I’ll talk about Propw, a cutting-edge proprietary trading company that gives traders access to funded accounts, in this post. Propw offers sophisticated trading platforms including MT4 and MT5, flexible account kinds, and organized challenges.

Propw seeks to assist both novice and seasoned traders in optimizing earnings while reducing personal financial risk through competitive profit splits, risk management tools, and training materials.

What is Propw?

Propw is the leading modern proprietary trading firms which offers traders access to capital to trade on and best in class trading technology and tools. Propw was established to cater to both novice and advanced traders by offering different account types and flexible capital divisions enabling traders to scale their systems without the need of risking their own capital.

Propw is MT4 and MT5 compatible and offers features like advanced analytics in real time, risk control and education for users to navigate the platform. With a passion for enabling traders to earn the maximum profits while risking the least, Propw has become a leader in the competitive trading industry. Being transparent with fees, having industry leading customer service, and taking an interest to help their traders scale has made Propw stand out.

Key Point

| Category | Details |

|---|---|

| Founded | 2026 |

| Platform Type | Proprietary Trading Firm (Prop Firm) |

| Account Types | Multiple funded account types for different trading levels |

| Trading Platforms | MT4, MT5, Web Trader, Mobile Apps |

| Instruments Offered | Forex, Commodities, Indices, Cryptocurrencies |

| Funding Model | Traders get funded accounts; profit-sharing model |

| Risk Management | Stop-loss rules, daily/weekly limits, account scaling |

| Education & Resources | Webinars, tutorials, trading guides, analytics |

| Customer Support | Live chat, email support, FAQ section |

| Fees & Costs | Account fees, spreads, minimal withdrawal fees (transparent pricing) |

| Unique Features | Instant funding options, multiple challenges, scalable capital |

| Target Users | Beginner to professional traders seeking funded accounts |

Trading

Benefits Of Propw

Access to Funded Accounts: With Propw, traders use company capital to trade, meaning that the financial risks are significantly mitigated.

Flexible Account Options: Propw is one of the few prop trading companies that offers account flexibilities for newbies, intermediates, and experts.

Advanced Trading Platforms: Propw offers MT4, MT5 and web/mobile trading for convenience.

Profit-Sharing Model: Profit-sharing incentivizes traders to perform well, as they get to keep a percentage of the profit.

Risk Management Tools: Tools like built-in stop losses, scaling options, and account guard are there to help traders manage risk.

Educational Resources: Trading education is available through tutorials, webinars, and guides.

Fast Withdrawals: The withdrawal process is quick, and the terms are straightforward.

Responsive Customer Support: Customer support is available through live chat, email, and FAQ.

Scalable Trading Capital: There are long-term growth opportunities because of the performance-based capital increases.

Transparent Fees: There are no hidden fees.

Risk & Considerations

Performance Pressure

Traders have a set of targets to hit. If they fall behind or exhibit losses they can have their funding removed.

Account Rules & Limitations

These can go as far as setting daily or weekly loss caps, limiting total loss potential for trades.

Profit Split Conditions

Some accounts also have these ‘pooled’ structures where the profit-sharing percentages is considerably lower than the industry average.

Withdrawal Restrictions

Some of these funding programs have a set of withdrawal rules or even withdrawal lock period.

Market Risk

Even with funded accounts, a trader could lose money.

Challenge Requirements

Not all accounts come with funded accounts, some require the trader to pass a set of evaluation ‘challenges’ first.

Platform Dependence

Some traders who would rather use their own tools might feel restricted when a funding program is set up to run solely on MT4/MT5 or similar trading platforms.

Limited Instruments

You won’t have access to all the world’s markets or trading instruments.

Fee Considerations

If there are account fees or spreads, these can impact your bottom line.

Eligibility Criteria

Not all programs are open to every country, or even every level of trading experience.

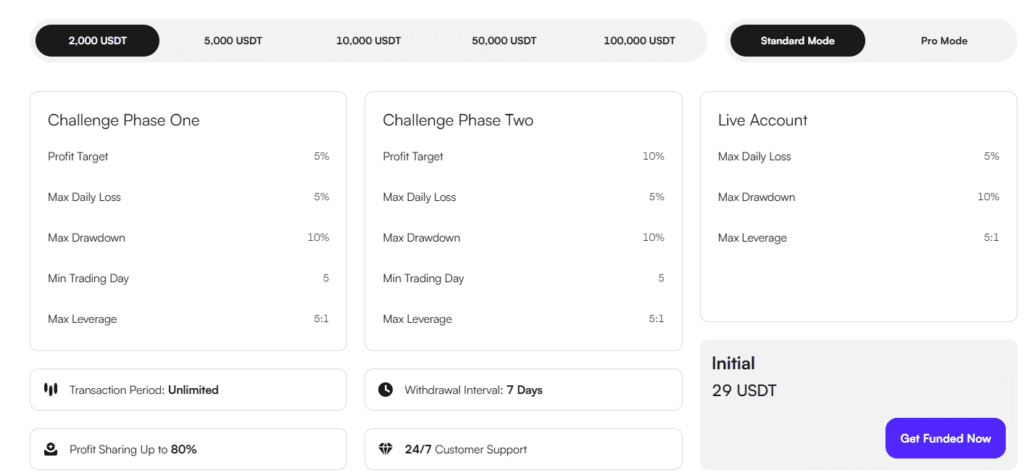

Propw Challenge

2-Step Evaluation

For a chance to receive a funded account, each trader must complete the two steps, which are called Phase 1 and Phase 2, one after the other.

Profit Requirement

Every stage of the challenge includes a profit requirement one must meet to continue on to the next stage. For Phase 1, you must make approximately 5%. In Phase 2, you must make approximately 10%.

Minimum Number of Trading Days

Participants must, at a minimum, trade for a specific number of days, usually five, to complete a phase.

Risk Limits

The evaluation has strict limits on accounts in terms of a daily loss and in terms of the total account cannot be drawn down too much. If either of these limits are breached, the trader will automatically fail the evaluation.

No Overnight Position Restrictions

Based on the specific rules of each challenge evaluation, traders may or may not be allowed to hold positions overnight.

Duration of Trading Undetermined

The majority of the evaluation challenges will not have specific time limits, allowing traders to manage their time as they like while working on the challenge.

Multiple Challenge Accounts

Depending on the specific rules, traders may be allowed to run several challenge accounts at the same time to try to pass the challenge.

Profit Distribution After Completion

Once the trader has successfully completed their challenge and funded account, the trader will receive 80, but this may be increased in time, of the profit.

Entry Fees for Challenge

Each trader must pay a challenge fee to their account size, which must be paid when they register for the challenge.

Fees & Costs

| Category | Details |

|---|---|

| Account Funding Fee | One-time fee to start a funded account; varies by account type |

| Evaluation / Challenge Fee | Fee to participate in evaluation programs or trading challenges |

| Commission / Spread | Variable depending on instrument; generally low for major forex pairs |

| Withdrawal Fee | Minimal fee or free up to a certain number of withdrawals per month |

| Deposit Fee | Usually free, may depend on payment method |

| Inactivity Fee | Small fee applied if the account is inactive for a specified period |

| Profit Sharing | Percentage of profits shared with Propw, varies by account type |

| Platform Fee | No separate platform fee; included in spreads and commission |

| Scaling Fee | Additional fee if opting for higher capital allocation based on performance |

| Other Hidden Costs | Transparent platform; no hidden costs |

How Propw Compares to Other Prop Firms

| Feature / Firm | Propw (Estimated) | FTMO | MyForexFunds | The5ers | The Funded Trader |

|---|---|---|---|---|---|

| Profit Split | Competitive (e.g., ~70–90%)* | Up to ~90% | ~75–85% | ~80% | ~80–90% |

| Evaluation Model | Challenge / 1‑Step / 2‑Step* | 2‑Step Challenge | 1‑Step & 2‑Step | Instant / Scaling | 1‑Step Challenge |

| Max Funding Available | Varies by plan* | Up to ~$400k+ | Up to ~$300k+ | Scaling up to several levels | Up to ~$200k+ |

| Scaling Plan | Performance‑based* | Yes | Flexible | Strong scaling | Available |

| Platforms (MT4/MT5) | Supported* | Yes | Yes | Yes | Yes |

| Risk Control Rules | Standard risk limits* | Strict | Moderate | Moderate | Standard |

| Ideal for Beginners | Yes (with education)* | Moderate | Yes | Yes | Yes |

| Ideal for Experienced Traders | Yes | Yes | Yes | High‑growth focus | Yes |

Features of Propw

Multi-Stage Trading Contests

Tests consistency and risk management and funds participants after completion.

Funded Up To $200 000

Once verified, traders can participate in the live market.

Majority Profit Distribution

Around 90%; the investors can keep all of the profits from the accounts.

Adaptive Funding Strategy

Pro Mode and Standard Mode.

New Professional User Interface

Users can expect a customizable workspace with high-end features, advanced analytic tools, real-time updates, and quick trade execution.

Mobile Compatibility

Users can easily trade on desktop, mobile, and tablets.

Payment Flexibility

PropW accepts all major credit cards, mobile wallets, and crypto.

Education and Resources

PropW also offers programs with certification and mentorship.

Unambiguous Terms

Profit-sharing and rules aim to curb hidden fees.

Account Trading in Bulk

Traders can buy and control multiple challenge accounts.

Pros & Cons

| Pros | Cons |

|---|---|

| Competitive profit split (up to ~90% of profits). | Some users report issues with withdrawals or delays. |

| Clear challenge structure helps traders plan goals. | Strict rules and drawdown limits can be challenging to meet. |

| Smooth platform experience and payouts reported by some traders. | Some users have claimed rule changes or account issues mid‑challenge. |

| Widely accessible with competitive pricing and low entry fees. | Lack of clear information on fees, instruments, or rules for some accounts. |

| Users appreciate transparent evaluation process and unlimited time. | Mixed reviews on platform reliability and support quality. |

Conclusion

Propw is a cutting-edge, proprietary trading company created to help novice and seasoned traders access funded accounts with well-defined rules and planned challenges. It is a desirable option for traders looking to expand without risking personal funds because of its competitive profit splits, adaptable account settings, and sophisticated trading platforms.

Propw’s transparency, training materials, and scalable funding strategy offer substantial prospects for disciplined traders, even though stringent risk limits, challenge requirements, and sporadic withdrawal problems necessitate cautious consideration. All things considered, Propw is a dependable platform for individuals dedicated to steady trading success and long-term expansion.

FAQ

Propw is a proprietary trading firm that provides traders access to funded accounts, allowing them to trade Forex, commodities, indices, and crypto with company capital while sharing profits.

Traders complete the Propw Challenge, which typically has two phases with specific profit targets and risk limits. Passing the challenge grants access to a funded account.

Propw supports MT4, MT5, and web/mobile trading platforms for convenient, real-time trading.

Traders pay a one-time challenge or evaluation fee depending on the account size. Deposits are usually free, and profit splits are applied once funded.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.