This article will discuss Topstep, a platform that helps traders become professionals without risking personal capital.

I will discuss how it works, its key features and benefits, and address whether it is worth using for beginners and seasoned traders interested in futures trading with funded accounts.

Overview of Topstep

Topstep has a two-part process for business operation called the Trading Combine and Funded Accounts. The Trading Combine is a sort of a simulated trading system environment while traders fulfill some requirements such as risk management, consistency and, profit targets. Upon completion of the assessment, traders are given a funded account, allowing them to trade real capital while garnering a trader profit.

The product has become popular with new traders alike due to the low risk and professional environment. For this focus discipline, strategy and risk control, Topstep has become a reputable choice for traders wanting to change their trading practice to a full-time trader.

What is Topstep?

Topstep is an online trading platform made to evaluate traders and fund them in the futures markets. Seeing as it was created in the year of 2012, Topstep aims to help aspiring traders through a structured setup to test their strategies and risk management.

In contradiction to traditional trading accounts, where traders risk their own capital, Topstep permits traders to operate on simulated accounts in the evaluation phase and then possibly receive a funded account after satisfying the predetermined performance requirements.

Topstep emphasizes futures trading in particular, covering stock index, commodity, and currency futures. It aspires to provide professional trading opportunities to people who possess the discipline and talent necessary to thrive in the market.

Basic Information – Topstep

| Feature | Details |

|---|---|

| Founded | 2012 |

| Headquarters | Chicago, Illinois, USA |

| Type | Proprietary trading platform |

| Markets Supported | Futures (Stock indices, commodities, currencies) |

| Evaluation Program | Trading Combine (simulated account to test skills and discipline) |

| Funded Accounts | Yes, for traders who pass the evaluation |

| Profit Sharing | Traders keep up to 80% of profits |

| Trading Platforms | NinjaTrader, TradingView, and other compatible software |

| Performance Coaching | Yes, includes educational resources and guidance |

| Subscription Fee | Monthly fee required to participate in the Trading Combine |

| Target Audience | Aspiring and experienced traders looking to trade professionally |

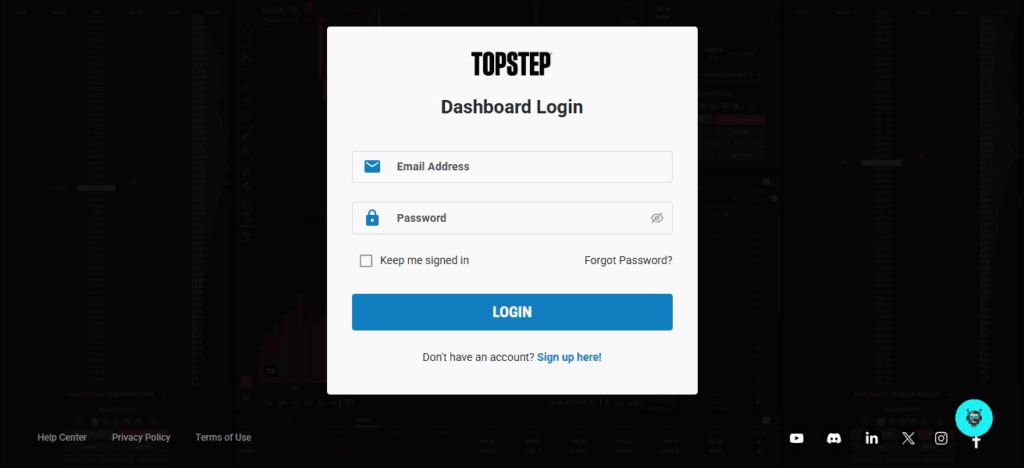

How To Login Topstep?

Official Websites: Always use the official website for Topstep Trading (topstep.com). Make sure you do not visit a different website since that is a way to get hacked.

Login or Sign in: From the home page start the login at the top right.

Login Credentials: Make sure to use the right registered email address along with the password. Be sure that the password associated with the email address is correct.

2 Factor Authentication: If you have the 2 Factor Authentication on you then you will have to enter the secondary code that is sent to your device.

How Does Topstep Work?

Trading Combine:

Every trader in Topstep starts in the Trading Combine, which offers traders a simulated account with live market conditions. Participants are expected to meet profitability targets along with preset risk management criteria including max daily loss and overall drawdown. This step is in place to ensure discipline and properly skilled traders only advance to the next step.

Evaluation Metrics:

Topstep tracks a number of traders’ performance metrics including, but not limited to, overall trade consistency and performance, risk carried per each trade, measures of discipline and rule adherence, and profitability. Traders are expected to follow their particular strategies and not trade emotionally, as this almost certainly leads to failure.

Funded Account:

Topstep has set a policy to pay a significant portion, about 80%, of the profits to the traders which is highly advantageous, especially to those traders who are looking to advance in their career without having to risk personal investment. This in return allows the traders to access a funded account and trade with real capital, bearing none of the risk as it is covered by Topstep.

Worth and Uses of Topstep

Topstep is a great option for those who do not have enough capital to trade big lots or want to develop their trading discipline in more structured surroundings. Some of the key uses include:

Building a Trading Career: Traders can move from simulated accounts to trading real capital which is a vital step towards professional trading.

Risk-Free Learning: The Trading Combine gives traders the chance to make mistakes, but, without the danger of losing their personal money.

Skill Evaluation: Traders are assessed and provided with necessary feedback where their strategies and tactics are ‘What to Do and What Not to Do’ improving and decision-making.

Access to Futures Markets: Topstep offers a great deal of futures contracts allowing traders to add more instruments to their trading portfolio.

Features of Topstep

Trading Combine: A customized assessment framework to evaluate individual trading capabilities.

Funded Accounts: Allocates actual capital to traders who meet the company criteria.

Performance Coaching: Provides insights and materials to assist traders in achieving their goals.

Real-Time Analytics: Monitors trades and evaluates performance indicators in relation to risk parameters.

Flexible Trading Platforms: Supports industry-standard trading applications such as NinjaTrader and TradingView.

Pros and Cons

Pros

- No Personal Capital Risk: Traders get access to professional accounts with zero balance.

- Structured Evaluation: Encourages responsible and focused trading.

- Profit Sharing: Traders make to keep the majority of the profits from funded accounts.

- Access to Professional Tools: Traders get access to all industry grade trading software and tools.

- Educational Resources: Offers mentoring and training to improve trading abilities.

Cons

- Subscription Fees: Traders have to pay a monthly fee to access the Trading Combine, which can become expensive if the evaluation drags.

- Strict Rules: Traders have to stick to the imposed rigid risk and performance limits, which are not easy for some.

- Futures-Focused: Trading is limited to Futures, which is not ideal for traders looking to stock, options, or forex.

- Pressure to Perform: Evaluation systems can be extreme; not hitting targets means you have to start all over again.

Alternatives Of Topstep

FTMO

FTMO is an international proprietary trading firm where forex and CFD traders are given the opportunity to trade using company funds. The traders have to first complete the FTMO Challenge as part of the first step in the company’s funnel.

They have to achieve a certain profit and risk target. After they are approved, they are given a funded account, and they are allowed to trade real money.

They also have profit sharing, educational resources, and analytics profit tools, thus providing everything a serious trader needs to scale their performance and career while minimizing their personal risk.

The5ers

The5ers is a prop trading firm concentrated solely on forex traders and provides funded accounts after completing performance assessments. The funded account is proportionately split after the trader passes performance criteria of showing continuous profit and abiding to risk parameters.

They receive profit splits while trading real money as soon as they clear the above criteria. The5ers is an excellent prop firm because it prioritizes consistency rather than short term profits and as a result, provides several funding programs.

Earn2Trade

Earn2Trade funded trading accounts after completing courses about forex trading and futures trading. They teach about risk management and how to use trading strategies. After evaluation programs, traders are offered accounts.

They are then assessed and once passed, are allowed for real trading, sharing profits. It has profit-sharing, and is a trader evaluation and funded trading account system platform. Can be used by novice and skilled traders. It equips traders to learn adequate skills and practice to reduce risk of trading personally.

Trader2B

Trader2B funds traders after completing a set system of steps. They have a demo account with strict rules. They must complete a profit target and risk profuse limits.

After completing their goals, Trader2B finances real accounts. They have a disciple approach for forex and indices, and trader strategy, strong risk management. It is good for traders with skills for pro trading.

Conclsuion

in conclusion Starting from scratch and advancing to professional futures trading without spending personal funds is made easier because of the exemplary platform provided by Step Top. It streamlines the entire trading process through its Trading Combine, financed accounts, performance coaching, and real-time analytics.

It assists traders in becoming more disciplined, improving their strategies, and honing their skills. Though there are subscription fees and stringent policies, the ability to access and trade real money is the true defining feature which sets Topstep apart in the industry standard.

FAQ

Topstep primarily supports futures, including stock indices, commodities, and currencies.

Yes, a monthly subscription fee is required to participate in the Trading Combine.

Yes, beginners can learn trading discipline, strategies, and risk management while trading in a simulated environment.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.