In this post, I intend to explicate Only Prop Firms, focusing on the instrumental role they play in assisting traders in proprietary trading.

Only Prop Firms assist both novice and proficient traders by providing the necessary funded accounts along with mentorship, risk management, and scalability.

This platform streamlines the process of selecting appropriate prop firms and, therefore, equips traders with the necessary tools to increase their skills and profits optimally.

What Is an Only Prop Firm?

OnlyPropFirms was designed to aid traders in their research when selecting a proprietary trading firm. Given all the experience day trading and the success therefrom, the founder of this platform, “YouTube’s Best Day Trader,” Patrick Wieland, provides insights that benefit the trading community.

Understanding that each and every trader has their own precious goals and their own distinct needs, OnlyPropFirms, which is a prop trading firm, provides them with a centralized resource offering mentorship, prop firm reviews, and clarity in choosing a prop firm that best resonates with each trader’s trading style.

In a world full of choices that could make any trader feel overwhelmed, practical and customized advice from Patrick Wieland makes all the difference. OnlyPropFirms helps these traders master the complexities that come with prop trading and helps them make decisions that guarantee success over time.

Basic Information – OnlyPropFirms

| Feature/Aspect | Details |

|---|---|

| Definition | Companies that provide traders with capital to trade financial markets. |

| Purpose | Allow traders to trade larger amounts without risking personal funds. |

| Funding | Traders get access to accounts ranging from $10,000 to $500,000+. |

| Profit Sharing | Traders keep 50–90% of profits; firm covers losses within limits. |

| Who Can Use | Aspiring, experienced, part-time, and algorithmic traders. |

| Trading Instruments | Forex, stocks, commodities, indices, cryptocurrencies. |

| Evaluation | Many firms require passing a trading challenge or evaluation. |

| Key Features | Risk management rules, mentorship, trading platforms, scalability. |

| Pros | Access to capital, professional tools, mentorship, profit potential. |

| Cons | Strict rules, evaluation fees, limited strategy freedom, stress. |

| Worth | High for skilled traders with limited capital; depends on performance. |

How To Login OnlyPropFirms

Visit the Official Website

Open your web browser and go to OnlyPropFirms.com

Locate the Login Button

On the homepage, look for the “Login” or “Sign In” button, usually at the top-right corner.

Enter Your Registered Email

Type the email address you used to register your OnlyPropFirms account.

Enter Your Password

Input your account password carefully. Ensure Caps Lock is off to avoid errors.

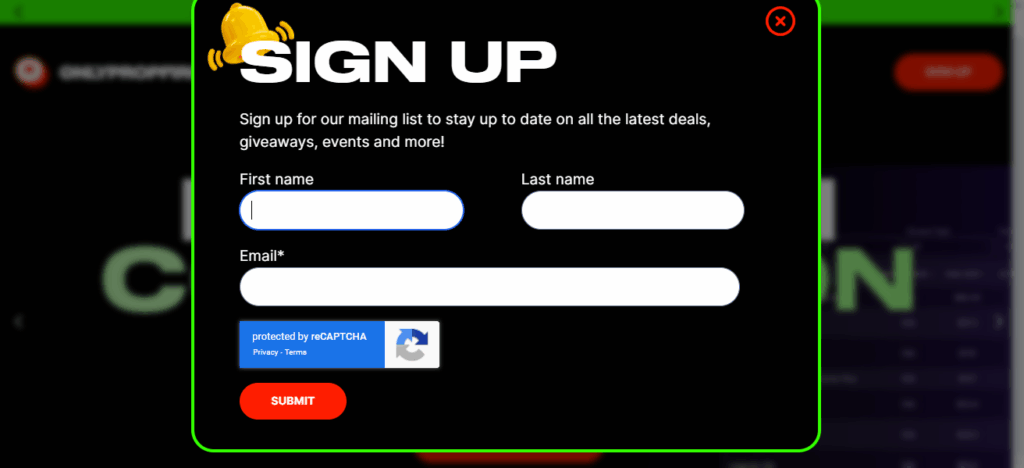

Complete CAPTCHA (If Required)

Some login pages may require CAPTCHA verification to ensure you’re not a bot.

Click “Login”

Press the Login or Sign In button to access your dashboard.

Access Your Dashboard

After successful login, you’ll be directed to your dashboard, where you can explore prop firm reviews, guides, and personal settings.

Forgot Password?

If you cannot log in, click “Forgot Password”, enter your email, and follow the instructions to reset your password.

Secure Your Account

When possible, enable two-factor authentication (2FA) for an additional layer of security.

How Only Prop Firms Work

The operational model of a prop firm is simple but structured:

Application: Traders wanting to join a prop firm can apply to any firm of their choice. Some firms have a ‘trading evaluation’ or ‘trading challenge’ to test your skills before onboarding.

Funding: Once traders are approved, they are assigned a funded account, which on average is between 10,000to10,000to500,000, depending on the firm.

Trading: Using the firm’s capital, Traders are required to make trades under certain guidelines and risk thresholds.

Profit sharing: Firms losses are covered up to an agreed limit and traders are allowed to take home a percentage of the profits which on average is between 50%-90%.

Scaling: Accounts of successful traders are able to scale, which allows them to manage larger amounts, which means greater profit potential and greater accountability.

The trading model presented allows prop firms to manage their trading risk whilst allowing successful traders to grow their career without any personal capital risk.

Who Uses Only Prop Firms?

Novice traders – People with adequate trading skills, but don’t have money to spare.

Professional traders – Specialists willing to grow their trading volumes, with no appetite for personal exposure.

Algorithmic traders and quants – Individuals responsible for designing and programming trading bots, but have none of the cash needed to deploy them.

Hobby traders – Individuals wanting to access luxuries such as guidance and fancy software and plugins, while holding down other forms of employment.

Put simply, prop firms are made for traders who want to access funds and seize opportunities that are not possible to exploit with personal capital.

Features of Prop Firms

Funded accounts with flexible withdrawal options

Prop firms grant traders funded accounts, which enable them to execute trades using significant amounts of capital at no personal risk. Depending on the firm’s policies, profits can be withdrawn regularly, which ensures liquidity and motivation.

Risk management rules to protect firm capital

Prop firms set stringent risk management policies, such as daily loss limits and position size restrictions, to protect their capital, while simultaneously teaching traders the art of disciplined and responsible trading.

Trading platforms such as MT4, MT5, or proprietary software

Traders use professional-level platforms like MetaTrader 4 and MetaTrader 5 or proprietary software, which includes sophisticated charting, indicators, and other trading aides that enhance the execution of strategies.

Mentorship programs for beginners and intermediate traders

Many prop firms have mentorship programs aimed at providing beginners and intermediate traders with strategies and tactics that, when combined with constructive criticism, enable them to cope better with market behavior and construct risk management strategies.

Profit-sharing models to incentivize performance

Prop firms are under the profit-sharing systems, whereby traders are allowed to keep a certain percentage of the profits made. This ensures that traders can incentivize themselves to perform while also aligning the interests of the trader and the firm.

Pros and Cons of Only Prop Firms

Pros:

- Access to large capital with minimal personal risk.

- Professional trading tools and platforms.

- Mentorship and training opportunities.

- Clear rules and structured trading environment.

- High profit-sharing potential.

- Opportunities to scale accounts as performance improves.

Cons:

- Strict risk management rules may limit trading flexibility.

- Evaluation or challenge fees may apply.

- Pressure to meet profit targets and rules can be stressful.

- Some firms have restrictions on trading strategies (scalping, news trading, etc.).

- Not all prop firms are transparent about profit splits and rules.

Conclsuion

In conclusion, it can be stated that OnlyPropFirms provides traders with a dependable marketplace to analyze and choose a suitable proprietary trading firm. It enables traders to understand funding options, risk management, mentorship, and the potential for scalability.

Clearly articulating the gaps, OnlyPropFirms provides supportive guidance to beginner traders and even to seasoned professionals, intending to help them achieve the best-controlled outcomes in professional trading.

FAQ

Traders keep a percentage of profits, usually between 50–90%, while the firm covers losses up to set limits.

Yes, risk rules must be followed. Violating rules may result in account closure or loss of funding. Proper discipline and strategy are crucial.

Yes, top-performing traders can access scalability programs to manage larger accounts and increase profit potential.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.