This is a SeacrestFunded Review that covers everything a trader would want to know about SeacrestFunded.

From evaluation challenges to trading platforms, profit-sharing plans, and account options, this review covers how SeacrestFunded is unique in the prop trading world.

This is a step-by-step guide and outline that is designed to assist traders of every experience level.

Introduction

Proprietary trading has evolved to allow traders to employ firm capital without any personal financial risk.

One of the largest companies in the forex prop trading world, Seacrest Funded, led by founder Matthew Leech, provides traders with significant capital along with the opportunity to share profits.

This review analyzes the features which make Seacrest Funded different from other prop firms, including its supportive evaluation challenges and flexible trader-friendly policies, numerous trading platforms, and extensive trading instruments.

Additionally, it discusses the merits of being a part of their community for both beginner and seasoned traders.

What Is SeacrestFunded?

SeacrestFunded gives traders the opportunity to showcase their talent and evaluation challenges and fund live simulated accounts as high as $1 million.

Their partners include regulated brokers, Seacrest Markets, Purple Trading, and Match-Prime in the industry, providing traders the opportunity to access and trade from over 175 assets including forex, indices, cryptocurrencies, and commodities.

Basic Information

| Feature | Details |

|---|---|

| Website | https://seacrestfunded.org |

| Founded | 2022 |

| Headquarters | Dallas, Texas, USA |

| Type | Proprietary Trading Firm (Prop Firm) |

| Supported Platforms | MatchTrader, MetaTrader 4 & 5, DXTrade |

| Instruments | Forex, Indices, Commodities, Cryptocurrencies |

| Account Sizes | $5,000 – $100,000, scalable up to $1,000,000 |

| Evaluation Models | 1-Step, 2-Step, 3-Step Challenges |

| Profit Share | 80% standard, up to 90% with add-on |

| Payout Frequency | Bi-weekly or 5 days, depending on account and model |

| Trading Style Allowed | Scalping, Swing Trading, News Trading (with risk management) |

| Daily Loss Limit | Varies by evaluation model (4–5%) |

| Total Drawdown Limit | Varies by evaluation model (6–8%) |

| Time Limit | No strict time limit for completing evaluation challenges |

| Customer Support | Responsive support via website and dashboard |

| Regulated Brokers Partnered | Seacrest Markets, Purple Trading, Match-Prime |

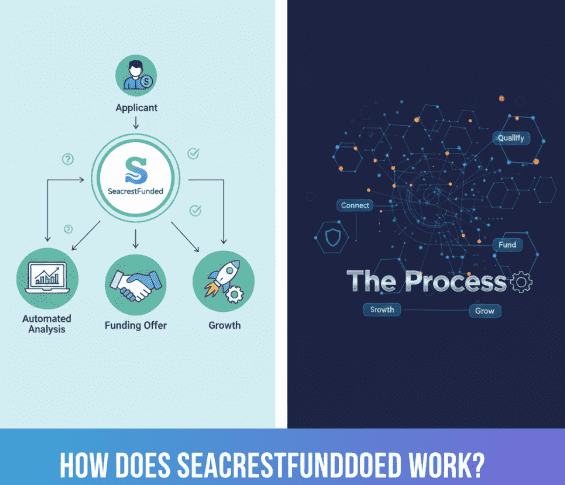

How Does SeacrestFunded Work?

To join SeacrestFuned, traders start with an evaluation challenge, which focuses on their trading and managing risk skills.

During this phase, traders work with simulated accounts and must abide by specific rules, including maximum daily losses, overall account drawdowns, as well as minimum profit thresholds.

Adherence to these rules tests disciplined trading, consistency, and the effectiveness of a trading strategy. Traders in this phase must be able to make a profit while managing their account’s risk.

Upon passing the challenge, the trader is given access to a live funded account, which means he can trade the firm’s capital.

The live account profits are profit-shared, creating an opportunity for the traders to make a high return with. Profitable traders have the ability to protect their personal capital from high risk.

Evaluation Challenges and Account Options SeacrestFunded Prop Firm

“SeacrestFunded provides multiple assessment paths to suit all traders and their strategies and risk appetite.

1-Step Challenge: Evaluations for traders who want to keep their assessment as simple as possible.

2-Step Challenge: A compromise that provides two stages to the evaluation.

2-Step News Challenge: Designed for traders who work with news and want to trade news subject to refined risk parameters.

3-Step Challenge: A tailored evaluation for traders who want to go through all the rigor within their trading.

Each trader is allowed to choose account balances bewteen $5,000 and $100,000 and once their goals are achieved, scaling is available up to $1Million.

The company has a funding scaling policy that increases capital by 25% for every increasing ratio of profitability, up to a maximum of 100% at a time. `”

Features Of SeacrestFunded

Access to Capital of the Firm

Traders can utilize the capital of SeacrestFunded which lowers the risk of their own finances and eliminates the possibility of using personal funds to pay for the strategy.

Multiple Evaluation Challenges

SeacrestFunded has various profit target trade evaluations and trading conditions to structure their exaction to assess the skill’s and consistency of the trader’s performance.

Flexible Trading Rules

The firm fosters varied trading rules for each trader which provides a balance of strategy implementation and risk parameters to ensure compliance for effective trading.

Profit Sharing

All account types allow traders to keep 80% of the profits earned which encourages and praises the traders for the risk controlled strategies implemented which is the highest trader split in the market.

Unlimited Days of Trading

SeacrestFunded is similar to other prop firms as there is no limit for completing step evaluation challenges which allows the trader to work at their own pace.

Variety of Instruments

Traders are easily able to trade forex pairs, commodities, indices, and cryptocurrencies which allows them to diversify their portfolio across several markets and trading instruments.

Trading Platforms Available

SeacrestFunded has support for MatchTrader, MetaTrader 4 & 5, and DXTrade, so traders have access to easy-to-use and dependable platforms for both beginner and advanced strategies.

Customer Support and Educational Resources

SeacrestFunded has chat support for their service users all day, every day, all the time. They provide additional assistance and educational resources to help their traders fine-tune their capabilities while also keeping track of the financial ecosystem.

They do have a clearly outlined operational policies and an evaluation framework which helps to find the fit for traders to evaluate the firm before making a commitment.

Pros and Cons SeacrestFunded

Pros of SeacrestFunded

Access to Firm Capital – Traders gain first-hand market experience while remaining financially safe because they trade the firm’s capital.

Flexible Evaluation Models – Provides Differentiated skill-based challenges like One-step, Two-step, Two-step max, and Three-step.

Profit on Retained Earnings – Along with the other benefits, SeacrestFunded offers traders eighty percent profit retention, which rates them as one of the top prop trading companies.

Unlimited Trading Days – Constant, consistent performance is the only requirement for traders as there are no time limits set to complete the challenges.

Supports Multiple Strategies – Traders are allowed to strategize as swing traders, news traders, and scalpers.

Wide Range of Instruments – Trading is allowed in forex, indices, commodities, and cryptocurrencies.

Growth of Firm Capital – Funds can be scaled from 5,000to5,000to1,000,000 depending on the satisfactory performance.

Reliable Platforms – The firm caters to all traders by supporting MatchTrader, MetaTrader 4 & 5 and DXTrade.

Cons of SeacrestFunded

Limited Payment Options – The withdraw methods available may be limiting for some traders.

Short Track Record – Compared to older prop firms, SeacrestFunded has less historical data because the firm is new to the market.

Customization Problems – There are reports of small problems some users encountered on the MatchTrader platform.

Evaluation Fees – Upfront payment for evaluation challenges may not sit well with some beginners.

Harsh Risk Rules – There is some flexibility, but otherwise breaking drawdown and daily loss limits leads to the termination of the account.

FAQ

One-step, two-step, two-step max, and three-step challenges with different targets and rules.

Traders keep 80% of profits, which can increase with add-ons.

MatchTrader, MetaTrader 4 & 5, DXTrade.

Forex, indices, commodities, and cryptocurrencies.

No strict deadlines; traders can take their time to meet targets.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.