The Top Prop Firms for Stock Traders that offer funded accounts, organized evaluation challenges, and profit-sharing chances will be covered in this post.

In order to enable traders access substantial capital, trade stocks and other assets, and advance their trading careers while lowering personal financial risk, these companies—which include FTMO, E8 Funding, FundedNext, and TFT—were established.

Advantages of Trading US Equities & CFDs via Prop Firms

Access to Substantial Capital – Traders get the opportunity to handle large accounts without the possibility of losses to their own funds, making it easier to take larger positions and receive larger profits.

Profit Split Potential – Most of the best prop firms run on 70-90% profit share policies, meaning that highly skilled traders keep most of their profit.

Risk Management – Firms set rules on daily losses, max drawdown, and position sizes to help traders trade within limits.

Account Scaling – Prosperous traders are able to increase their allocated accounts over time, as their profit \ increases, enabling them to make more better.

Leverage Freedom – Prop firms provide leverage on US equities and CFDs, enabling traders reach maximal return of their capital.

Variety of Markets – Traders get access to US equities, indices, ETFs, and CFDs, allowing them to diversify their strategies and use different instruments.

Quick Payments – Leading prop firms including FTMO, FundedNext, and E8 Funding offer instant or weekly payments once profit targets are met.

Learning and Development – Many companies provide learning materials, feedback, and community support to help develop trading skills.

No Personal Capital Risk – Traders can acquire hands-on experience in the actual market, which lessens the money problem as there is no personal financial risk involved.

Career Advancement Potential – Good performance at a prop firm can lead to higher funding levels as well as trading professionally for a living in the foreseeable future.

Top Prop Firms for Stock Traders & Key Point

- E8 Funding Equities – Offers flexible account sizes with competitive profit splits for equity traders.

- FundedNext Equities – Provides instant funding options and low-risk evaluation programs.

- The Funded Trader (TFT) Equities – Focuses on simple rules and fast scaling for profitable equity trading.

- Finotive Funding Equities – Emphasizes low fees and accessible funding for retail equity traders.

- SurgeTrader Equities – Features rapid funding with a focus on consistent trading performance.

- FunderPro Equities – Provides multiple account types and high profit share for skilled equity traders.

- Lux Trading Firm Equities – Offers multi-tier funding and global market access for professional equity traders.

- B2Broker Prop WL Equities – White-label solutions with flexible equity trading programs and risk management.

- Smart Prop Trader Equities – Combines instant funding with tech-driven trading support for equities.

- FTMO Equities Program – Well-known for structured challenges and scalable funding for disciplined equity traders.

Top Prop Firms for Stock Traders

1. E8 Funding Equities

Founded in November 2021, E8 funding (also known as E8 Markets) was one of the early prop firms to provide flexible funded accounts, in particular up to $1,000,000 for experienced traders. E8’s evaluation process is known to have one- step, two- step, and three-step challenges with target and loss limits for disciplined traders.

Traders after the evaluations are awarded an 80 % profit split with the company also having scaling plans to increase account size while maintaining the profit share. with no minimum trade days and multiple access assets (equities, forex, CFDs) E8 is known for its fast profit sharing and customization options.

Why Recommend E8 Funding Equities

- Traders can choose from a variety of account sizes ranging from 10K to 1 Million dollars.

- After funding, profit splits of up to 80 % are possible.

- Evaluations can be flexible due to 1-step, 2-step, or 3-step challenges.

- Payouts can be as quick as a week, or sometimes 48 hours.

- Traders can access a variety of markets, including equities, CFDs, and forex.

E8 Funding Equities

| Pros | Cons |

|---|---|

| Flexible account sizes up to $1,000,000 | Newer firm, less historical track record |

| High profit split up to 80% | Limited brand recognition compared to FTMO |

| Multiple evaluation challenge options | Some account types may have higher fees |

| Fast payouts (weekly/48h) | Fewer learning resources for beginners |

| Access to multiple markets (equities, CFDs, forex) | Smaller community/support compared to larger firms |

2. FundedNext Equities

FundedNext is a proprietary trading company founded in the year 2022, with its headquarters in the UAE and offices around the globe.With Standard, Easy Next, and Express models, different evaluation options are available with account sizes generally starting as low as $10,000 and going up to $200,000+. Traders are able to receive profit splits as low as 80 % to 90 % after funding, and some models grant up to 95 % profit share to high achievers.

Other benefits of FundedNext are lifetime funded accounts, no time limits on challenge evaluations, and quicker payment (within 24–48 hrs). Because of its flexible challenges, wider access to assets including CFDs and equities, and high profit share potential, it is considered one of the best prop firms for stock traders who are looking for quick returns and scalable capital.

Why Recommend FundedNext Equities

- Funding can be instant, along with the option of a lifelong funded account.

- Accounts can scale to over $200K with high profit splits (80-95 %).

- Evaluations can be Standard, Easy Next, or Express models.

- Payouts are earned quickly and trading rules are easy to follow.

- Supports multi-asset trading: stocks, indices, forex, and CFDs.

FundedNext Equities

| Pros | Cons |

|---|---|

| Instant funding options | Premium challenge fees for some accounts |

| Lifetime funded accounts | Relatively new in the market |

| High profit splits (80–95%) | Limited offline support options |

| Multiple evaluation paths (Standard, Easy Next, Express) | Smaller social/trader community |

| Multi-asset support including stocks & indices | Some rules may be strict for beginners |

3. The Funded Trader (TFT) Equities

The Funded Trader (TFT) is a proprietary trading program and lets traders showcase their abilities through a multi-phased evaluation process before obtaining funded accounts.

While the public does not have access to a comprehensive history of the company’s founding, TFT is recognized for its unique multi-tiered evaluation structure – starting with a ChallENGE, then coming to Verification, and finally becoming a funded trader, where traders are provided with unlimited simulated accounts up to about $600,000.

Funded traders are required to adhere to the firm’s risk policies and profit sharing structure when implementing their strategies in the equities and other markets.

TFT has built a name for itself among traders looking for systematic development and upward mobility, and this makes it a popular option for proprietary trading programs for stocks and other markets.

Why Recommend The Funded Trader (TFT) Equities

- Evaluation consists of: A Challenge, Verification, and then a Funded account.

- Funded accounts can be up to approximately $600K depending on the program.

- Risk management is structured and daily loss limits are imposed.

- Profit split is high, so trading discipline is rewarded.

- Focused on equities, CFDs, and global markets.

The Funded Trader (TFT) Equities

| Pros | Cons |

|---|---|

| Structured multi-phase evaluation | Less widely known internationally |

| Funded accounts up to ~$600K | Limited publicly available trading stats |

| Focus on disciplined trading & risk management | Smaller payout flexibility |

| Supports equities & CFDs | Fewer educational resources |

| Scalable accounts for top performers | Slower onboarding compared to instant funding firms |

4. Finotive Funding Equities

Finotive Funding is a proprietary trading company that offers traders evaluation challenges and instant funding opportunities with accounts between $2,500 up to $200,000 (with scaling options).

Their model has 1-step, 2-step, and direct instant funded accounts, and traders get weekly payouts with profit splits as high as 75 % to 95 % depending on the program and performance.

Finotive focuses on transparent rules, a simple dashboard, and quick payouts, to allow traders to spend more time trading than doing admin tasks. For equity/CFD traders, Finitive has become a preferred option with flexible evaluation and funding opportunities.

Why Recommend Finotive Funding Equities

- Options include funding in 1-step, 2-step, and instant funding.

- Profit splits are typically 75-95%, depending on account.

- Account sizes range from $2.5K to $200K.

- Easy to understand rules and a simple dashboard.

- Multi-asset trading including stocks and derivatives.

Finotive Funding Equities

| Pros | Cons |

|---|---|

| Multiple evaluation paths (1-step, 2-step, instant) | Smaller firm, less historical data |

| High profit splits (75–95%) | Limited account sizes for beginners |

| Flexible accounts from $2.5K to $200K | Fewer community resources |

| Transparent rules & user-friendly platform | May not support all global markets |

| Multi-asset trading options | Some advanced features may require experience |

5. SurgeTrader Equities

SurgeTrader, est. around 2020 in Florida, USA, gained popularity for featuring funded trading accounts for forex, equity, CFD, and other markets and simple evaluation criteria.

Traders had the option of participating in one-step or two-step audition challenges, and profit splits around 75 % with account scaling up to considerable amounts were common. However, in early 2024, SurgeTrader stopped all operations due to licensing and operational problems (particularly with their tech provider), resulting in them no longer accepting new auditions and putting a hold on their services.

Despite this, SurgeTrader was historically regarded as one of the best prop firms for traders seeking quick evaluations and great access to capital prior to the suspension.

Why Recommend SurgeTrader Equities

- 1-step and 2-step evaluation challenges are available.

- Profit splits are usually 75 %.

- Quick funding for qualified traders.

- Accounts and performance-based expansion.

- Traditionally focused on stocks, CFDs and forex (activities suspended in 2024).

SurgeTrader Equities

| Pros | Cons |

|---|---|

| Rapid funding for qualified traders | Operations suspended in 2024 |

| 1-step & 2-step evaluations | Profit split only around 75% |

| Scalable account sizes | Less reliable long-term support |

| Focus on equities, CFDs, and forex | No new trader intake currently |

| Historically fast onboarding | Limited reputation compared to FTMO/others |

6. FunderPro Equities

FunderPro is a prop trading firm that provides evaluation challenges that culminate in funded accounts, and these are available for traders in all asset classes, including equities and CFDs.

It offers multiple account sizes with attractive profit splits (usually 80 % or more) and generous flexible risk rules that pay off the disciplined trader. Different challenges are available to traders depending on their experience and trading style, and strong performers have opportunity to scale their accounts.

Although FunderPro is a newer firm and less documented than some of the older ones, it is gaining a reputation among retail traders as a growing prop funding choice that offers a good balance of scalability and trader-friendly funding terms, especially for equity and CFD traders who want to access funding with minimal risk.

Why Recommend FunderPro Equities

- Different account types based on trading experience.

- Profit splits for top performers are 80 %+.

- Evaluation challenges with risk management are designed.

- Performance determines scalable capital.

- Offers stocks, CFDs and other asset classes.

FunderPro Equities

| Pros | Cons |

|---|---|

| Multiple account types for different experience levels | Less widely known among traders |

| High profit splits (80%+) | Limited public reviews and testimonials |

| Structured evaluation challenges | Smaller trading community |

| Scalable capital allocation | Fewer educational resources |

| Supports equities, CFDs, and other assets | May lack instant funding options |

7. Lux Trading Firm Equities

Lux Trading Firm functions as a prop trading firm that finances traders with capital in equities, forex, and other markets.

They generally provide various tiers of funded accounts with performance-based profit split contracts that incentivize traders for consistent net positive performance. These contracts also include evaluation challenges with built-in scaling mechanisms to receive further capital increases over time.

Lux highlights sophisticated trading technology and universal market reach, which is a bonus for veteran traders.

In Lux’s competitive market position, it stands out as one of the prominent firms for equities/CFD traders in need of structured capital advancement and top-tier offerings despite limited public information on the founding date and differing profit-share contracts per offered program.

Why Recommend Lux Trading Firm Equities

- Performance gives multi-level funding accounts with growth.

- Profit splits depend on size of account and consistency.

- Global market access and infrastructure.

- Funded traders have structured risk management.

- For equity, CFDs, and forex traders needing professional capital.

Lux Trading Firm Equities

| Pros | Cons |

|---|---|

| Multi-tier funding accounts | Limited information on public reputation |

| Performance-based profit splits | Smaller trader community |

| Access to global markets | Less beginner-friendly interface |

| Professional-grade trading infrastructure | Slower evaluation process |

| Supports equities, CFDs, and forex | Less brand recognition internationally |

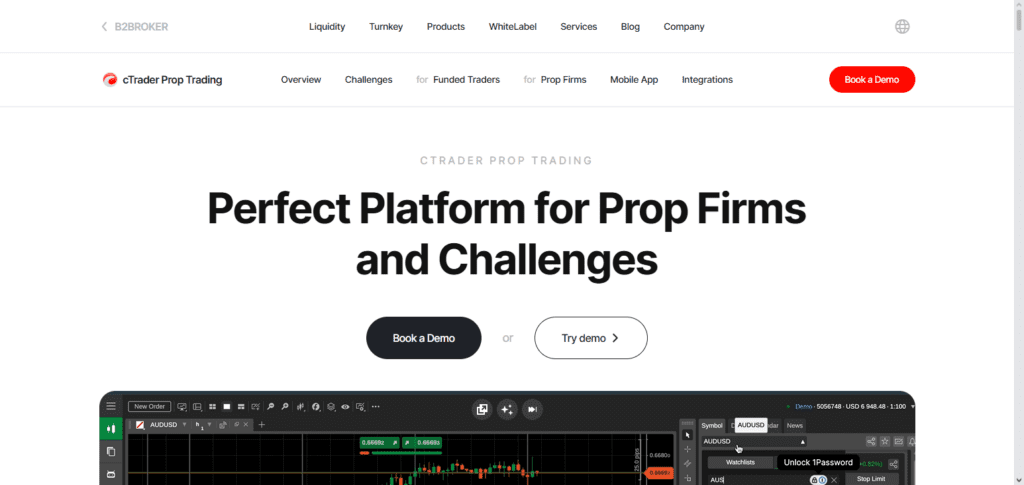

8. B2Broker Prop WL Equities

B2Broker Prop WL refers to proprietary trading solutions offered under the B2Broker white‑label structure, where firms can host prop trading programs for equities and other assets.

This white-label structure allows for proprietary trading flexible account management, risk management, and execution management systems that enable lower-tier funded trader programs to operate with institutional-grade liquidity and connectivity.

Traders can use these prop accounts after understanding and fully complying with risk and profit margin split rules, which are described as having an 80 % profit split, as per the white-label partner located on the B2Broker site. The B2Broker Prop WL model is especially appreciated by stock and CFD traders who seek professional trading conditions with institutional-grade infrastructure support.

Why Recommend B2Broker Prop WL Equities

- White label for prop trading program.

- Trading tech and liquidity of institutional quality.

- Varying account sizes and risk management.

- Profit sharing of about 70–80 % based on firm.

- Specialized in white-label partners for equities, CFDs, and multi-asset trading.

B2Broker Prop WL Equities

| Pros | Cons |

|---|---|

| Institutional-grade infrastructure | Profit split depends on white-label firm |

| Flexible account sizes & risk rules | Limited direct support for traders |

| Multi-asset trading including equities | Not a direct prop firm; platform provider |

| Reliable liquidity & execution | Branding/experience varies by partner firm |

| Suitable for professional traders | Can be complex for beginners |

9. Smart Prop Trader Equities

Smart Prop Trader is a funded trader program offering evaluation challenges and direct funding accounts for traders in all asset classes, including equities, forex, and CFDs. Their model often has single-phase or multi-phase evaluations, and traders who pass these evaluations receive firm capital along with profit splits of around 80 %.

Smart Prop Trader is known for speedy onboarding, user-friendly dashboards, and clear guidelines that allow traders to showcase their skills and effectively control risk. As a more recent prop firm, it is well positioned among easily available programs for equities/CFD traders who want to be funded quickly and with uncomplicated evaluation processes.

Why Recommend Smart Prop Trader Equities

- Quick start and evaluation challenge programs.

- Profit sharing typically about 80 %.

- Evaluation as single phase or multi phase according to account type.

- Equity, forex, and CFD trading are all supported.

- Intuitive platform and known risk management rules.

Smart Prop Trader Equities

| Pros | Cons |

|---|---|

| Fast onboarding & evaluation | Limited global recognition |

| Profit splits around 80% | Smaller trader network |

| Single/multi-phase evaluation options | Fewer educational materials |

| Supports equities, CFDs, and forex | Smaller capital allocation for new traders |

| Transparent risk management | Less historical performance data |

10. FTMO Equities Program

TMO, established in 2015 in Prague, Czech Republic, is among the oldest proprietary trading firms, and is well-known for its rigid Challenge + Verification process leading to FTMO funded accounts with a simulated capital amount of about $200,000 or more.

Traders can receive up to 90 % profit split on the profits earned as soon as they become funded, as well as the chance to increase their capital gradually.

FTMO has become a standard in the market since they offer a traded funded program with great support and tools for a claimed disciplined and transparent trading experience for clients trading equities, forex, commodities, and indices.

Why Recommend FTMO Equities Program

- Established in 2015, first to have Challenge + Verification system.

- Funded accounts as high as 200K+ with up to 90 % profit split.

- Strict daily and overall loss limit risk management.

- Increasing funds for high achievers.

- Supports multi assets including equities, indexes, forex, and commodities.

FTMO Equities Program

| Pros | Cons |

|---|---|

| Well-established, founded in 2015 | Challenge fee required upfront |

| Structured Challenge + Verification | Profit split slightly lower for smaller accounts (70–90%) |

| Funded accounts up to $200K+ | Strict rules for daily/max loss may be challenging |

| Multi-asset support (equities, forex, indices, commodities) | Longer evaluation compared to instant funding firms |

| Strong community & educational resources | Less flexibility in evaluation process compared to some modern firms |

Conclusion

To sum up, the world of proprietary trading for stock traders provides a wide variety of options to suit both inexperienced and seasoned traders.

Disciplined traders can effectively expand their capital with the help of companies like FTMO, E8 Funding, and FundedNext, which offer scalable account sizes, high profit splits of up to 90%, and structured evaluation programs.

Other companies like Lux Trading Firm, Finotive, and TFT concentrate on user-friendly platforms, quick payouts, and flexible funding routes.

Overall, these leading prop businesses have made a name for themselves as trustworthy resources for equities traders looking for funded accounts, expert risk management, and long-term trading industry growth, despite some, like SurgeTrader, experiencing operational difficulties.

FAQ

Prop (proprietary) trading firms provide traders with firm capital to trade stocks, CFDs, or other assets. Traders follow risk rules, complete evaluation challenges, and earn a profit share without risking personal funds.

Top firms include FTMO, E8 Funding, FundedNext, TFT, Finotive, Lux Trading Firm, FunderPro, Smart Prop Trader, and B2Broker Prop WL, offering structured programs, scalable accounts, and high profit splits.

Profit splits vary, typically 70 %–90 %, depending on the firm, account type, and performance. Some firms offer scaling programs that increase capital allocation for successful traders.

Traders complete set profit targets and adhere to daily & maximum loss limits in demo or real-time accounts. Passing the challenge earns access to funded accounts.

Most top prop firms, like FTMO, FundedNext, and E8 Funding, provide weekly or instant payouts once traders meet profit targets, often within 24–48 hours.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.