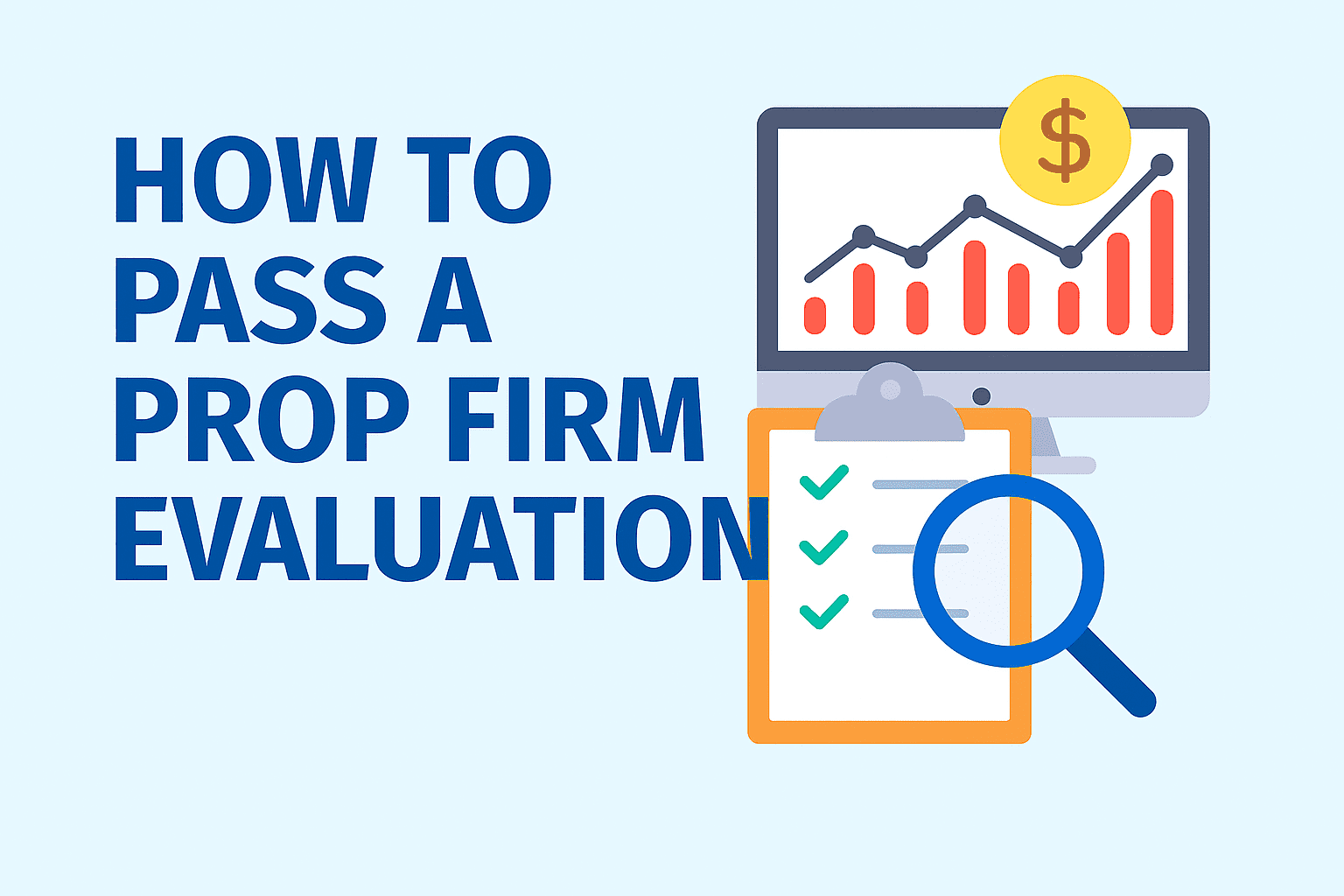

In this article, I will discuss What Is Consistency Rule In Prop Firm. The Consistency Rule is a crucial guideline that ensures traders show steady and reliable performance rather than relying on occasional big wins.

Understanding this rule is essential for passing prop firm challenges, managing risk effectively, and building a disciplined, long-term trading career in a funded environment.

What Is Consistency Rule In Prop Firm?

In the context of proprietary trading, the Consistency Rule constitutes a fundamental protocol within proprietary firm evaluation metrics, compelling participants to demonstrate uniform and dependable performance metrics rather than relying on isolated, high-value returns.

While the firms underwrite proprietary accounts and afford access to firm capital, they simultaneously instantiate rigid risk parameters designed to safeguard their balance sheets.

Although absolute profitability remains a strategic objective, the firm’s analytics extensively scrutinise the trader’s capacity to accrue regular margins without assuming disproportionate exposure.

By calibrating empirical returns to capital at risk, the rule seeks to elevate traders whose empirical methods manifest persistence, effectively distinguishing between systematic and stochastic performance profiles.

Mastery of, and compliance with, the Consistency Rule is thus a prerequisite not merely for the procedural award of firm capital, but for the establishment of an enduring, professional trading trajectory.

Here Are The key Features of the Consistency Rule in a prop Firm:

Stable Profit Requirement

Participants are obliged to produce steady earnings across consecutive trading sessions rather than skewing results through infrequent, outsized wins.

Mandatory Risk Controls

The framework enforces adherence to pre-defined daily loss ceilings and position-size limitations to curtail exposure to extreme volatility.

Profit Distribution Validation

Gains must appear evenly across multiple trades or days, thereby certifying repeatable cognitive and decision-making competencies.

Behavioral Discipline Emphasis

The design compels continual fidelity to empirically validated trading protocols, averting behavior motivated by transient psychological pressures.

Strategy Longevity Assessment

Each candidate’s method undergoes longitudinal scrutiny to ensure it is both structurally sound and resilient under persistent market conditions.

Traction on Overtrading Mitigation

The rule inherently curbs frequent trades that could breach established risk parameters and denigrate steady result profiles.

Indicator of Sustainable Future Performance

The benchmark serves to segregate unrealized profit expectations from systematic, replicable capacity, aligning firm interests with enduring trader success.

Why Consistency Is Important

Consistency underpins successful trading practice; without it, even the most lucrative traders ultimately fall short. Erratic behaviour and reliance on high-stakes, poorly-calibrated bets dilute the edge traders seek.

Proprietary firms, in contrast, prefer traders whose risk management proves resilient and whose profit trajectories remain steady over the long haul.

A solitary, outsized profit may grant several days of excess equity, yet absent an algorithm that repeatedly executes entry and exit points, the same trader soon stands on the precipice of painful, disorderly equity drawdowns.

The Consistency Rule compels accountable, deliberate trading, ensuring that documented methodologies remain replicable in varying market regimes and that variance is, itself, sharply controlled.

How the Consistency Rule Works in Prop Firm Challenges

The typical proprietary firm evaluation combines two essential metrics: reaching a strictly defined profit objective and complying with a series of risk parameters.

Prominently featured among these metrics is the Consistency Rule, which mandates that profits be accrued steadily over a prescribed trading horizon rather than produced in a sudden spike.

For illustrative purposes, a challenge demanding a ten-percent gain might effectively obligate a trader to generate a symmetrical return of one percent for every day over a ten-day cycle rather than securing the total profit in the course of a single session.

Implementation of the rule is neither uniform nor arbitrary; different prop firms adopt varied frameworks of verification. Some may stipulate a minimum quota of profitable days within the overall evaluation window

While others utilize statistical measures of return variability—typically the standard deviation—to guard against excessively concentrated or erratic profit spikes.

A single violation of the Consistency Rule can culminate in immediate cessation of the challenge, a consequence that can be imposed even if the overall profit requirement has, by nominal measures, been satisfied.

Tips To Follow The Consistency Rule

Adhere Rigidly to the Trading Blueprint

Resist the momentum to execute spur-of-the-moment orders or to alter the strategy while the evaluation window is in progress. Uniform results emerge from executing a methodically defined, previously validated scheme.

Constrain Risk Exposure Per Transaction

Proprietary trading institutions commonly stipulate an absolute threshold for daily drawdown or for the maximum allowable unit size. Guarding against transgression of these parameters is fundamental to the preservation of habitual performance.

Operate with Insubstantial Lots, Progressive Incrementing

Refrain from excessive leverage in a bid to reach performance benchmarks in condensed timelines. Incrementally accumulated profit is more tenable over protracted horizons.

Maintain a Chronicle of Transactions

Catalog each trade, detailing the point of initiation, point of liquidation, and the underpinning logic. This discipline reveals recurring tendencies and reinforces behavioral fortitude.

Prioritize Intrinsic Excellence Over Aggregate Volume

The market will not invariably furnish the optimal trading venue. Enduring the delay until the manifestation of statistically favorable alignments is superior to effecting transactions for the sake of mere activity.

Common Mistakes Traders Make

Disregard for rigorous risk controls causes numerous traders to breach what practitioners term the Consistency Rule. The pursuit of outsized returns swiftly incites heightened emotional reactivity, engendering a feedback loop of overexposure, excessive trade frequency, and breach of self-imposed loss thresholds, whether on a daily or cumulative scale.

Compounding the issue is the temptation to abandon proven methodologies whenever market fluctuations generate impatience; surrendering to noise or seemingly fleeting opportunities invariably produces erratic, and generally unfavourable, performance.

Pros and Cons Table for What Is Consistency Rule In Prop Firm:

| Pros | Cons |

|---|---|

| Encourages disciplined trading and adherence to a strategy | Can feel restrictive for traders who rely on occasional high-risk, high-reward trades |

| Promotes steady, long-term profits rather than short-term luck | May slow down profit accumulation during favorable market conditions |

| Helps manage risk and prevents large drawdowns | Traders may become overly cautious and miss potential opportunities |

| Builds professional trading habits and replicable strategies | Requires patience and can be frustrating for beginners |

| Increases chances of passing prop firm challenges | Strict rules may lead to disqualification if not properly followed |

Conclusion

To summarize, the Consistency Rule serves as a cornerstone principle within proprietary firm trading, mandating that practitioners prioritize disciplined, incremental growth rather than erratic, high-yield returns.

This approach affords firms the assurance that a trader’s results are replicable and not a product of capricious market encounters or excessive risk. Compliance necessitates a measured cadence, rigorous risk protocols, and steadfast alignment with a well-defined trading blueprint.

By orienting performance metrics toward stable, incremental profits rather than immediate, sizeable rewards, individuals substantially enhance their probability of successfully navigating proprietary evaluations and, consequently, of advancing toward sustainable, professional trading careers.

FAQ

By tracking daily gains, number of profitable days, and adherence to risk limits.

Violating the rule may lead to disqualification, even if profit targets are met.

Stick to a trading plan, limit risk per trade, and maintain consistent strategies.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.