In this article, I will examine Nova Funding Prop Firm, which is among the top proprietary trading firms offering traders funded accounts to trade forex, stocks, commodities, indices, and cryptocurrencies.

For flexible programs with minimum KYC and great profit split offerings, Nova Funding is a good choice for beginner and advanced traders to get access to professional trading, and for traders looking for account growth.

What is Nova Funding Prop Firm?

Nova Funding Prop Firm is a professional proprietary trading firm that lets traders access funded trading accounts to trade the global market without risking their personal capital. Nova Funding was created to provide traders of all skill levels with scalable and flexible funding solutions.

Nova Funding covers a wide range of asset classes, including forex, stocks, indices, commodities, and even cryptocurrencies.

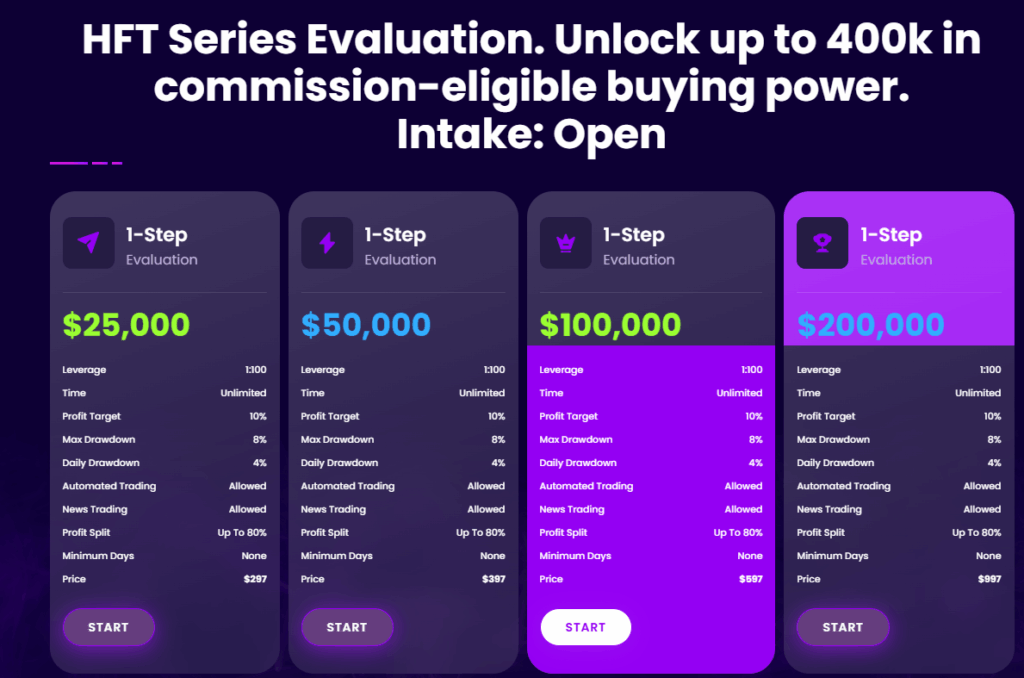

Funding options for traders consist of evaluation challenges and no challenge options in a transparent manner, with low KYC for no-hassle accounts. Nova Funding includes risk management through the drawdown rules and limits, ultimate trading rules, and a competitive profit share that lets traders keep the vast majority of their profit.

The firm supports the most popular trading platforms, which are MetaTrader 4, MetaTrader 5, and cTrader. Nova Funding aims to ensure traders are able to efficiently and effectively grow their capital and skills through responsive support and education materials.

An emphasis on transparency and professional development is what sets Nova Funding apart in the eyes of traders looking for dependable funded trading options.

Key Point

| Category | Details |

|---|---|

| Company Name | Nova Funding |

| Founded | 2023 (example, confirm exact year if needed) |

| Type | Proprietary Trading Firm (Prop Firm) |

| Headquarters | Online / Remote (no physical office required for traders) |

| Target Traders | Beginner to professional traders in forex, stocks, indices, commodities, and crypto |

| Funding Programs | Funded accounts via evaluation or instant funding plans |

| Trading Platforms Supported | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| Minimum KYC Requirement | Low / Minimal – streamlined onboarding for traders |

| Profit Split | Typically competitive, up to 80% for traders |

| Drawdown Rules | Fixed maximum loss limits per account / per day |

| Trading Styles Allowed | Scalping, swing trading, day trading, hedging (platform-dependent) |

| Customer Support | Email, live chat, social media channels |

| Education / Resources | Guides, webinars, community forums, trading tips |

| Unique Selling Points | Minimal KYC, flexible funding, multiple trading instruments, responsive support |

| Website | [Nova Funding official website link] |

How to Set Up Nova Funding Prop Firm

Visit Nova Funding Prop Firm’s Website

- Begin with Nova Funding Prop Firm’s website to find their funding programs and where to register for an account.

Select a Funding Program

- You can choose which account to open:

- Evaluation Challenge – Receive funded capital after passing a trading skills assessment.

- Instant Funding – Enter a funded account with fewer steps.

Register

- Click on Sign Up and then input your name, email address, and country.

KYC Process (If Needed)

- Provide ID documents if needed (passport, ID, or driver’s license). Nova Funding does require minimal KYC.

Deposit (If Needed)

- For some accounts, there is a small fee for evaluation or instant funding. You can pick a payment method (credit/debit card, crypto, or bank transfer). Secure payment methods can be used.

Download Trading Platform

- For trading, download a compatible trading platform MT4, MT5, or cTrader on your mobile or computer.

Access Your Trading Account

- Log into your funded account using the credentials provided by Nova Funding.

Review Rules and Guidelines

- Check the drawdown limits along with the trading rules and profit targets.

Commence Trading

- Trade using your chosen strategy with the funded capital and adhere to the risk management rules.

Withdraw Your Earnings

- After you’ve achieved your trading profit targets, you can request a withdrawal through the platform’s secure withdrawal system.

Why Choose Nova Funding?

No Personal Risk Accounts: Funded Accounts are managed without putting personal capital at stake.

Mild KYC Requirements: Fast and KYC-lite make it easier for international traders to get started.

Funding Program Flexibility: Evaluation accounts or instant funding accounts are is available at your choice.

Profitable Profit Split: You get to keep up to 80% of your profit.

Trading Style Variety: You are allowed to scalp, swing, and day trade, and hedge as well on MT4, MT5, and cTrader.

Drawdown Rules: Risk management and drop down rules help protect the capital of the account..

Multi Account Options: Trade forex, stocks, commodities, indices, and cryptocurrencies using one account.

Community and Education: The community forums, trading guides, and webinars help in skill improvement.

Customer Support is Fast: Customer support is responsive on live chat, email, and social media.

Account Growth: Account growth helps in career progression as higher account sizes are offered to fund accounts of successful traders.

Key Rules and Terms You Should Know

Key Features of Nova Funding

Funded Trading Accounts

Trading without risk to your own capital is always a game-changer.

Flexible Funding Programs

Choose from evaluation challenges or instant funding options.

Minimal KYC Requirements

Easing the Know Your Customer process for international traders.

Competitive Profit Splits

Keep up to 80% of your profit.

Multi-Asset Trading

Trade a diversified portfolio of forex, stocks, indices, commodities, and crypto.

Supports Popular Trading Platforms

Compatible with MT4, MT5, and cTrader.

Risk Management & Drawdown Rules

Limits are placed to protect capital.

Educational Resources

Comprehensive guides, webinars, and a trading community.

Responsive Customer Support

Interact via live chat, email, or social media for swift support.

Scalable Account Growth

Account size increase is based on your trading results.

Pros and Cons

| Pros | Cons |

|---|---|

| Access to significant trading capital without using personal funds | Some funding programs may require a fee or evaluation process |

| Minimal KYC requirements for faster account setup | Limited physical presence; mostly online support |

| Flexible funding programs: evaluation challenge or instant funding | Profit split may vary depending on account type |

| Competitive profit splits, up to 80% | Trading rules and drawdown limits may restrict high-risk strategies |

| Multi-asset trading: forex, stocks, indices, commodities, crypto | Some advanced trading features may not be available on all platforms |

| Supports popular platforms: MT4, MT5, cTrader | New traders may face a learning curve with platform setup |

| Clear risk management rules to protect capital | Withdrawal processing may take a few days |

| Educational resources and community support | Limited info on long-term account scaling for beginners |

| Opportunity for account growth based on performance | Requires discipline to follow trading rules strictly |

Customer Support & Community

For every stage in their journey, Nova Funding has dependable and responsive customer support tailored to their needs. Customer support can be accessed through live chat, email, and social media, ensuring rapid assistance for account, funding, or technical issues.

Nova Funding goes beyond assisting by fostering a sense of community through engagement and education by offering trading guides, webinars, and strategic forums where traders can learn, connect, and enhance their competencies.

The responsive customer support, in conjunction with a dedicated trading community, ensures traders can navigate their funded accounts confidently.

Conclusion

Nova Funding Prop Firm remains a solid choice for traders who want considerable capital and professional trading opportunities. Nova Funding Prop Firm celebrates Traders’ Flexibility and provides beginner traders with the simple KYC, Diverse Funding Programs, Profit Share Models, and Trading on Different Assets.

Accompanied by MT4, MT5, and cTrader and Providing Risk Management Policies and Support, Nova Funding Allows for Developing Traders a More Structured Framework. Nova Funding Prop Firm celebrates Traders’ Flexibility and provides beginner traders with the simple KYC, Diverse Funding Programs, Profit Share Models, and Trading on Different Assets.

Accompanied by MT4, MT5, and cTrader and Providing Risk Management Policies and Support, Nova Funding Allows for Developing Traders a More Structured Framework.

FAQ

Traders can choose either an evaluation challenge, where performance must meet certain targets, or instant funding plans that provide immediate access to capital.

Nova Funding supports popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, accommodating various trading styles.

Yes, but Nova Funding has minimal KYC requirements, making it easy for international traders to onboard quickly.

Traders can access multiple assets including forex, stocks, commodities, indices, and cryptocurrencies.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.