The Prop Firms with Unlimited Trading Periods & Flexibility, which help traders finish assessments at their own speed without having to meet deadlines, will be covered in this post.

These companies are perfect for both novice and seasoned traders looking for steady growth and reliable performance in forex, indices, commodities, and other markets since they offer stress-free trading environments, support a variety of methods, and give large profit splits.

What Are Prop Firms with Unlimited Trading Periods?

Prop firms with limitless trading periods are proprietary trading firms that don’t have time restrictions on traders’ assessment or challenge phase completion.

These organizations allow traders the flexibility to take as much time as necessary to fulfill profit targets and adhere to risk management guidelines, in contrast to standard prop firms that frequently impose a predetermined length, such as 30 or 60 days.

Because this paradigm eases pressure, promotes consistent performance, and enables strategy testing over longer market cycles, it is particularly advantageous for traders who choose a calm, methodical approach.

In essence, traders are free to learn, adjust, and expand their accounts at their own speed without being constrained by a ticking clock when they have limitless trading periods.

Advantages of Unlimited Trading Periods & Flexibility

Less psychological pressure: The absence of trading periods means that traders do not have to reach profit targets within the given trading period. This reduces stress and the likelihood of making impulsive trades.

Developing strategies that can be used over the long term: With no limit to the trading period, traders are able to develop, optimize, and complete entire strategies over various market cycles. This is more beneficial than obtaining temporary, short term gains.

Part-time traders can accommodate themselves: The flexibility reduces the psychological pressure of having to meet daily trading targets as traders can set their own trading periods.

Focus on the long term, not short term: The absence of trading periods means that traders who want to improve on their skills, analyze their mistakes, and the market can do so without time constraints.

Diverse trading styles: Trading firms that offer flexible trading periods are more accepting of diverse trading styles. This means that traders can incorporate their preferred strategies, be it scalping, swing trading, or high-frequency trading.

Profit potential: With no incentives to earn more than a set number of pips, disciplined traders can maximize their trading opportunities while adhering to their risk management rules.

Top 5 Prop Firms Offering Unlimited Trading Periods

1. GoatFundedTrader

Founded in 2021, GoatFundedTrader has been gaining popularity for its flexible evaluation model with unlimited trading periods. Traders are able to finish challenges without the time limitations making it an ideal firm for those looking for a low pressure trading environment.

Depending on the size and the performance of the account, GoatFundedTrader provides profit splits of up to 80% which rewards consistent traders.

The firm includes intraday, swing, and scalping trading, and supports various trading styles in Forex, Commodities, and Indices. The transparent guidelines, low challenge costs, and scalable funding options make GoatFundedTrader one of the best firms in the industry.

Why Recommend GoatFundedTrader

- No Evaluation Deadlines – Complete the evaluations at your own pace.

- Up to 80% Profit Split – Profit splits are awarded by account size and performance.

- No Restrictions on Trading Style – Freedom to use any trading style (i.e. scalping, swing, intraday, etc.)

- Trade Multiple Markets – Forex, indices, and commodities.

- Account Growth Potential – Consistent traders will be able to upgrade to larger account sizes.

GoatFundedTrader

| Pros | Cons |

|---|---|

| Unlimited trading periods reduce stress and allow strategic planning. | Being new (founded 2021), limited historical reviews and reputation. |

| High profit splits up to 80% reward consistent traders. | May have fewer account size options compared to larger firms. |

| Supports multiple trading styles: scalping, swing, intraday. | Limited market variety (mainly forex, indices, commodities). |

| Scalable funding encourages long-term growth. | Some traders may take longer to reach profit targets due to unlimited periods. |

| Transparent rules and low challenge fees. | No advanced analytics or automated tools provided yet. |

2. FundedNext

Founded in 2020, FundedNext is a well-established proprietary trading company known for its trader flexibility and unlimited evaluation periods. FundedNext allows traders to take their time in order to be compliant with firm rules on risk management.

FundedNext splits profits between 75% and 90%, with the firm rewarding traders with a 90% split for achieving the zenith of company goals. FundedNext allows trading on forex, stocks, commodities and indices and is great for trading strategies with fewer than average trading restrictions, especially for scalping or swinging.

Traders who want to put less pressure on their cancellation pathway will find it ideal considering the numerous account sizes, focus on long-term goals, and low challenge fees.

Why Recommend FundedNext

- No Evaluation Deadlines – Complete the evaluations at your own pace.

- Up to 90% Profit Split – Top performers are rewarded generously.

- Trade Multiple Markets – Forex, equities, commodities, and indices.

- Affordable Entry Fees – Challenge fees are low for even the most inexperienced traders.

- No Restrictions on Trading Style – Freedom to use any trading style (i.e. scalping, swing, intraday, etc.)

FundedNext

| Pros | Cons |

|---|---|

| Flexible evaluation with no strict deadlines. | Longer challenge periods may delay live account access. |

| Profit splits start at 75%, can go up to 90% for top performers. | Overtrading risk if discipline is not maintained. |

| Access to multiple instruments: forex, equities, commodities, indices. | May have slightly higher challenge fees for larger accounts. |

| Supports various strategies: scalping, swing, intraday. | Some rules for high-risk strategies can be restrictive. |

| Beginner-friendly with low entry fees. | Newer firm (2020), may lack extensive market credibility. |

3. The Funded Trader (TFT)

Established in 2019, The Funded Trader (TFT) stands out for its trader-friendly policies, including unlimited trading periods. TFT offers an evaluation process that removes time constraints, allowing traders to take as long as they want to complete challenges, which is great for part- time or more methodical traders.

The firm’s profit split policies reward more disciplined trading and steady profit generation, as they offer splits between 70% and 85%. TFT offers a range of accessible markets including forex, indices, and commodities, while allowing a variety of trading strategies.

With tiered funding, low fees, and clear policy transparency, TFT is an excellent choice for novice and experienced traders aiming to develop a career in trading and avoid the stress of time constraints.

Why Recommend The Funded Trader (TFT)

- No Evaluation Deadlines – Complete the evaluations at your own pace.

- 70 – 80% Profit Split – Consistent trading is rewarded.3. Flexible Market Access – Availability to trade forex, indices, and commodities.

- Transparent Rules – You’ll know the guidelines relating to drawdown limits and position sizing.

- Progressively Scalable Funding – If you perform well, you can increase the size of your accounts.

The Funded Trader (TFT)

| Pros | Cons |

|---|---|

| Unlimited trading periods reduce pressure and support learning. | Profit targets may take longer to achieve without deadlines. |

| Profit splits from 70% to 85% reward disciplined traders. | Limited access to certain markets compared to global firms. |

| Transparent rules on drawdown and position sizing. | Less flexibility for extremely high-frequency trading. |

| Scalable funding plans encourage long-term growth. | May require additional time for account upgrades. |

| Supports multiple strategies and trading styles. | Newer evaluation tools, may lack advanced reporting. |

4. E8 Funding

E8 Funding began operations in 2021, and amidst all other competitors, they stand out in providing flexibility and unrestricted period evaluations. Most traders can appreciate this benefit as they can lower their mental evaluation period and finish challenges over extended periods.

The profit split can be as high as 80% for accounts of larger size and different style of trading. E8 Funding is supportive of different strategies including: scalping, swing, and day trading, as well as different instruments like forex, indices, and commodities.

With low costs of challenges, easily understandable guidelines, and funding plans that allow trade to grow for as long as they like, E8 Funding is the best fit for traders looking to maintain their control over their own trading schedule.

Why Recommend E8 Funding

- Challenges Have No Time Limits – Traders can do evaluations over an extended period.

- Profit Split Up to 80% – Long and sustainable trading leads to the greatest rewards.

- Variety of Instruments Available – Forex, indices, and commodities.

- Flexible Strategy Adaption – Allowed to trade by means of scalping, swinging, or intraday.

- Performance Based Account Scaling – You can get account size upgrades depending on your performance.

E8 Funding

| Pros | Cons |

|---|---|

| No time limits on challenges, stress-free evaluation. | Longer evaluation can delay live funded account access. |

| Profit splits up to 80% reward consistency. | Market access slightly limited to forex, indices, commodities. |

| Flexible trading strategies allowed: scalping, swing, intraday. | Beginners may overtrade due to unlimited period flexibility. |

| Scalable accounts encourage growth for successful traders. | Relatively new firm (2021), smaller community support. |

| Low challenge fees and clear rules. | Limited advanced analytics and mentoring support. |

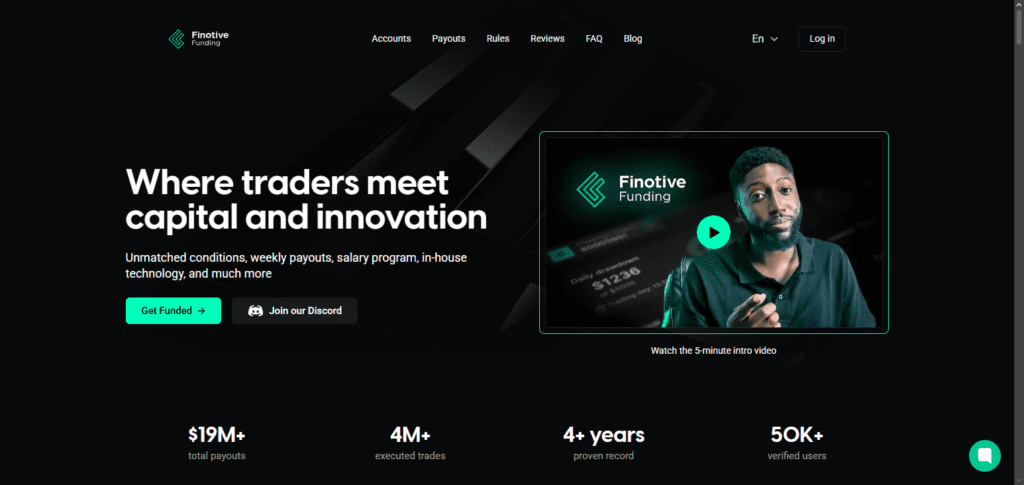

5. Finotive Funding

Founded in 2022, Finotive Funding, is a cutting-edge prop firm focused on trader flexibility and unlimited trading periods. The company offers an opportunity to practice self-paced progression, and by offering no deadlines for evaluations, encourages a more disciplined trading approach.

Flexible funding plans are offered, and profit splits of 75% to 85% are given to traders who provide consistent profits.

Finotive Funding is a great option for sustainable trading because of low challenge fees, risk management rules, unlimited evaluation periods, and support of all trading styles: Forex, of course, but also indices and commodities. traders can practice scalping, swing trading and intraday trading.

Why Recommend Finotive Funding

- No Limits on Eval Periods – Challenges can be done at the trader’s discretion.

- Profit Splits Between 75% – 85% – Lengthy and sustained trader behavior is rewarded.

- Wide Market Range – Forex, indices, and commodities.

- Diverse Trading Styles – Flexible scalping, swing, and intraday methodologies.

- Challenge Fees & Account Scalability – Lower costs & more funding opportunities down the line.

Finotive Funding

| Pros | Cons |

|---|---|

| Unlimited evaluation periods for stress-free trading. | Profit targets may take longer due to no strict deadlines. |

| Profit splits from 75% to 85%, rewarding consistency. | Limited account size options compared to larger firms. |

| Diverse market access: forex, indices, commodities. | Fewer automated tools or platform integrations currently. |

| Supports flexible trading styles: scalping, swing, intraday. | Traders need strong self-discipline to avoid overtrading. |

| Affordable challenge fees and scalable funding options. | Relatively new firm (2022), less historical performance data. |

Key Features of Flexible Prop Firms

No Time Limits on Evaluation or Trading Periods

Traders complete challenges or evaluation phases at their own pace and profit target goals become not as big of a priority.

Flexible Trading Styles Allowed

Traders can use their own preferred methods such as scalping, swing, high frequency, intraday, or any other trading style.

Risk Management Rules Can Be Adjusted

Traders can adjust their daily loss limits, maximum drawdown limits, position size limits, and other rules to fit their own strategies.

Different Account Sizes and Profit Splits

Flexible firms often have multiple account sizes available and generous profit splits which rewards consistent performance and progression.

Multiple Markets Accessible

A variety of markets like forex, equities, commodities, or crypto can be traded allowing diversification.

Growth Opportunities and Less Stress

Flexibility is focused on long-term account growth, allowing traders to build their sustainable trading careers.

Risks & Considerations

Greater Challenge Costs (or Fees)

Some flexible prop firms may have higher costs for unlimited evaluations or for trading periods that extend your trading access.

Delayed Access to Live Accounts

Traders may complete challenges. This is because there are no strict deadlines.

Overtrading

With a lack of self-discipline, unlimited trading periods can lead to excessive, unjustified risk, and trading.

Self-Discipline is Required

Traders are required to have some self-discipline in enforcing the risk management and trading rules.

Over Complication of Strategies

With the ability to trade no less than a given strategy, some traders may be tempted to redirect their attention.

Risks Related to Trading Exposure

.Pet a given trading strategy leads to loss, exposure to the given trading strategy may lead to loss.

Tips for Succeeding in Unlimited Trading Period Prop Firms

Stick to Strict Risk Management

Adhere to daily loss limits and maximum drawdown policies to preserve your account for the long evaluation period.

Focus on Consistency, Not Speed

Aim to achieve profit targets consistently rather than hurrying trades to finish the challenge quickly.

Keep a Trading Journal

Record all your trades (entry/exit, strategy, result) and document them to find successes and failures and improve over time.

Avoid Overtrading

Unlimited time may lead to trading more than necessary but remember, it is quality that matters.

Test and Optimize Strategies

Use your time to trade different styles, markets, and patterns. However, keep it consistent on what is working.

Maintain Discipline and Patience

Flexible prop firms draw heavily on your ability to stay in control, loss, and the drawing board.

Use Market Analysis Effectively

Make your trades rational by using technical and fundamental analysis instead of trading on a whim.

Future Trends in Flexible Prop Trading

The future looks promising for trader-centric models that emphasize stress-free evaluations and long term evaluations. Prop trading will offer more unlimited trading periods, tailored risk tiers, and support for various trading styles.

The use of artificial intelligence and advanced analytics will allow for better performance, risk optimization, and provide traders with the tools they need to manage risk.

The ability to trade multiple markets will give traders even more options in portfolio diversification. As trader needs change, flexible Prop firms will continue to provide funding that encourages consistent use of profitable tools.

Conclusion

Prominent prop firms like GoatFundedTrader, FundedNext, TFT, E8 Funding, and Finotive Funding offer traders the flexibility to trade at their own speed without worrying about deadlines. These organizations also offer unlimited trading periods.

These companies let traders concentrate on consistency, discipline, and long-term growth by combining flexible assessment mechanisms, significant profit shares, and support for a variety of trading styles. They enable both novice and seasoned traders to build long-lasting trading careers while optimizing their earning potential by providing stress-free settings and scalable funding choices.

FAQ

These are proprietary trading firms that allow traders to complete their evaluation or challenge phase without strict time limits. Traders can meet profit targets at their own pace while following risk management rules.

Most flexible prop firms support a variety of trading styles, including scalping, swing trading, intraday, and sometimes high-frequency trading, depending on the firm’s rules.

Profit splits usually range from 70% to 85%, with top-performing traders sometimes earning up to 90%, depending on account size and performance.

Yes. Unlimited trading periods reduce stress and give beginners the time to learn, experiment, and refine strategies without strict deadlines.

Notable firms include GoatFundedTrader, FundedNext, The Funded Trader (TFT), E8 Funding, and Finotive Funding, all offering flexible evaluations and scalable funding options.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.