This article focuses on discussing Vittaverse Prop Firm. It is a global trading company since 2022, founded and headquartered in Saint Vincent and the Grenadines. Vittaverse gives traders different financial instruments and access to trading currencies like forex, cryptos, metals, indices, and stocks.

It uses high-tech platforms like MetaTrader 5 and cTrader to trade. The firm provides remarkable trading conditions with high leverage. However, the firm being unregulated and offering limited transparency raises concerns for people looking to invest.

What Is Vittaverse Prop Firm?

Vittaverse Ltd began operations in 2022 and has its headquarters in Kingstown, Saint Vincent and the Grenadines, a center noted for its offshore financial services.

As a private company, Vittaverse is concentrated on the global retail forex market and serves individual traders around the world, but because of restrictions, it does not take clients from the USA, Iran, or North Korea.

Vittaverse aims to offer various trading instruments and a simple trading environment. Offering high leverage and a wide array of assets enabled it to capture a bigger audience.

The company works under an STP and ECN model, which allows direct market access and potentially lower spreads.

Vittaverse Prop Firm Overview

| Category | Key Details |

|---|---|

| Company Name | Vittaverse Ltd |

| Founded | 2022 |

| Headquarters | Kingstown, Saint Vincent and the Grenadines |

| Regulatory Status | Unregulated – Registered under SVG FSA (No. 26879) but not licensed |

| Trading Platforms | MetaTrader 5 (MT5), cTrader |

| Account Type | Standard Account |

| Minimum Deposit | $100 |

| Spreads | Starting from 0.5 pips |

| Leverage | Up to 1:500 |

| Commission | Not specified |

| Funding Methods | Cryptocurrencies (Bitcoin, Ethereum, Stablecoins) |

| Withdrawal Transparency | Limited information available |

| Client Fund Protection | No fund segregation or compensation scheme |

| Customer Support | 24/7 Live Chat, Email (support@vittaverse.com), Phone |

| Educational Resources | Limited – Basic market analysis tools only |

| Restricted Regions | USA, Iran, North Korea |

| Trading Instruments | Forex, Cryptocurrencies, Indices, Metals, Energies, Stocks, ETFs |

| Execution Model | ECN (Electronic Communication Network) |

| Mobile Trading | Available on iOS and Android |

| Key Concern | Lack of regulation and transparency |

| Overall Assessment | Offers diverse trading options but high risk due to unregulated status |

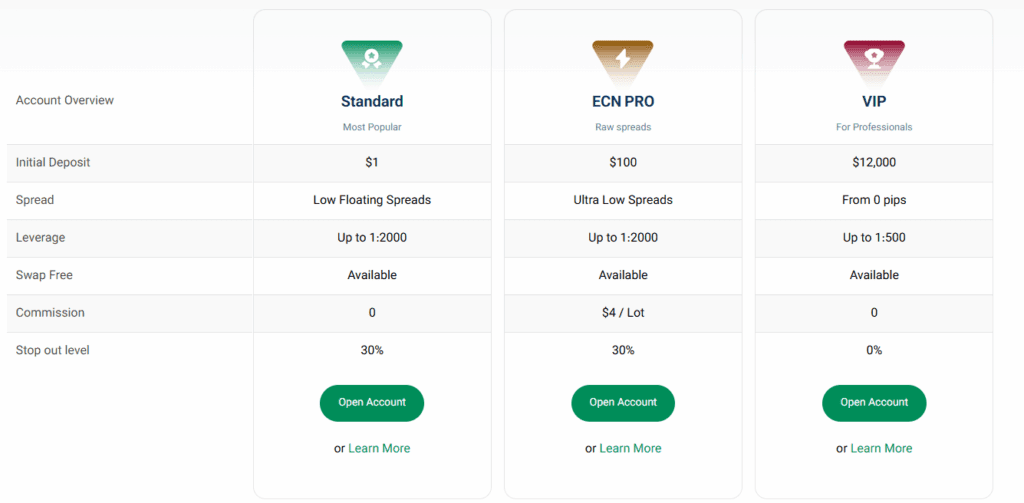

Account Types and Trading Conditions

Vittaverse has a basic account system with a standard trading account that fits most retail traders. The primary trading conditions consist of:

- Minimum Deposit: $100

- Spreads: From 0.5 pips

- Commission: None stated

Vittaverse provides no account tier variations, which is uncommon among brokers. For instance, there are no VIP, professional, or Islamic accounts. This may restrict flexibility for traders whose strategies or religious trading needs require Islamic accounts.

The broker gives forex trading leverage of 1:500, which is hefty and can increase profit, but adds a considerable portion of risk. The minimum trade size is not stated and may present risk mgmt. issues.

Your Trading Skills, Funded by Vittaverse

Fund Management

Vittaverse promotes several funding options, with an emphasis on cryptocurrency transactions.

- Accepted Methods: Bitcoin, Ethereum, and various stablecoins.

- Bank Transfers: not officially accepted.

- Minimum Deposit: $100.

- Deposit Fees: Not mentioned.

Deposit fees for cryptocurrencies are simple, but there are unregulated processing times for deposits and withdrawals that may leave traders with a lack of info about the flow of their funds. In addition, unregulated withdrawal fees and policies may leave funds and access poorly explained, contributing to a poorly managed flow of funds.

Trading Products and Services

Vittaverse serves traders new and old by providing various trading instruments and different asset classes. The broker has over 100 forex pairs, which is quite competitive in the retail forex market, and includes both minor and major currencies.

Vittaverse goes beyond trading forex and also offers a wide variety of CFDs (Contracts for Difference) on several popular markets.

- Cryptocurrencies: over 100 crypto pairs incl. major cryptocurrencies like Bitcoin, Ethereum and lots of altcoins.

- Indices: 13 CFDs on indices of leading global stocks.

- Metals: 12 CFDs on precious and industrial metals incl. gold, silver, platinum, and palladium.

- Energies: 3 CFDs on crude oil, natural gas, and other key energy commodities.

- Stocks: over 100 stock CFDs on major US and European companies.

- ETFs: 7 CFD ETFs on a wide variety of exchange-traded funds.

Having so many different products also helps traders adjust their risk and take advantage of different situations in the market. Nevertheless, more frequent updates and more trading instruments would be helpful, but parametrically there has no been no information.

Trading Platforms and Technology

All of the top trading platforms are available to you. These include MetaTrader 5 (MT5) and cTrader, both of which are popular for the functionalities included and the ease of use.

- MetaTrader 5 (MT5) is a multi-asset trading platform that possesses advanced automated trading with Expert Advisors (EAs), and advanced trading tools. MetaTrader 5 is very popular among traders owing to the depth of its offerings and the flexibility it allows.

- cTrader is popular among traders for its seamless interface. It is one of the few platforms that provides Level II Pricing, which greatly streamlines order execution and equips the trader for market analysis and trading.

Currently, a proprietary trading platform is not available, nor are MT5 and cTrader mobile (iOS and Android) applications which are necessary for trading. Thus, there is a gap in the platform being able to be tailored to the user’s needs and features being designed.

The broker claims to use an ECN (Electronic Communication Network) model. This allows for some of the tightest spreads.

However, there is a lack of concrete info concerning the model (specifically server locations) resulting in ambiguity concerning execution and the dependability of the network tailored to the traders

Regulatory and Compliance Information

No regulation from any financial authority centers on the concern of potential investors. The company is registered with the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) under registration number 26879. However, the SVG FSA stopped issuing forex broker licenses with no regulation on Vittaverse after this took place.

To make matters worse, Vittaverse does not practice the client fund segregation policy. The company does not separate the operational accounts from the clients’ funds. Consequently, clients of the broker are not protected from becoming victims of company insolvency since the broker is not part of any investor compensation scheme.

Vittaverse states that they apply KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, but the absence of independent verification of this compliance leaves a gap that suggests otherwise. Taking everything into account, caution is the best policy when investing with this company.

Regional Coverage and Restrictions

Vittaverse operates globally but restricts access to traders from jurisdictions with strict financial regulations, including the USA, Iran, and North Korea. The company does not maintain regional offices, indicating a primarily online operational model, which may reduce the availability of localized support.

Is Vittaverse Legit? Is it Safe?

For complete certainty on the trustworthiness of Vittaverse, checking the primary governing regulatory websites that oversee the company would be required. But based on some of the performance metrics, there are some primary indicators that we can help highlight.

Customer Support and Educational Resources

Vittaverse provides customer service through multiple communication channels:

- Live Chat: Available 24/7 via the official website.

- Email: support@vittaverse.com

- Phone: Direct line available for client assistance.

The support team reportedly serves a multilingual client base, though feedback suggests inconsistency in response quality.

When it comes to education, Vittaverse offers limited learning materials — no comprehensive courses, tutorials, or webinars are available. Traders seeking in-depth knowledge may need to rely on external resources. Some market analysis tools are provided, though details regarding their frequency and depth are not specified.

Conclusion

Vittaverse Prop Firm claims to be a global trading firm with access to many tradeable instruments and advanced trading technologies such as cTrader and MetaTrader 5. Value offered trading with high leverage and access to a multitude of diverse markets, the firm’s lack of oversight and potential regulation should be a dealbreaker to any investor.

Equally important is the almost total opacity of the firm’s management of its funds, withdrawal processes, and the overall structure/quality of its customer support, which emphasizes a risk-averse approach to trading with the firm. Hence, the risks involved and lack of investor protection should be the focal point of any assessment.

To traders seeking high flexibility, high leverage, and equity in their trading, Vittaverse would be highly attractive. To the rest, the approach and operational lack of clarity would constitute the need for the most scrutiny.

FAQ

Vittaverse Prop Firm is a private trading company established in 2022, offering access to global financial markets such as forex, cryptocurrencies, metals, indices, stocks, and ETFs. It provides traders with advanced platforms like MetaTrader 5 (MT5) and cTrader for executing trades.

No, Vittaverse operates without regulation from any recognized financial authority. Although registered under the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA), this registration does not provide regulatory protection for investors.

Vittaverse supports MetaTrader 5 (MT5) and cTrader, both known for their advanced analytical tools, fast execution, and user-friendly interfaces. These platforms are available on desktop and mobile devices.

Vittaverse primarily offers a standard trading account with a minimum deposit of $100 and spreads starting from 0.5 pips. Currently, there are no VIP, professional, or Islamic account options available.

Vittaverse provides leverage of up to 1:500 on forex trades. While this can enhance potential profits, it also increases exposure to risk, making risk management essential.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.