I’ll talk about Nostro Accounts, a crucial tool in global banking, in this post. A Nostro account, which facilitates effective cross-border payments, foreign exchange management, and trade settlements, is a foreign currency account held by a domestic bank in a foreign bank.

For banks and companies that operate internationally, it is essential to comprehend the functions, applications, and advantages of Nostro accounts.

What is a Nostro Account ?

A Nostro account is a foreign currency account a domestic bank holds in a foreign bank in a different country. In Latin, Nostro means “ours”, as in “our money you hold”, which means money the domestic bank keeps in a foreign correspondent bank.

Nostro accounts are used in international banking to help perform foreign exchange transactions, international payments, and trade settlements. Foreign currency reserves are better managed, international payments on clients’ behalf are made instantaneously, and money transfer costs are eliminated.

The foreign bank on behalf of the domestic bank holds Vostro accounts, which are the exact opposite. With the help of a Nostro account banks are able to manage liquidity, international transactions, and currency risk. In conclusion, Nostro accounts are a relevant tool for banks engaged in international trade and foreign exchange.

Nostro Overview

| Aspect | Details |

|---|---|

| Definition | A bank account held by a domestic bank in a foreign currency at a foreign bank, primarily for international transactions. |

| Origin of Term | Latin word “Nostro” meaning “ours” – refers to “our money held by you.” |

| Purpose | Facilitates cross-border payments, foreign exchange transactions, and trade settlements. |

| Related Accounts | Vostro Account – the opposite, i.e., a foreign bank holding funds for a domestic bank. Loro Account – “their account with another bank.” |

| Currency | Usually maintained in a foreign currency like USD, EUR, GBP, depending on trade needs. |

| Users | Primarily banks engaged in international trade and foreign exchange operations. |

| Benefits | Efficient international payments, better liquidity management, reduced transaction costs, improved reconciliation, and risk control. |

| Challenges | Maintenance costs, exposure to currency fluctuations, and regulatory compliance requirements. |

| Example | An Indian bank holds USD in a US-based bank to pay suppliers abroad. |

How To Set Up Nostro Account

Step 1: Identify the Need for a Nostro Account

- Check with your bank if they need a foreign currency account for international trades or transactions.

- Determine what foreign currencies you will need to use frequently.

Step 2: Decide on a Correspondent Bank

- Select a reliable foreign bank in the country/currency you want to operate in.

- Make sure the bank is capable of international banking services and is used to working with Nostro accounts.

Step 3: Establish a Banking Relationship

- Get in touch with the foreign bank to explain account requirements and terms.

- Conduct your due diligence.

Step 4: Open the Nostro Account

- Provide the necessary documents (business registration, banking license, authorized signatories, etc.)

- Complete the appropriate contracts regarding account operations, fees, and limits.

Step 5: Fund the Account

- Make the initial deposit in the foreign currency to the Nostro account.

- Make sure the account has enough balance to cover the active operational needs and the international transactions costs.

Step 6: Integrate with Banking Operations

- Integrate your bank’s internal systems with the Nostro accounts for foreign exchange transactions, payments, and processing payment reconciliations.

- Educate employees on how to conduct transactions through Nostro accounts.

Step 7: Monitor and Reconcile Transactions

- Keep an eye on the transactions, balances, and the changing exchange rate.

- Ensure the Nostro account balances are in sync with the internal accounts and other records.

Step 8: Comply with Regulations

- Comply with applicable legislation on local and global banking, anti-money laundering (AML) measures, and your reporting obligations.

- To verify continued compliance and operational efficiency, review the functioning of the account from time to time.

How a Nostro Account Works

Funds Held Abroad: One domestic bank has a corresponding bank account in a foreign country and in a different currency.

Facilitates International Payments: The bank is able to initate payments to foreign vendors, settle a trade transaction, or make a cross-border payment in real-time.

Currency Exchange Management: Assists the bank in foreign currency managing more efficiently on a per transaction basis than converting multiple times for each trade.

Reconciliation: The transactions that flow through the Nostro account are internally balanced with the bank and its systems on a regular basis to ensure.

Correspondent Bank Relationship: Foreign banks works as a correspond partner providing payment and currency exchange services along with banking services.

Example: A bank in India has a Nostro account as a bank in the USA to directly make payments to its suppliers in the USA and significantly reduces the costs and time.

Supports Liquidity: Makes certain the bank is liquid in foreign noted it has access for customer payments or themselves.

Benefits of Using Nostro Accounts

International Payments Processing: Cross-border transactions are done without complications or delays.

Liquidity Management Services: Banks get to manage and maintain balances of foreign currencies at other financial institutions.

Lower Transaction are Safed: International transfers will no longer incur additional service and conversion rate fees.

Reconciliation Services: International transactions can be easily tracked and reconciled against other external balances.

Management of Risks: Fluctuations in the currency are managed and the exposure to rate risk is minimized.

Assistance in International Trade: Payments can be made to overseas vendors and partners in order to foster better business relationships.

International funds transparency: The clear traceability of international funds provides transparency, accountability and compliance to/with various banking regulations.

Challenges & Considerations

Maintenance Costs

The administrative and banking operational costs for opening a Nostro account and leading account with another bank is not cheap.

Currency Risk

There is a risk of losing money as a result of negative movements on the foreign exchange market as you hold an account with a foreign currency.

Regulatory Compliance

There are a multitude of requirements banks must follow on a domestic and international level, including but not limited to money laundering and various report writing requirements.

Operational Complexity

There is a risk of operational complexity in the maintenance of a number of Nostro accounts, in a variety of currencies, resources to assist with the complexity of the maintenance of the accounts may be necessary.

Limited Interest Earnings

The funds on deposit with the corresponding bank hold in Nostro accounts may earn little interest or none at all.

Reconciliation Challenges

There must be considerable attention to the movement of funds in and out of the various accounts in order to ensure operational integrity and do not take on too much risk.

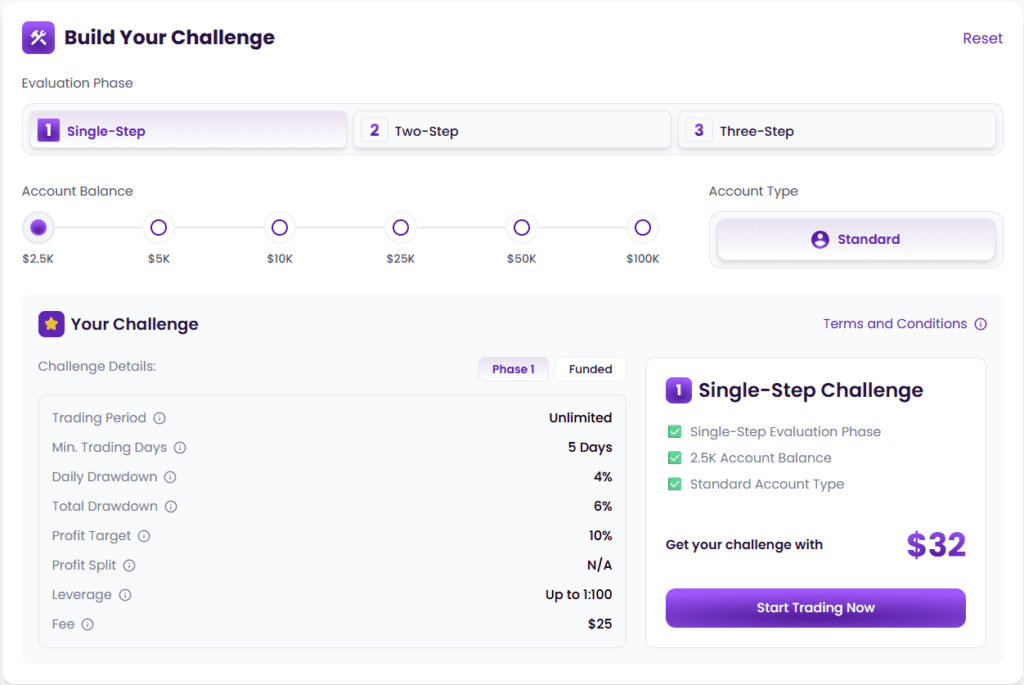

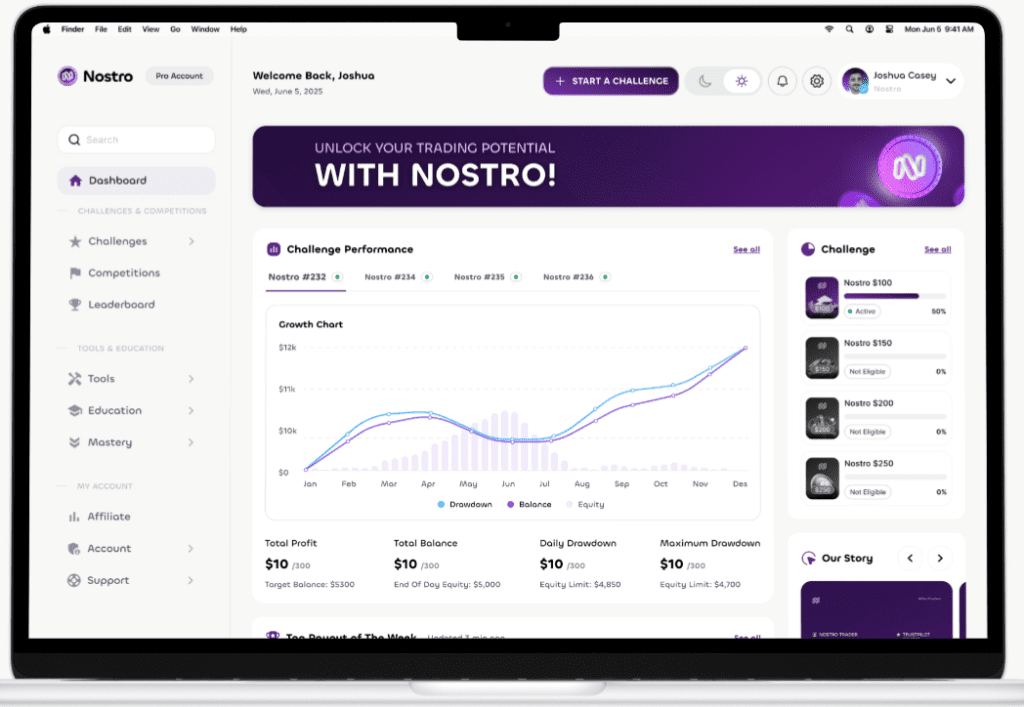

The Ultimate Trader Nostro Accounts Dashboard

Key Uses of Nostro Accounts

Cross-Border Payments: Assists the banks to make the international payments for their clients and for their business activities.

Foreign Currency Purchases: Allows the banks to buy and sell different currencies and control their cross currency requirements.

Settlement of Trade: Eases the payments to overseas counterparties (suppliers, importers, and exporters).

Access to liquidity: Provides immediate needs for the banks to hold foreign currency, for their activities and for their customers.

Transaction Time and Cost: Provides the benefits of international payment without the delay and high fees.

Correspondent Banking: Improves ties with foreign banks to enable easy international business.

Currency Risk: Helps supports lessens the currency exposure in transactions of international trade.

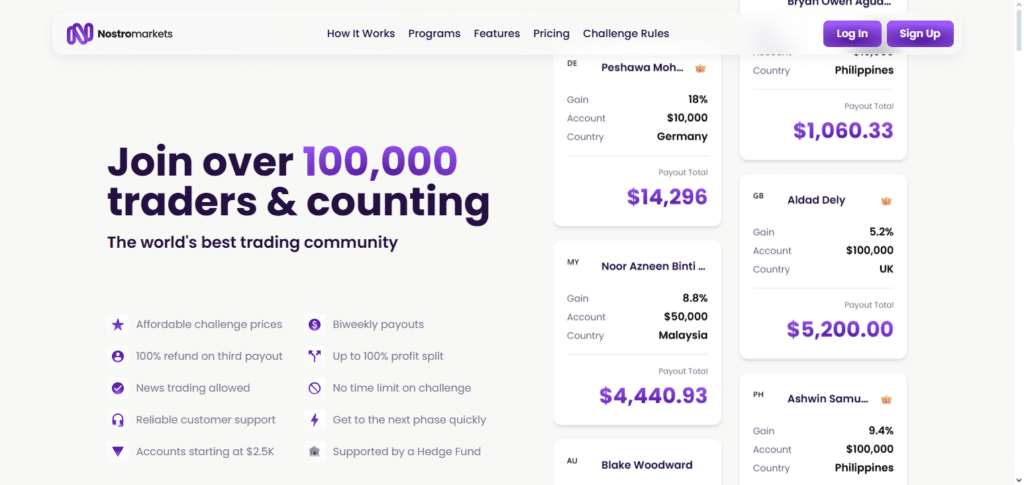

Join Our Affiliate Team

Turn your network into passive income with our lucrative affiliate program. Join an exclusive network of affiliates and get rewarded for every successful referral.

- Earn up to 25% commission on referrals

- Automated payouts

- Real-time tracking in the affiliate dashboard

- Exclusive promotions for top affiliates

Key Features of Nostro Accounts

Foreign Currency Account

Nostro accounts are kept in foreign currencies in foreign correspondent banks.

Correspondent Banking Relationship

They work in conjunction with foreign banks to carry out foreign transactions.

Used for International Payments

Nostro accounts are mainly used for seamless international money transfers.

Supports Foreign Exchange Operations

They assist banks in foreign currency conversion and foreign exchange options.

Regular Reconciliation

Transactions are periodically verified.

Liquidity Management Tool

Nostro accounts allow financial institutions to have immediate foreign currency availability.

Regulatory Compliance

They are subjected to regulatory compliance and reporting requirements for domestic and international banking.

Minimizes Transaction Costs and Time

They save time and money on international transactions.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables fast and efficient cross-border payments. | High maintenance and administrative costs. |

| Helps manage foreign currency and liquidity effectively. | Exposure to currency exchange rate fluctuations. |

| Reduces transaction time and international transfer fees. | Requires strict compliance with regulatory and AML rules. |

| Simplifies reconciliation of international transactions. | Operational complexity in managing multiple currencies. |

| Supports global trade and strengthens correspondent banking relationships. | Funds often earn little or no interest. |

| Assists in risk management for currency and trade operations. | Needs continuous monitoring and reporting for accuracy. |

Join Nostro Accounts Community

Conclusion

Nostro accounts are essential to contemporary banking since they facilitate easy and effective overseas transactions. They enable international commerce operations while enabling banks to handle foreign exchange, lower transaction costs, and expedite cross-border payments.

The advantages of increased liquidity, precise reconciliation, and stronger correspondent banking ties make Nostro accounts a crucial tool for banks engaged in international finance, despite obstacles including maintenance costs, currency risks, and regulatory compliance. Businesses and financial institutions hoping to succeed in the global market must comprehend and manage these accounts.

FAQ

A Nostro account is a bank account held by a domestic bank in a foreign currency at a foreign bank, primarily for international transactions and trade settlements.

They enable faster cross-border payments, better liquidity management, reduced transaction costs, accurate reconciliation, and risk mitigation in foreign currency operations.

Challenges include high maintenance costs, currency exchange fluctuations, regulatory compliance, operational complexity, and limited interest earnings.

The domestic bank deposits foreign currency in a foreign correspondent bank. It uses this account to pay overseas suppliers, manage forex transactions, and reconcile international payments.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.