rules usually comprise a maximum daily drawdown, a total drawdown limit, as well as restrictions on leverage per trade. These measures are in place to protect traders from making reckless decisions.

Support and Community

MFFU provides educational materials and webinars in addition to community access, making them a prop provider that truly invests in their traders. With access to a supportive community of traders, MFFU participants can actively collaborate and optimize their trading methodologies.

Benefits of Trading with MFFU Prop Firm

Access to Capital in Trading – With MFFU, traders can access larger accounts, making it easier to achieve consistent profitability without risking personal funds.

Low Entry Cost – MFFU traders need only pay a modest evaluation fee in lieu of a deposit, making it easier to get started.

Scalable Growth – MFFU prop traders can initially start with a lower account balance, but as they trade profitably, their accounts can be scaled, increasing potential earnings.

Diversified Opportunities – In addition to forex, MFFU provides traders with access to a wide selection of asset classes.

Performance-Based Rewards – Strong trading performance directly translates to enhanced profit shares, account scaling, and drawdown limits.

Considerations and Challenges

Despite the potential advantages that MFFU offers, challenges exist such as passing the tests. They require discipline and strict adherence to risk parameters. Many drop out because they tend to over-leverage the account or make impulsive high-stakes trades. Additionally, although profit splits are more than fair, participants need to keep in mind that prop firms still take a cut.

Another point to keep in mind is that working in prop firms still mean that market risk is a factor. Lack of strategy or control over emotions will lead to instant account wipeout. As such, only disciplined traders with shakedown-tested strategies should undertake the challenge.

The Unique Attributes of MFFU Prop Firm

In the over-saturated prop firm market, MFFU is distinguishing itself with supportive environments, a transparent and prop firm-first policies. Credibility as a retail trader is now built through positive verification. As such, timely payouts and bolstered educational initiatives beyond community feedback greatly contribute a shift from a short-sighted business model.

Pros and Cons

| Pros | Cons |

|---|---|

| Access to Firm Capital – Trade larger accounts without risking personal funds. | Evaluation Required – Traders must pass strict evaluation phases to qualify. |

| High Profit Split (70%–90%) – Skilled traders keep most of their profits. | Strict Risk Rules – Daily and overall drawdown rules can feel restrictive. |

| Scalable Accounts – Account size grows as traders prove consistent performance. | Upfront Evaluation Fee – Requires paying a fee to start the challenge. |

| Variety of Markets – Forex, indices, commodities, and cryptocurrencies available. | No Guaranteed Income – Only profitable traders receive payouts. |

| Educational Resources – Webinars, training materials, and community support offered. | Emotional Pressure – Rule violations or overtrading can lead to account termination. |

| Global Availability – Open to traders worldwide with online access. | Limited Trading Freedom – Must follow firm’s rules instead of trading completely independently. |

| Low Entry Barrier – More affordable compared to funding your own large account. | Account Termination Risk – Breaking rules ends the funded account immediately. |

Conclsuion

For traders seeking to establish a professional career path without the burden of capital investment, MFFU Prop Firm stands out as a viable option. Its reasonable evaluations, generous profit-sharing model, robust allocation resources, and potential for growth make the firm attractive to both novice and experienced traders.

Yet as with any other prop firm, achieving success at MFFU requires unwavering discipline, a solid plan, and emotional steadiness. A professional approach to the firm allows traders to exploit the chance to manage substantial capital, achieve financial independence, and propel their trading careers.

To summarize, MFFU is more than a mere funding platform; it serves as a connector for retail traders and professional trading opportunities. If approached with the proper strategy, it can aid in building a long-term successful trading career.

FAQ

MFFU (My Forex Funds Unlimited) is a proprietary trading firm that funds traders who pass its evaluation challenges.

Traders complete an evaluation, follow risk rules, and if successful, trade with firm capital while sharing profits.

Traders can earn between 70% to 90% profit split, depending on their plan and performance.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.